Mood EA is a trading advisor that works based on a momentum indicator and its data provided from terminal. The presentation looks simple and not informative. Let’s figure out if the system is good to go or not.

Features

So, we grouped the most important claims, settings details, and features in the following list:

- The system was designed to help traders to open and close orders on the market automatically.

- The system “works on the Momentum indicator, which is a leading indicator. To enter a position, the advisor uses the oversold or overbought conditions of this indicator, catching the “mood” of traders.”

- It looks for market conditions all the time to be sure it’s safe to open an order.

- The dev decided not to explain the rest to us. It’s ridiculously not enough to make a wise decision about the system.

- After purchasing the robot we have to contact the devs immediately.

- We had trading results published from an account. Now, we have only past screenshots.

- The system focused on trading in the market direction.

- It can help us with managing manual opened orders.

- We have a hedge feature.

- The system helps us with calculating lot sizes automatically for us.

- It manages them based on the available margin.

- We can customize TP and SL levels.

- There can be a trailing feature used.

- It can reduce drawdowns, using this system.

- A magic number helps the system to mark its orders.

- It trades during the determined hours.

How to start trading with Mood EA

The offer is $199 for a single copy for trading on a real account. We have no subscription options available. We can download a demo copy for executing tests and checking settings.

Backtests

Alas, the presentation doesn’t include a backtest report. It’s a huge con because we have no idea if the system worked properly on the past tick data and what broker was used to bring it.

Verified trading results of Mood EA

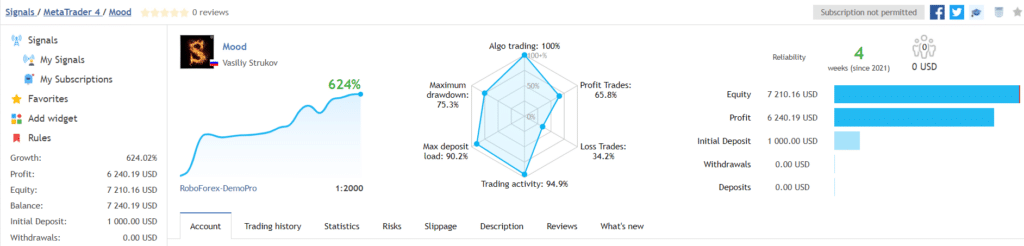

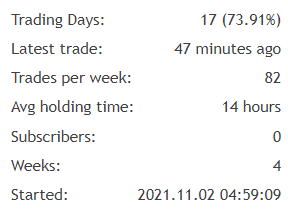

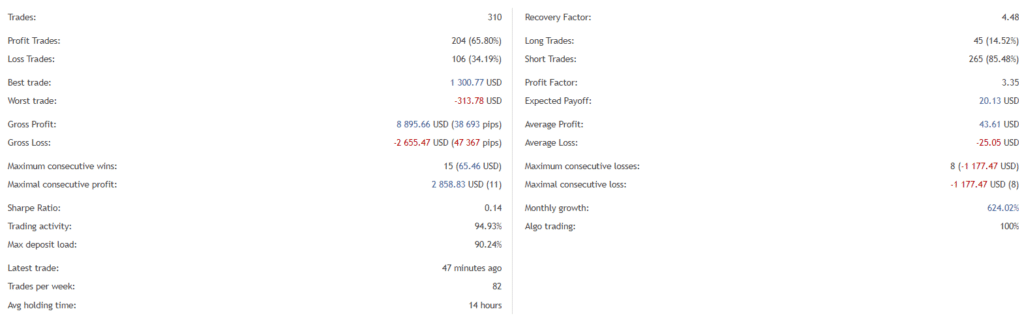

The owner decided to remove the account. Most likely, something went wrong and high leverage forced the account to huge losses. The advisor executed trades on a demo account on RoboForex. The leverage was 1:2000. It’s four times higher than usual. The maximum drawdown was 75.3%. The maximum deposit load was 90.2%. These numbers were completely unhealthy. The account worked for four weeks only. An initial deposit was $1000. The absolute gain has become 624.02%.

