Margin GRID Bot is a crypto trading bot from the Pionex team. As per the vendor’s claims, this system is useful in different scenarios and you can use it for downtrending, rising, or fluctuating markets. It is tied to the Pionex exchange where you can trade using automated systems.

How does this crypto bot work?

With this bot, you can mortgage a currency to borrow an asset for running the grid. For example, if the price of ETH is rising, you can mortgage ETH to borrow USDT. The USDT can then be used to run the grid for making money. The mortgaged ETH won’t be sold since the currency price went up. Also, the borrowed USDT will earn grid profits. On the other hand, when the market is downtrending, you can run the grid by borrowing ETH. This way, you can sell it at a high price and then buy it back at a low price.

Getting started with Margin GRID Bot

After visiting the official website of Pionex, you need to log in to your account and locate the bot in the terminal. To access the parameters, you need to click on the ‘create’ button. Here, you can configure key parameters. The system will then start trading automatically without any manual inputs.

Company information

Pionex is a company which is based in Singapore. It has been providing hybrid currency trading services with 12 in-built crypto bots since 2019. Unfortunately, we don’t have any background information available on the team members.

Features of Margin GRID Bot

Let’s check out the main features:

Slippage control

The crypto market is highly volatile, due to which price slippage is quite common. This system lets you control the slippage by creating the order limit price.

Dual models

This bot has two modes. The first one lets you lock your tokens to loan USDT. The net amount you can loan depends on the price of the mortgaged asset and the leveraged multiples. With the second mode, you can lock your USDT to loan tokens.

Advanced settings

You can set a trigger price for the bot to be created. It has risk management features like stop loss and take profit.

Strategies of Margin GRID Bot

This system follows a margin grid strategy. It is a combination of spot grid and margin trading strategies where the invested capital is amplified to get higher returns in grid trading through margin lending. The bot dives the capital into several grids which will be used for buying or selling, depending on the market conditions.

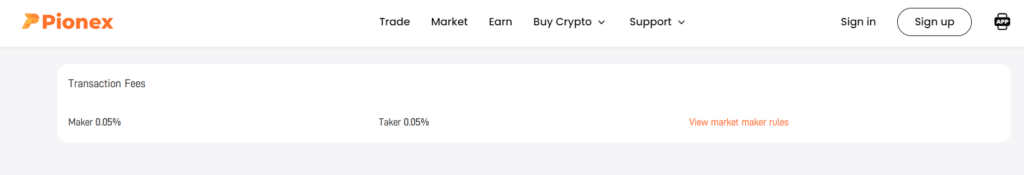

Pricing, fees and commissions

This is a free software app that you download from the Google Play Store or the Apple app store. All you need to pay is the 0.05% maker and taker fee for each transaction.

Deposit requirements

Pionex doesn’t have a minimum deposit requirement. If you wish to make debit or credit card deposits, you would require the Pionex Lite app.

What exchanges does Margin GRID bot support?

This bot is linked with the Pionex exchange.

What languages does Margin GRID bot support in their product?

Supported languages include English, Indonesian, Portuguese, Russian, French, German, Spanish, Turkish, Chinese, Japanese, Thai, Vietnamese, and Arabic.

Can you really make money with this bot?

Profitability in the crypto market depends on a number of different factors, so there is no 100% guarantee that you can make money with this system.

Advantages of Margin GRID Bot

Here are the advantages:

- The two modes of the bot help you deal with different market scenarios

- There is no one-time fee to be paid for the bot

- You can seek community support on Discord, Telegram, Facebook, and Reddit

Disadvantages of Margin GRID Bot

- There is no demo account for you to practice trading

Customer support

You can contact the support team via live chat and email.

User reviews

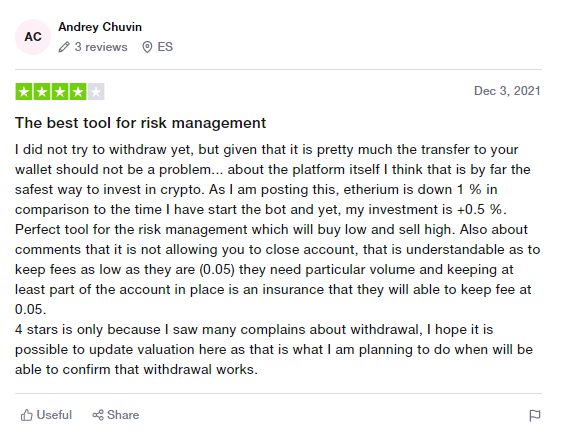

There are no reviews for the bot, but Pionex has a rating of 4.2 out of 5 on Trustpilot based on 262 reviews. Here, users have praised the performance of the bots.

Who is the Margin GRID Bot suitable for?

The strategy is complex and there is no demo account, which means the platform is better suited to advanced traders.

Margin GRID Bot summary: is it worth going for it?

This is a trading bot that helps you make profits in rising and falling markets. It has multiple advanced settings you can configure and there is only a small transaction fee that is applicable. However, it is not suitable for novice traders with zero technical knowledge.