Fundamental analysis is a decision-making method where forex traders and investors look to understand the economic situation of a country. To do this, they look at the underlying news and economic data to determine whether an economy is doing well or not. With this information, they can then determine whether to buy or sell a currency pair. In this article, we will look at how you can use job numbers in forex trading.

What are job numbers?

Governments and policymakers are in constant need of knowing how an economy is performing. Most countries have put in place statistics agencies that collect these numbers to get this information. These agencies are tasked with collecting various types of data, including the population, inflation, retail sales, housing, and — last but not least — jobs numbers.

Jobs numbers are data that compile the number of people who got into employment in a given month. They also look at the number of vacancies, number of layoffs, wages, number of hours worked, and the participation rate. Many countries like Canada and the US usually publish these numbers per month. Others, like New Zealand, tend to publish theirs quarterly.

These numbers are important because they provide a picture of the strength of the economy. Besides, an economy that is doing well will create more jobs every month. This trend will, in turn, lead to higher wages, which will translate to higher consumer spending. Consumer spending is the biggest component of an economy.

Similarly, an economy that is not doing well will usually see a higher rate of unemployment. Such a situation will lead to low wages and affect economic growth.

Components of employment numbers

The job report is usually made up of several important numbers. For this piece, we will focus on the American report, which is usually the most comprehensive.

- Non-farm payrolls (NFP) – The NFP data usually tracks the total number of jobs created in an economy by both the government and the private sector. A higher number shows that the economy is doing well.

- Manufacturing and government payrolls – These numbers measure the number of workers added in the manufacturing and government sectors.

- Unemployment rate – This data shows the number of people of working age who are not in employment. There are several types of this data, including the U3 and U6 unemployment rates. The U3 is a general rate that looks at people who are not working. The U6, on the other hand, includes people who have been discouraged by the labor market and those working part-time.

- Participation rate – This data looks at the proportion of the population that is employed and those who are searching for jobs.

- Wages – The data looks at the overall wage growth in an economy. It looks at whether wages are rising, stagnant, or falling.

- Claimants – these numbers are released every week. They show the number of people who signed and those who are receiving unemployment benefits.

- Vacancies – The vacancy rate data is published every month. The Bureau of Labor Statistics (BLS) collects this data from both large and small companies.

Jobs numbers and inflation

Jobs numbers have a close relationship to inflation. For starters, inflation refers to the overall price increase of products like food and gasoline.

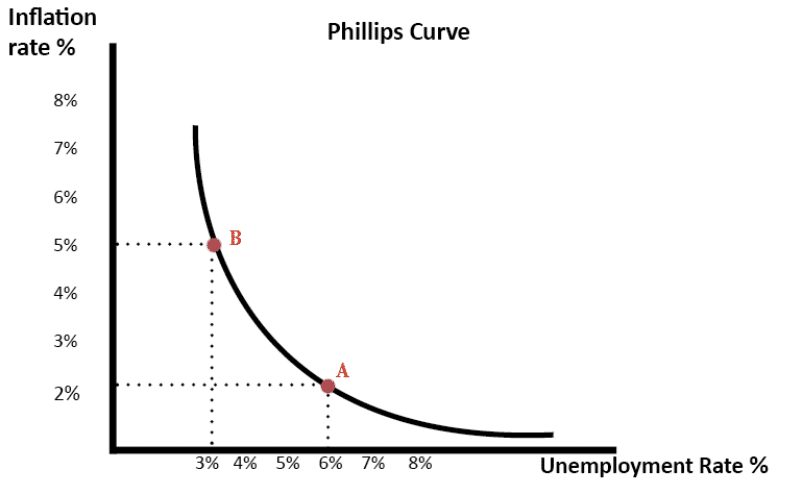

The special relationship between job numbers and inflation is often described by a concept known as the Phillips curve.

As shown below, the concept of the Phillips Curve is that inflation tends to rise when the unemployment rate falls. This happened because a low unemployment rate leads to higher wages, which in turn leads to higher consumer spending.

Phillips curve chart

The two also have a close relationship because of central banks. In most countries like the United States, UK, and Japan, the central banks are given the mandate to watch the unemployment rate and inflation rate. Precisely, they are mandated to ensure that the inflation rate remains steady and that the unemployment rate remains low. Central banks have tools like interest rates, quantitative easing, and even money printers.

Central banks play an important part in the forex market. In most cases, a dovish Federal Reserve is usually bearish for the US dollar. A good example of this is what happened after the Covid-19 pandemic broke out. The US dollar tumbled against key currencies after the Federal Reserve decided to lower interest rates to a record low and then implement the biggest quantitative easing program on record.

How to use jobs numbers in forex trading

Historically, currency pairs tend to have substantial movements when countries publish their employment numbers. Therefore, the first thing you need to do is to use the economic calendar to identify when a country is set to publish its data.

As you get used to forex trading, mastering this timing will be relatively easy. For example, the US and Canada tend to publish their monthly data on the first Friday of the month. The US also publishes its initial jobless claims every Thursday unless there is a public holiday. Similarly, the UK tends to publish its jobs numbers on Tuesday.

Second, you need to know the expectations and the recent trend. Having a good understanding of this will help you position your trades well. You can gain more insights by reading articles written by major publications like the Wall Street Journal and Bloomberg about these numbers.

Third, a good strategy to trade before the release is to use pending orders. These are orders that are only implemented when a currency pair reaches a predetermined level. For example, if the EUR/USD is trading at 1.1100 before the data release, you could place a buy-stop at 1.1150 and a take-profit at 1.1200.

At the same time, you could place a sell-stop at 1.1050 and a take-profit at 1.100, and stop-loss at 1.1100. In this case, these trades will be initiated depending on how the numbers come out. The take-profits and stop-losses will help to cushion you from any substantial risks.

Summary

Jobs numbers are some of the most closely watched economic metrics on the calendar. This data provides more information about the state of the economy and what the central bank may do. In this article, we have looked at some of the key components of a job report and how to trade it.