Betting and forex share one attribute, risk exposure. In both, one needs to risk some money to accrue some returns. While most strategies in the two fields call for extreme caution and risk management plays, when losses start to pile up, the Martingale system calls for the opposite.

Understanding martingale system

Simply put, it is a trading strategy for forex traders with deep pockets. With this strategy, little attention is paid to risk management plays as it assumes the market would reverse regardless of the number of losses one pile up on top with each new trade in the same direction.

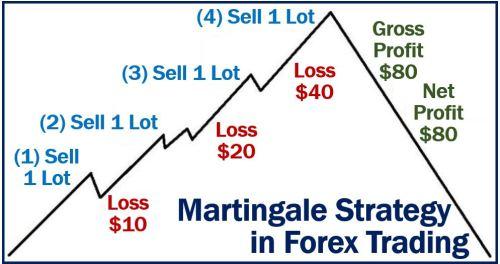

In this case, a trader gets to double up on a new trade as losses pile up on the previous trade. For instance, one can increase the position size of the next trade on the first position accruing losses. The doubling up continues until the market reverses and the last position starts generating profits.

The Martingale systems assume that one needs only one trade to turn around their fortunes. This is because if the market is left to run, it will reach a reversal point. Consequently, the system assumes there will always be an opportunity to recover from a losing streak as the market does not move in one direction.

Having sufficient money to continue doubling on each successive trade is crucial to make it to a trade that eventually pays off and wipes out all the previous losses.

In addition, it is assumed that one cannot lose all the time. With this thought in mind and sufficient capital at hand, one can continue adding up to a losing trade until a reversal occurs and a position turns positive.

Nonetheless, the amount of money risked with this system is usually higher than what one can make if things don’t pan out as expected. While this is one of this strategy’s biggest deficiencies, there are various ways to improve the final outcome.

Its use in forex

The Martingale system has been leveraged extensively by whales with sufficient amounts of money to ride whatever wave comes their way. With sufficient capital, the trade always works out, given that a currency pair can never go to zero. The fact that a currency pair can move in one direction, pull back, edge lower and then pull back provides an opportunity to double up with each new entry.

However, the strategy can pose significant risks in the stock market, especially on the sell-side. This is because, unlike forex, stocks can go to zero in case of a company going bankrupt, making it extremely difficult to offset positions already in play.

In addition, the system is highly effective whenever one borrows in low-interest-rate currency only to trade a currency backed by high interest. The prospects of aiming interest in these aces while trading makes it an ideal play.

Example

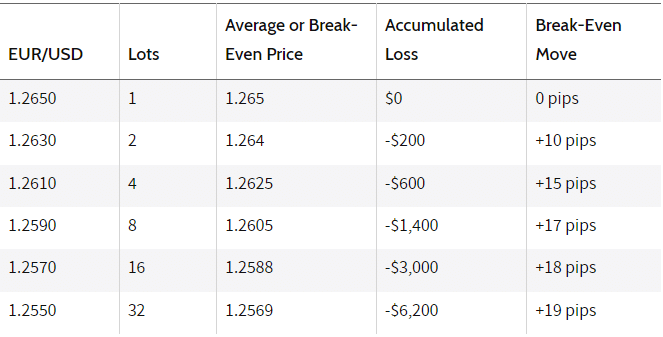

Consider a trader who enters a long position on EURUSD with 1 lot at 1.2650 at the start. As soon the position starts to accrue a loss, the use of the Martingale system will see the trader triggering a second position, double the size of the previous position at 2 lots at, 1.264

If the second trade accrues loss on the EURUSD edging lower instead of up, the trader will trigger a third buy position with 4 lots. The process will continue as long as there is sufficient capital to support the already running trades and the losses incurred.

The chart above clearly shows that the trader went to the 6th trade with a lot size of 32 and a loss of $6,200. Were the market to reverse at this point, trade 1.2550 being of a much bigger size (lot 32) would accrue profits much faster.

The trade breaks even and accruing profits would erase the previous losses much faster, given that they are of a much smaller lot. This is partly because the trade is triggered as a buy at a much lower level and much bigger position size.

Given that the 6th trade was opened at 1.2550, the trader will only require the market to bounce back to 1.2569 to break even, which is still way below the first five trades.

Nonetheless, to execute such a play in a highly liquid market such as EURUSD, you would need more than $10,000 in capital. Anything below this would lead to a margin call before reaching the 6th trade, whereby the market reversed.

Drawbacks

One of the biggest drawbacks to this trading strategy is that the amount of money spent trading can increase exponentially and reach huge unmanageable proportions. In addition, if the market fails to reverse and one opts to exit, the losses accrued can be extremely high and disastrous.

The risk-reward profile with the Martingale system is usually not good given the high-risk exposure with the prospects of making a small amount of profit. In addition, the strategy ignores the transaction costs incurred, which can be extremely high going by the increase in lot size with each new trade.

The fact that most exchanges come with limits on the trade sizes that one can place regardless of the amount of capital in play can make it extremely difficult to break even fast, should the losses continue to pile up.

Bottom line

The Martingale system is a proven trading strategy that works well with many assets. The prospects of wiping out all the losses with one trade are always sure to entice many traders. However, it is important to note that the risk of an account being wiped out is usually high, especially when one does not have sufficient capital.

Additionally, the strategy only works well with traders with deep pockets able to ride any wave and remain solvent for the longest time until a reversal occurs. The aspect of doubling up on each losing trade only goes to increase the risk exposure as opposed to the amount of profits one is likely to make.