As the Covid-19 pandemic unfolded, The World Bank Group’s Chief Economist Carmen Reinhart wrote a thought-provoking commentary warning of a possible credit crunch. According to the blog post, the medical crisis had spawned “record-shattering falls in output” and surges in unemployment and poverty.

But Reinhart’s thoughts were not novel. Throughout 2020, multiple voices worldwide were counseling governments to prepare for a financial crisis. They also warned that the global economy faced a credit crunch risk emanating from non-traditional sources. So, the question is: what is credit crunch risk, and how does it impact markets like forex?

Explaining credit crunch

The economics profession lacks consensus on what amounts to a credit crunch. According to an article by the Federal Reserve Bank of Dallas, the absence of clarity emanates from the difference in opinion about the causes of the contraction.

Nevertheless, the professionals seem to agree that a credit crunch is a sharp decline in credit supply that is unusually large for a given stage of the business cycle. Other names for this phenomenon include credit crisis or credit squeeze.

A credit crunch is different from a recession

People like to think of a credit crunch as a recession, perhaps because both entail reduced economic activity. However, the former Chairman of the United States Federal Reserve, Ben Bernanke, and others dispelled the claims in a 1991 article for the Brookings Institution.

Titled “The Credit Crunch,” the article distinguishes the two in that a credit crunch often arises because of a sudden and abnormal shortage of funds available for borrowers in an economy. They said financial institutions grow nervous about lending money in the economy because of unexpected occurrences, such as the Covid-19 pandemic.

On the contrary, a recession is part of the normal business cycle. It comes at the end of extended economic growth. Financial institutions are often generous when the economy is expanding and are usually open to lending to subprime borrowers. The problem is that such loans turn toxic during a downturn as lenders begin fleeing to quality.

Furthermore, a credit crunch often comes before a recession. For example, according to a Centre for Economic Policy Research (CEPR) analysis, the 2007/08 recession arose from a credit crunch. The phenomenon happened because of the financial shock from the collapse of the US subprime mortgage market.

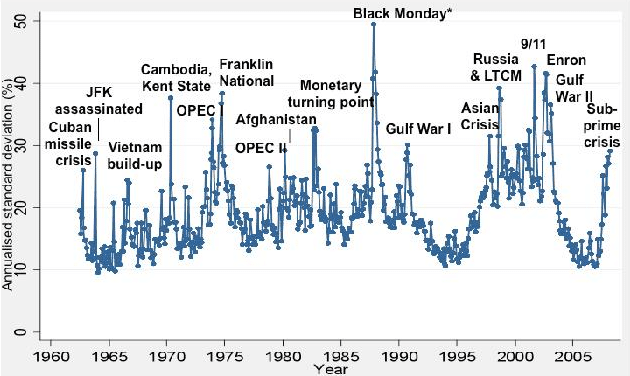

To be precise, the financial damage from events like the collapse of Lehman Brothers spawned an uncertainty level in the global economy that was unsustainable.

Interestingly, the ensuing financial fear equaled the magnitude of the first Gulf War and the Asian Crisis. If recessions do not cause a credit crunch, what does?

A sudden decline in financial institutions’ capital

Financial institutions such as banks facilitate the movement of liquidity from the supply side to the demand side. They do so, mostly through loans to businesses and consumers.

In a typical business cycle, demand and supply forces dictate the banks’ actions. For example, the institutions slow down on lending in a risky environment, such as when default rates are high. But the lending soon recovers when the economy establishes recovery.

However, the business cycle sometimes launches into a severe slowdown, which hinders the establishment of recovery. As a result, financial institutions record larger than normal bad loans, leading to a sharp reduction in available capital, and, in severe cases, some banks could collapse.

New credit standards

Sometimes financial institutions survive severe business cycles unscathed, but the experience alters their perception of risk. After the incident, bank executives will likely change their risk-taking behavior and re-evaluate risky bets.

For instance, banks could increase their capital ratios, which reduces their willingness to supply credit. The ultimate result of such actions is a credit squeeze.

Regulatory burden

Given their unique role in the proper functioning of the economy, banks are the subject of some of the toughest regulatory restrictions. This became clearer after the Great Recession, where regulators demanded more transparency in the institutions’ risk pricing and reporting of reserve ratios.

Such an environment diminishes the banks’ willingness to take risks. Moreover, if regulators impose the restrictions in one go, their impact could be widespread and deeply hurting, there is a great probability of a resulting credit crisis.

The correlation between credit crunch and disturbances in the forex market

The invariable contagion of financial crises is why a credit crunch in the US can cause a global recession. But what is the precise relationship between credit crunches and disturbances in forex?

To answer this question, one must first understand the relationship between interest rates and foreign exchange rates.

Let’s use the US for illustration. High-interest rates in the country indicate the dollar is more valuable. For example, from the perspective of a trader in Europe, one is more likely to earn better returns when investing or saving in the US.

Thus, the demand for the USD would increase at the expense of the euro. As more European traders shift capital across the Atlantic, the USD will appreciate against the EUR. When this happens, we say high-interest rates improve the exchange rate.

As we have seen, a credit crunch squeezes liquidity in the economy. But we should also note that the phenomenon leads to costlier loans, where banks charge higher interest rates during the flight to quality.

Therefore, in case of a credit crunch in the US, forex traders are likely to witness a strengthening dollar against primary rivals.

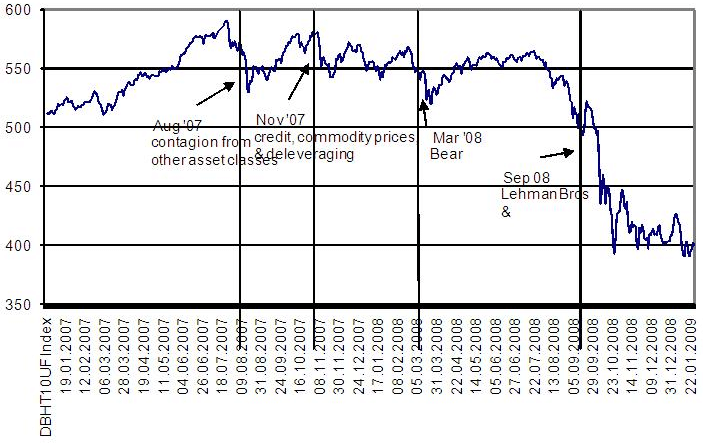

But a credit crunch will also increase volatility in the forex market. For example, portfolio managers liquidated their positions in fixed income and equity portfolios en masse in the wake of the 2007 subprime crisis in the US. The liquidation soon spilled over into forex, and winning currency positions were soon deleveraged.

Investors continued to shed risk from their portfolios as credit problems mounted. For example, winning positions in many carry trades fell victim to deleveraging. In addition, confidence in the market suffered more when Lehman Brothers collapsed. As a result, more carry trades were liquidated; see the chart above.

Conclusion

Credit crunches often come accompanied by recessions. On the one hand, a credit crunch can cause diminished output in the economy or, on the other hand, prolong the recession.

The bottom line is that the two concepts are separate, and a clear understanding could go a long way in improving your market research.