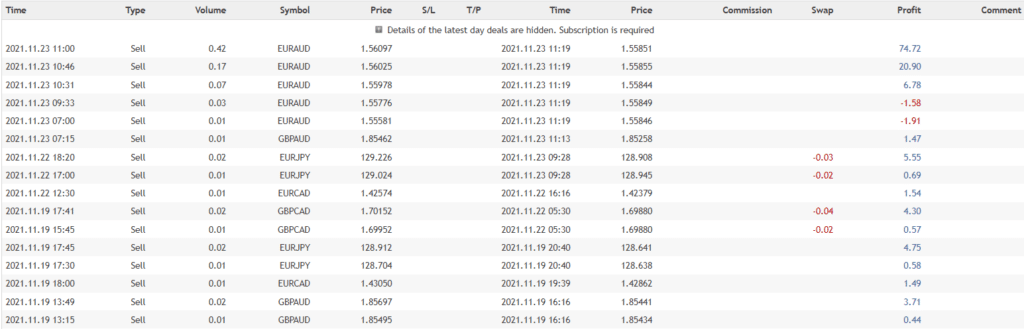

A trade frequency was 82 deals every week on average. A common holding time was 14 hours.

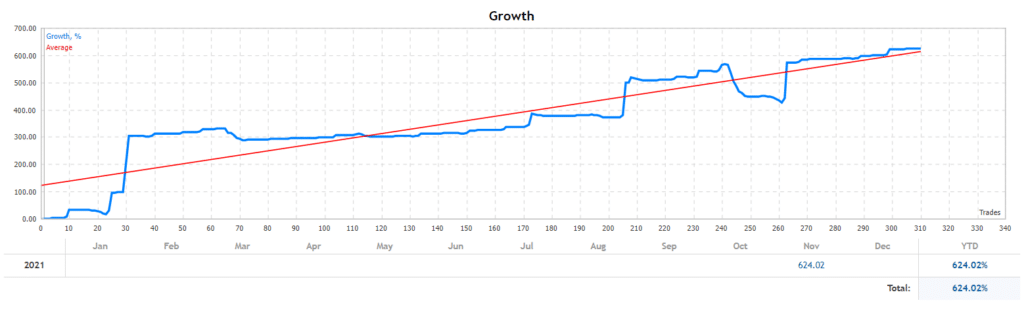

The chart of growth showed that there were periods of high risk trading.

The advisor used aggressive Martingale that could be a reason for losing the account.

There were 320 deals traded by the system. The best trade was $1300.77 when the worst trade was -$313.78. The recovery factor was 4.48 when the profit factor was 3.35.

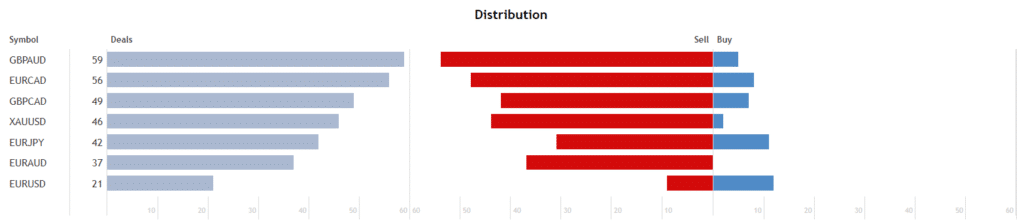

GBPAUD was traded by the system the most actively – 59 deals. The advisor prefers trading the sell direction much more than the buy one.

