Kapola Trader EA works on multiple currency pairs on the M15 timeframe and uses a trailing stop loss to exit the trade when it is in profit. The algorithm comes with numerous subscription packages and has a 30-day money-back option for traders. We will cover all the major points of the system in our review and see if it can be a good choice for us.

Features

The robot has the following features:

- It has a win ratio of 3:1.

- There are multiple indicators in use.

- It’s a fully automated trading robot.

- The algorithm is highly safe to use.

The developer states that the robot works on EURUSD, GBPUSD, AUDUSD, USDJPY, and NZDUSD on the 15 minute time frame and uses CCI, Bollinger Bands, and moving averages. The Bollinger bands are used to place buy and sell trades, while CCI and the moving averages are employed to take the exit. There is a trailing stop under use which allows trades to close when the market enters in profits.

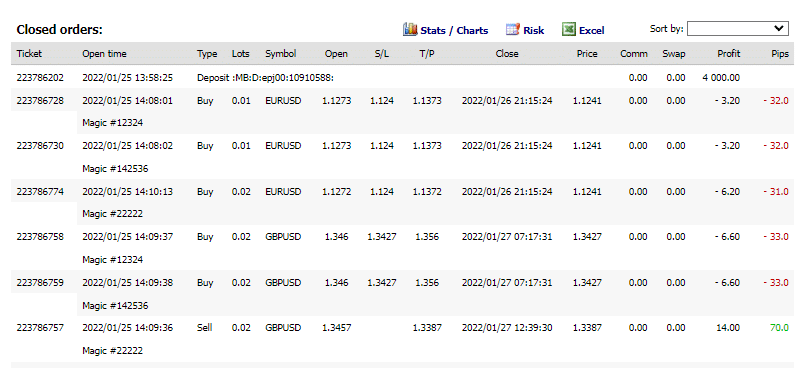

From the live records on FXBlue, we can observe that it uses averaging and martingale strategies. It holds trades for an average of 12.7 hours which conforms to a day trading approach.

How to start trading with Kapola Trader EA

To get the service up and running, traders have to use the following steps:

- Purchase the system from the developer and provide your account number

- Download it on your MT 4 or MT5 platform and place it on your charts

- Do not forget to enable the auto-trading button

Price

The EA is available for an asking price of $99, $149, and $249 for 1, 2 and 4 demo and 1, 2 and 4 real accounts. There is a 30-day money-back guarantee. Unfortunately, there are no renting options present.

Verified trading results of Kapola Trader EA

There are no backtesting records available that could show us how the algorithm works for an extensive history. We could not find any detail regarding the topic on the website.

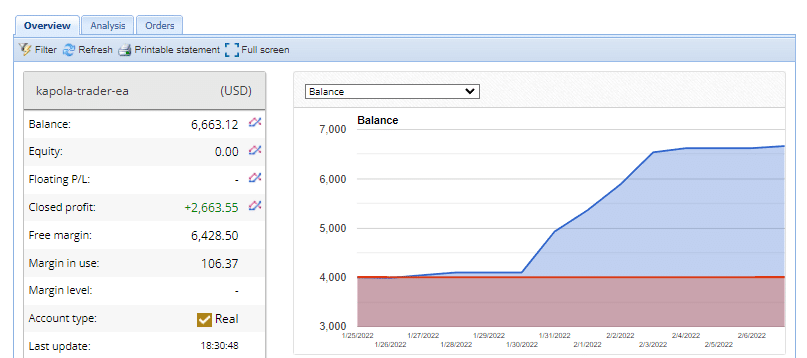

Verified trading records are available on the FXBlue that show performance from January 25, 2022, till the current date. The system made an average monthly gain of 192.1%, with a drawdown of 0.3%.

The winning rate stood at 69.4%, with a profit factor of 3.43. The best trade was $230, while the worst was -$46.24 in a total of 497 trades. The developer made $4000 in deposits on a real account. The account’s current balance stands at $6663.12, with a total return of 66.6%.

Customer reviews

No customer reviews are present on noted forums such as Forex Peace Army or TrustPilot. This shows us that not many traders have tried the system. They might vary because it uses grid and martingale approaches for trading and has live records for a short duration.

Vendor transparency

The developer does not detail their records or trading experiences. The complete information about the robot is presented through a single webpage. The only way to contact the team is to use a form on the website and fill it up. They claim to provide 24/7 support to customers. Lack of availability of social media contacts and live chat is not a good approach.

Is Kapola Trader EA a viable option?

The robot has the following benefits and demerits.

Advantages

- Available via multiple subscription packages

Disadvantage

- No detailed backtesting statement

- Short live records

- No information on developers

Conclusion

Kapola Trader EA uses grid and martingale strategies to trade the market. This approach can be extremely risky when the price trends in one direction. There is no information present on the real developer of the product. The vendor is also not transparent in the backtesting records, which is a poor approach.