The late 12th-century mathematician Fibonacci was one of the most influential people in our world’s history, most famous for being the author of the book – Liber Abaci. Like much of his work which can be used to describe several aspects of the world surrounding us, you can use Fibonacci to make sense of currency markets. When price moves in any direction, you can clearly identify the beginning and endpoints. Using the Fibonacci tool, you get the measurement of that move as it automatically places Fibonacci extension and retracement levels.

As a trader, you can find the Fibonacci tool very useful for spotting resistance and support levels as it shows both extension and retracement levels. However, you can use the Fibonacci tool as an indicator to use for trading decisions.

Apply the Fibonacci Tool for Trade Execution

You can use the Fibonacci retracement levels to enter trades in two ways. You can either place immediate or direct entries at the Fibonacci levels. Alternatively, you can wait for confirmation triggers at your desired Fibonacci levels, before you actually enter the market.

Surround Fib Levels with Pending Orders

When placing pending orders at the appropriate Fibonacci levels, the price must first retrace before it reaches the pending order. This requires confidence in one’s Fibonacci placement skills and technical analysis. As a trader, you are trading against the short-term momentum hoping that the price will hit your stop loss after bouncing.

Wait for Confirmation Triggers

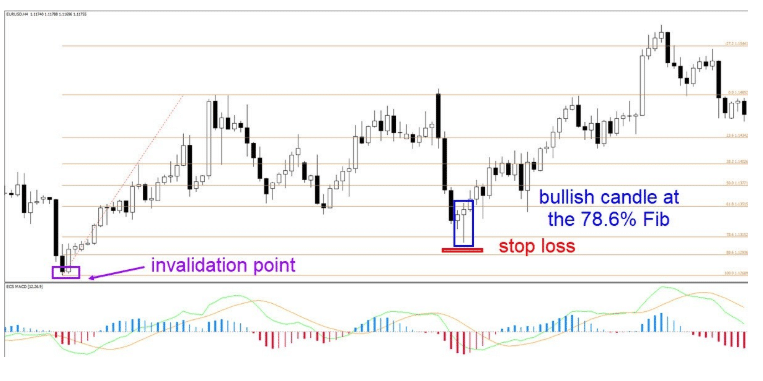

For waiting for confirmation triggers, you first have to wait for the price to reach your desired Fibonacci level. However, when the price reaches that point, do not enter. Instead, wait for the price to react to the Fib level before taking an entry decision. One of the best reactions is a candlestick confirmation such as the engulfing patterns at the expected Fibonacci level.

Aggressive or Conservative: Which One to Choose?

In most cases, traders prefer placing pending orders rather than waiting for confirmation. While it may be true most of the time, waiting for confirmation has some distinct advantages.

- Fibonacci levels are the most respected numbers amongst trading circles and apply on a higher time frame. It is also one of the most difficult tools to trade from a practical point of view. For instance, the difference between the bottom and the 50 Fibonacci levels could be so enormous on a 4-hour chart that makes it impossible for most traders to trade. If you wait for a price reaction, it allows you to use a tighter stop loss for this setup.

- If you have too much doubt about how the market’s reaction will be to the Fibonacci levels, just wait for the reaction. This is a great way for novice traders to place fibs on charts.

In other words, the main difference between an entry and trigger is relatively negligible. However, if you are relatively new to using Fibonacci levels and if the probability of it working out is low or average, it’s worth sacrificing a few pips and getting a slightly worse entry.

Are Fibonacci Levels reliable for placing Stops?

There are many traders who increase their lot size and seek out a tight stop as a result. This can have disastrous effects on your trading account. This is due to the enormous degree of volatility in the market where price zones are often retested. The presence of this noise in the market affects all stop losses. This makes them vulnerable to getting triggered before a sustainable directional movement is made by the price. Traders with an exceedingly tight stop loss will face even more issues.

Placing The Stop

If your analysis is correct, there will be a limit the price can go before the whole setup becomes invalid. Place the stop loss at this spot. There are two major benefits that can be had.

- You will only exit the trade at a loss if your analysis is proved incorrect.

- The loss will not psychologically affect you as you placed the stop loss at a point where you knew that your analysis is not correct.

The above graph shows the invalidation point where many traders do not place their stop loss. The Fibonacci tool is a great way to find this invalidation point, preventing traders from over risking or revenge trading. When trading on a lower time frame, you should not place your stop loss below the 100 marks.

The Fibonacci tool indicates entries and targets as well as correcting the stop loss level. You should always make sure to use the correct swing to get the right Fibonacci. You can place the stop loss a few pips away from the top or bottom. This could be 10 to 15 pips on a 4-hour chart or just 5 to 10 pips on a one-hour chart.

Thus, if you see a candlestick reaction at the Fib level, use a stop loss above the candle high or below the candle low. Stop losses that are placed just beyond a strong Fib level can offer better risk-reward ratios.

Conclusion

Fibonacci Tools will be used by every foreign exchange trader at some point in their trading careers. One thing to note here is that you should have a full understanding of the tool before you use it in active trading. Improperly applying incorrect methods of technical analysis can have disastrous consequences on your trading account. This includes incorrect entry points which lead to mounting losses.