The Non-Farm Payroll report is one of the biggest reports known to trigger big price movements in the currency market once every month. The report paints a clear picture of how the U.S economy is doing by focusing on employment data. Likewise, traders react differently to the report, conversely triggering wild swings that generate trading opportunities.

Understanding the Non-Farm Payroll Report

The Non-Farm payroll indicates the number of workers in the U.S. Unlike other employment reports, and it excludes farmworkers given their work’s cyclical nature. It also excludes some government workers and nonprofit employees.

In addition to showing the number of people employed over a given month, the report also indicates the unemployment rate, the average hourly earnings, and any revisions on previous releases.

The Bureau of Labor Statistics is tasked with carrying out surveys to determine the number of people employed both in the private and public sectors. The department issues the survey on the first Friday of every month at 8:30 am EST.

Interpreting the NFP Report

The NFP is extremely large contrary to what is usually reported by most news outlets. However, traders focus on three or four key pieces of information known to influence market sentiments. Once the report is out, traders focus on the actual figure, which indicates the number of people who got jobs in the month.

In case the number beats estimates as projected by economics, the same implies economic growth. However, an increase at a fast rate may be problematic as it may increase inflation, which could be bad for the economy.

The market often expects the payroll data to indicate an increase of at least 100,000 every month. It is often associated with a sign of continued growth in the economy. The actual number failing to beat estimates often arouses concerns about the health of the U.S economy. Such unexpected results could trigger worries that the economy is facing unforeseen challenges.

In addition to the actual figure, unemployment is another key data point that traders and economists pay close watch to. The data point signals the percentage of the total labor force that is unemployed but actively seeking work. While the figure moves in small increments compared to the actual figure, increases always arouse concerns as it signals a lack of job opportunities. A decline in the unemployment rate indicates the economy is expanding, therefore churning more job opportunities for the labor force.

Traders also pay attention to the wage growth data as it indicates the economy is growing at an impressive rate prompting employers to hike pay for workers. Likewise, the data is relied upon by policymakers to estimate future economic growth while also shaping inflation targets.

The Non-Farm Payroll Report Importance

The NFP is an important economic indicator as it accounts for more than 80% of the total U.S business sector. Likewise, forex traders pay close watch to the report as it provides insights on U.S economic growth and inflation. A rise in the actual figure signals companies are hiring more people, which leads to more money being spent in the economy.

While traders rely on the NFP report to gauge the U.S economy’s health, economists analyze the report to get insights on the unemployment rate, participation rate, and other trends in the economy.

The report also shows how various sectors in the U.S economy are doing either expanding or contracting. Expansions often result in a higher NFP number, while contraction leads to negative contributions.

The U.S central bank, the Federal Reserve, also pays close watch to the NFP report when making policy decisions concerning rate hikes and cuts and quantitative easing.

NFP Report Impact on Forex Market

Surprises or disappointments in the NFP data often influence trader’s sentiments, conversely influencing how they trade various currency pairs and commodities. For instance, exchange rates of U.S dollar-denominated currency pairs experience wild swings after the report.

Whenever the actual NFP figure comes out lower than what economists expected, traders are usually motivated to sell the dollar as the data signals weakness in the economy. A strong report that beats estimates on all thresholds often results in the strengthening of the U.S dollar as traders interpret the same as strength in the U.S economy.

In addition to influencing the dollar strength, the non-farm payroll report also has implications on the stock indices and commodities such as gold. Stock indices tend to rise whenever the NFP figure beats estimates as it signifies economic growth indicating higher prospects of companies generating stellar financial results.

Gold, on the other hand, comes under pressure whenever the NFP report comes better than expected. The strengthening of the dollar often results in a selloff of the precious commodity as yields rise. A robust economy often triggers an increase of interest rates by policymakers, causing gold to lose its allure as focus shifts to yields.

Forex traders pay close watch to the NFP report, given that it provides insights on potential rates of inflation as well as economic growth. Similarly, its ability to influence policy maker’s sentiments regarding interest rates also goes a long way in influencing the trader’s sentiments on the dollar.

