Are you on the hunt for a reliable online trading platform? Look no further than IG. With years of experience in the industry and a user-friendly platform, IG is an excellent choice for both beginner and advanced traders. In this review, we’ll take a deep dive into IG’s platform and see what sets it apart from its competitors.

Features

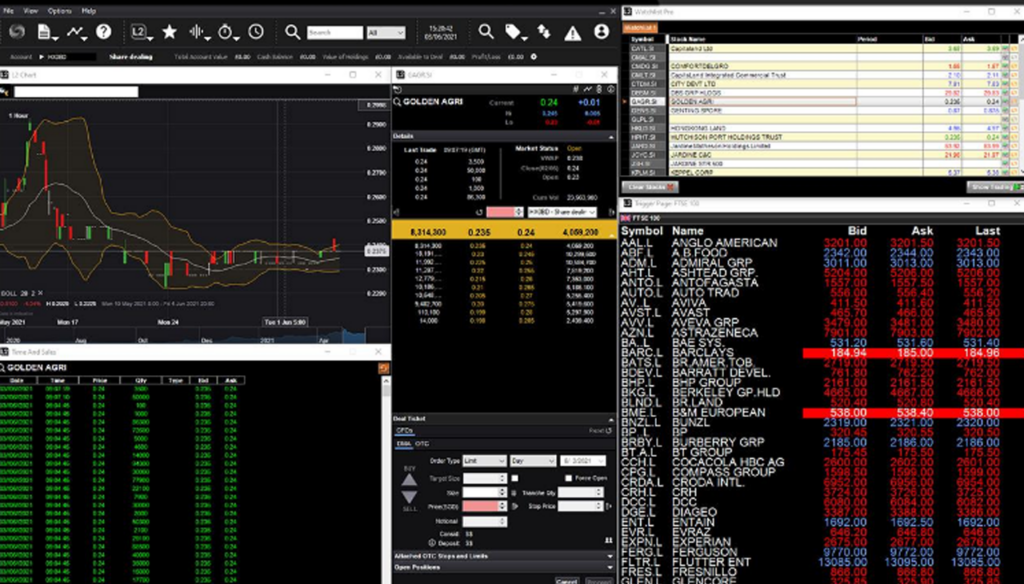

- User-friendly platform – IG’s platform is intuitive and easy to navigate, even for those new to trading.

- Multiple trading instruments – IG offers trading in multiple instruments including forex, stocks, cryptocurrencies, commodities, and indices.

- Advanced charting tools – The platform offers advanced charting tools and technical analysis capabilities, allowing traders to make informed decisions based on market trends and data.

- Automated trading – IG offers automation tools like Expert Advisors (EAs) and APIs for traders who want to develop and use their trading algorithms.

- Depth of Market (DOM) – This feature lets traders see the real-time order book of the market they’re trading in, giving them a better understanding of market conditions.

- Risk management – IG offers robust risk management tools including stop-loss orders, limit orders, and guaranteed stop-loss orders.

- Education – IG has an extensive education section that includes webinars, articles, and other resources to help traders hone their skills.

- Mobile trading – The IG trading platform is available as a mobile app for both iOS and Android devices, allowing traders to trade on the go.

Trading fees and account types

IG offers two types of trading accounts – a standard account and a retail account for professional traders.

The standard account has no minimum deposit requirement and offers access to a range of markets and basic trading features. The retail account, on the other hand, requires a minimum deposit of £500 and offers additional benefits like a dedicated account manager and lower trading costs.

IG’s trading fees vary depending on the instrument being traded. For example, forex trading fees typically range from 0.6 to 1.5 pips per trade, while stock trading fees range from £3 to £8 per trade.

It’s important to note that some instruments, like cryptocurrencies, carry higher trading fees. Additionally, IG charges an inactivity fee of £12 per month for accounts that have been inactive for more than two years.

Overall, IG’s trading fees are relatively competitive, but traders need to consider how fees may impact their trading strategy and profitability.

Customer support

IG offers several customer support options, including a 24/5 support hotline, email support, and live chat support on their website. They also have an extensive FAQ section and an online community forum where traders can ask and answer questions.

From personal experience, IG’s customer support is fast and responsive. The live chat feature is particularly helpful for quick questions or issues. The support team is knowledgeable and helpful, ensuring that traders receive the help they need to navigate the platform and resolve any issues that may arise.

Overall, IG’s customer support options are comprehensive and effective.

Automated trading

IG offers several tools for automated trading, including Expert Advisors (EAs) and APIs. Expert Advisors are trading algorithms that allow traders to automate their trading strategies. The platform also offers APIs, which are tools that allow traders to develop their automated trading strategies and integrate them with IG’s platform.

Using automation tools can be a great way to improve efficiency and remove human emotion from trading decision-making. However, it’s important for traders to carefully test and optimize their automated strategies before using them for live trading.

Overall, IG’s automated trading tools are a valuable feature for traders who want to take a more hands-off approach to trading. With a range of automation options, traders can choose the tools that work best for their trading style and skill level.

Risk management

IG offers a range of risk management tools designed to help traders mitigate their risk when trading. Some of the key risk management tools available on the platform include stop-loss orders, limit orders, and guaranteed stop-loss orders.

Stop-loss orders allow traders to set a specific price at which their trade will be closed automatically if the price moves against them. This can help prevent traders from sustaining significant losses if the market moves against them.

Limit orders, on the other hand, allow traders to define the maximum price they’re willing to pay to enter a trade or the minimum price they’re willing to sell at. Traders can use limit orders to enter trades at a more favorable price than the market is currently offering.

For even greater protection, IG also offers guaranteed stop-loss orders. These orders work like regular stop-loss orders but ensure that the trader’s position will be closed at the specified price regardless of any market volatility.

Advantages:

- Comprehensive range of trading tools and features

- Robust risk management options

- Competitive fees

- Excellent customer service

Disadvantages:

- Limited research and analysis tools

- Lack of social trading features

Summary

IG is a reliable and reputable broker that offers competitive fees, automated trading tools, and comprehensive risk management features. The platform is suitable for traders of all experience levels, from beginners to experienced pros. With its robust offering of features and tools, IG provides traders with everything they need to succeed in the markets.

- Fees: 4

- Customer Service: 5

- Automated Trading: 4

- Risk Management: 4

Overall Rating: 4.25/5.00 stars