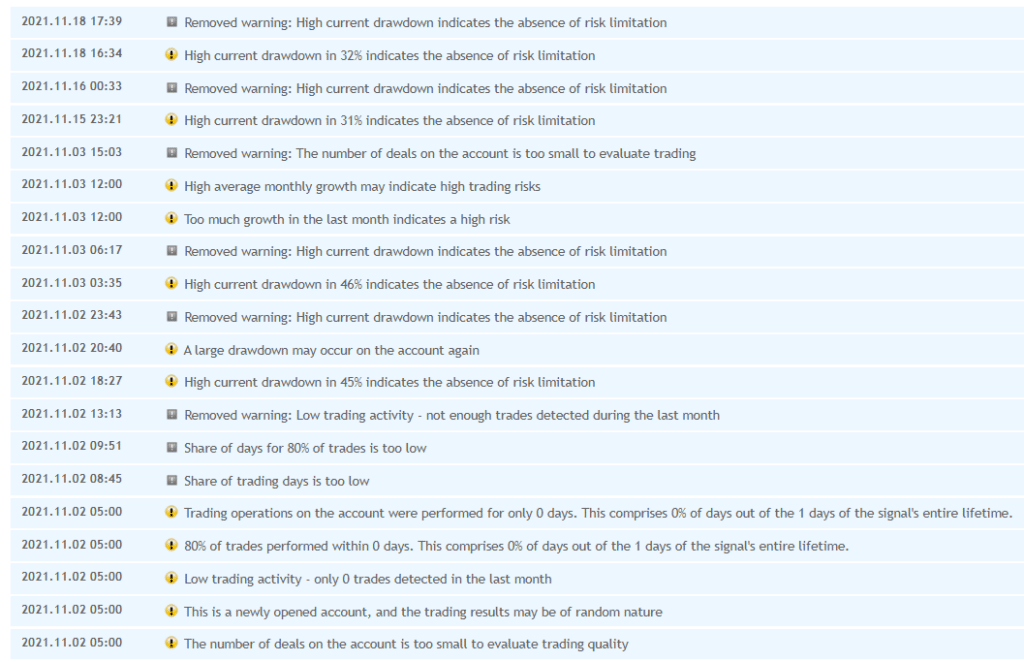

The system was warned many times for high risk trading.

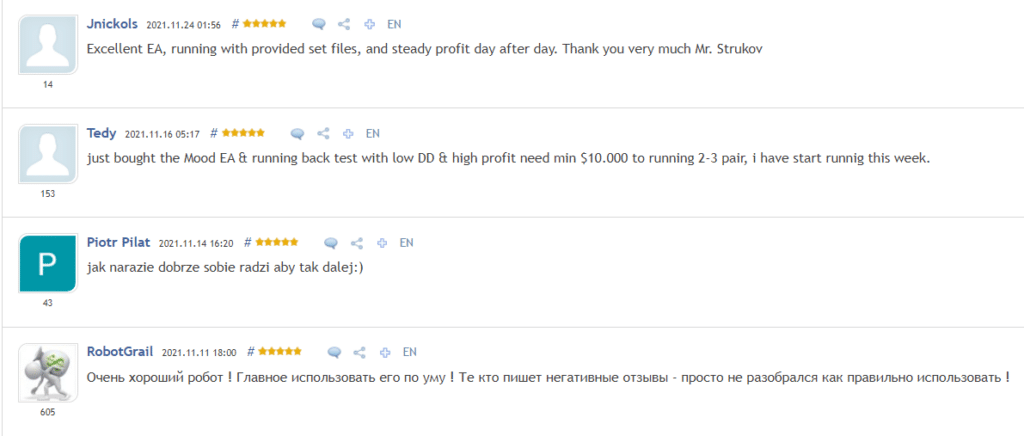

People feedback

We have only positive testimonials written. We don’t know if they are relevant.

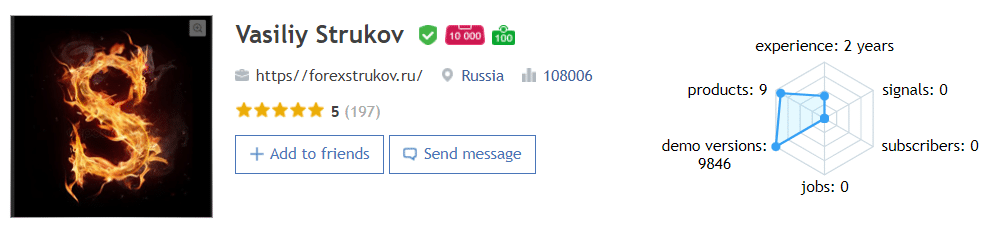

The developer is Vasiliy Strukov from Russia who has 9 products on the board. His rate is 108,006. We noted that seven products were removed. The advisors have a 5 rate based on 197 reviews.

Review summary

| Advantages | Disadvantages |

| Affordable pricing | No risk advice given |

| No money management advice provided | |

| No backtest reports provided | |

| Trading results were removed | |

| No refunds and no rental options available |

Mood EA is a robot that looks like a dangerous system. The presentation is several lines short, backtest reports aren’t provided. It has an account with trading results, but it was removed.