Overview

The euro is the second-most traded currency in forex, accounting for approximately a third of the market capitalization. Analyzing the euro for fundamentals is a little trickier than some of its counterparts simply because many different nations use this currency.

The euro is home to 19 of the 27 countries forming part of the European Union (EU). The group of 19 nations is collectively known as the Eurozone. However, there are only four countries we can consider as the biggest contributors to the overall GDP of the Eurozone: Germany, France, Italy, and Spain. Of course, before Brexit, there would have been a top 5 with the inclusion of the United Kingdom. Germany tends to be the best-performing economy in the EU. The GER30 index, which is an index of the top 30 German companies, strongly correlates with the euro and Euro-based currency pairs.

When analysing indicators for forex fundamental analysis, investors keep their eye on what they perceive as the most influential drivers of the euro in the markets.

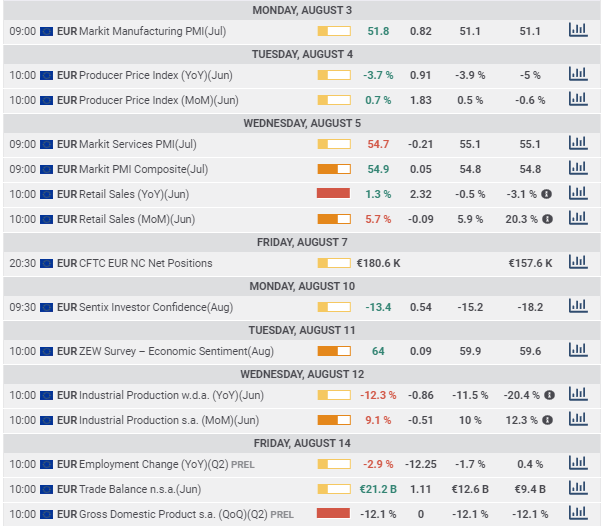

To make things simpler, we should scale each of these indicators according to low, medium and high importance. Below is a list of the main EU economic indicators used in fundamental analysis (and their level of importance in brackets):

- Interest rate (high).

- Gross Domestic Product/GDP (high).

- Consumer Price Index/CPI (high).

- Trade Balance/Balance of Payments (high).

- Retail Sales (high).

- Employment Change (medium).

- Manufacturing Purchasing Managers Index/PMI (medium).

- Producer Price Index/PPI (medium).

- Industrial Production (medium).

- M3 Money Supply (medium).

- Current Account (low).

- Construction Output (low).

- Sentix Investor Confidence/SIC (low).

- ZEW Survey (low).

- Consumer Confidence (low).

- Private Loans (low).

The most significant EU economic indicators

While debates persist over other indicators that some would consider significant (making this list indefinite), the five below are the ones that traders pay attention to the most:

- Interest Rate: Six members of the European Central Bank (ECB)’s executive board and 16 governors set the interest for the EU. Essentially, the interest rate is what commercial banks charge each other to borrow cash from their reserves. Considered one of the primary drivers of currency valuation, data for the interest rate is released eight times a year on a pre-determined Thursday (typically the second or third week) of a particular month at 12h45 CET.

- Gross Domestic Product/GDP: GDP reflects the output of goods and services produced by the economy. The preliminary and final reports for this indicator are each released at 10h00 CET. The preliminary report is released monthly someday in the third week. In contrast, the final report would be quarterly released in the second week of the month when there’d be no preliminary report.

- Consumer Price Index/CPI: The CPI measures the difference in the price of goods and services paid by consumers. This indicator is the primary one used for measuring buying trends and inflation in a nation. A preliminary report precedes the actual CPI release. The former is made available roughly two weeks before the main release. The main report comes out typically someday in the third week of the month at 01h00 CET.

- Trade Balance/Balance of Payments: This indicator calculates the difference between the total number of exports versus imports in goods and services. The data is made available roughly around the 15th of every month at 10h00 CET.

- Retail Sales: Considered the primary indicator of consumer spending, this indicator measures the differentials in the total value of inflation-adjusted sales generated by retailers. The data is made available in the first week of every month at 10h00 CET.

Medium to low significance EU economic indicators

- Employment Change: This indicator measures the change in the number of employed people in the EU.

- Manufacturing Purchasers Managers Index (MPMI): The MPMI calculates the level of activity of purchasing managers in the manufacturing industry.

- Producer Price Index (PPI): The PPI measures the price change received by local producers of commodities in all processing stages.

- Industrial Production: This indicator reflects the output of the broader industry sector.

- M3 Money Supply: M3 is the total quantity of money supply in circulation as local currency and bank deposits, which is very much related to inflation.

- Current Account: Closely related to Trade Balance, this index calculates the value difference of current transactions between exported and imported services, goods, and interest payments.

- Construction Output: This report shows the output of the private and public sector construction industries.

- Sentix Investor Confidence (SIC): This sentiment survey reflects the opinions of several thousand financial analysts and investors on the economic situation using 36 indicators.

- ZEW Survey: Short for the Zentrum für Europäische Wirtschaftsforschung Survey, this sentiment survey aims to reflect the opinions of the EU economy from about 350 German investors and analysts.

- Consumer Confidence: This index measures the level of consumer spending by surveying roughly 2300 consumers in the EU.

- Private Loans: This indicator reflects the change in the total value of new loans given to businesses and customers in the private sector.

Conclusion

Most indicators on this list don’t influence the euro to a substantial level . Traders should focus on those indicators, such as the interest and GDP, that hold slightly more weight for the short and long term.