Trading the Non-Farm Payroll Report

Long Term NFP Trading Strategy

The NFP report is known to trigger wild swings a few minutes to and a few minutes after. That said, it would be wise to wait for the market to digest the report before triggering any position. With this strategy, traders are advised to pay attention to the 15-minute chart. Likewise, it would be wise to select an ideal currency pair to trade, such as the EUR/USD or GBP/USD, as they generate solid moves after the report.

Rules of engagement

With this strategy, nothing is done during the first bar between 8:30 and 8:45, after releasing the NFP data. The idea is to wait for the market to digest the data.

Once the 15-minute bar closes at 8:45, wait for a confirmation bar to see where the price is likely to go. The next candlestick acts as a confirmation candlestick.

The second candlestick highs and lows would set up the potential trade trigger. When the second candlestick in the 15-minute chart closes above the first candlestick, traders can use this opportunity to enter a long position as the price is likely to edge higher.

A trader can enter a long position as soon as the second candlestick closes above the first candlestick after the NFP report. The stop-loss order to mitigate against price reversing should be placed 30 pips below the second candlestick.

A trader can enter a short position as soon as the first candlestick after the NFP report closes lower, followed by a second bearish candlestick that closes much lower. The stop loss should be placed 30-pips above the second candlestick to mitigate against price reversing and starting to move up.

The target on the short or long positions would be a time target given that the NFP report tends to trigger trends that move for hours. A trader can use a trailing stop to track profits as price moves up or down.

Short term Forex Trading Strategy

The short term strategy is for traders looking to profit from short-term price movement after the NFP report.

Rules of engagement

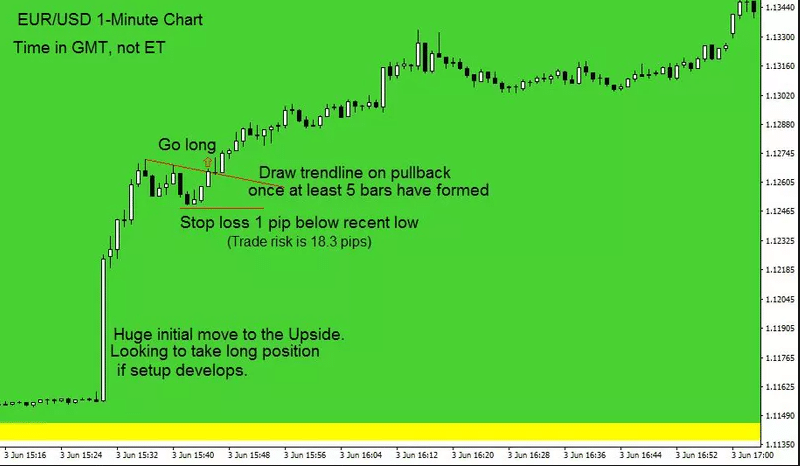

With this strategy, traders should focus on the one minute chart while trading liquid pairs such as EUR/USD or GBP/USD, given the ample price movements they always offer.

Ten minutes into the report release, close all opened positions, and refrain from opening any other position until the report is out.

Once the report is out, price is likely to move either by more than 30 pips up or down. If the initial move is up, wait for the price to pull back off the initial high. The price should not drop below the 8:30 am price in this case.

Once the price moves lower and consolidates in the one minute chart, draw a trend line across the consolidation’s highs and lows. Once the price breaks the trend line again, enter a long position in anticipation of price edging higher.

Once a long position is triggered, place a stop loss one pip below the recent low on price spiking.

If the initial move was down, wait for the price to bounce back but should not break the 8:30 am price level. As price consolidates, draw a trend line that acts as a support level. Once the support level is breached, enter a short position in anticipation of price moving lower in the one minute chart. On opening a short position, place a stop loss one above the recent high.

Bottom Line

The Non-Farm Payroll report is an important economic data that forex traders should always pay attention to when trading. Its influence on the U.S dollar, which is the most traded currency in the trillion-dollar market, makes it a vital resource to keep track of.