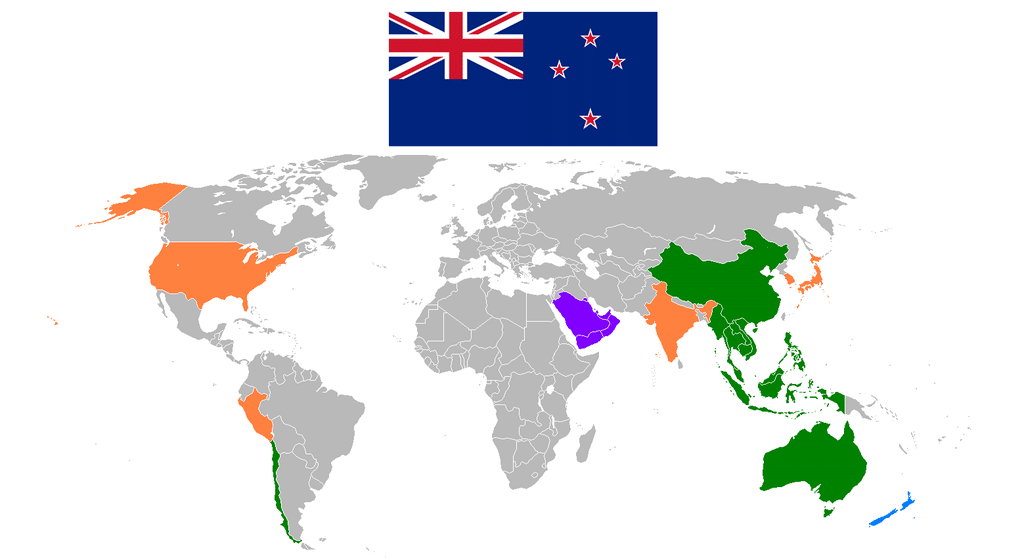

New Zealand has a highly developed economy and gets top ranks in terms of per capita GDP and economic development. It is among the most globalized economies and has substantial trade with Australia, China, the US, Japan, and the European Union. These five regions account for nearly two-thirds of New Zealand’s total trade.

Despite the country’s small size, its outsized influence in global trade and economy means that New Zealand’s currency is also widely tracked across the world. The New Zealand dollar is its official currency and is also known as the Kiwi dollar.

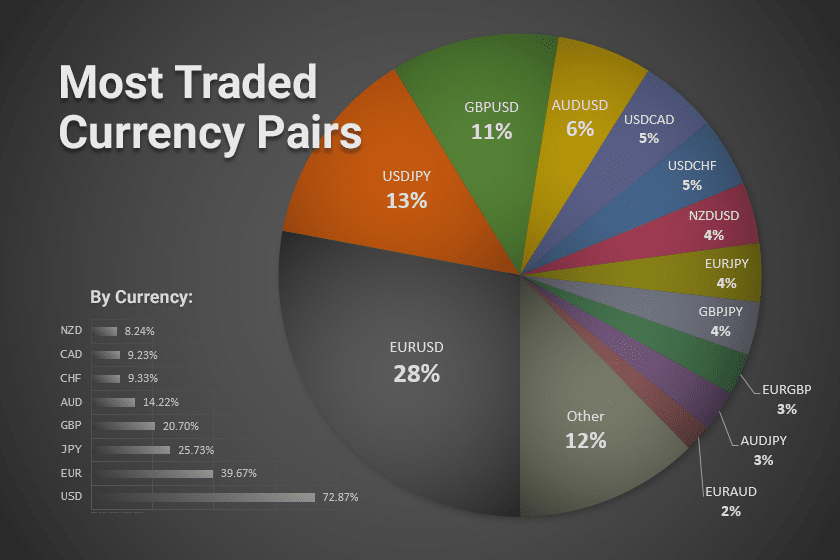

The NZDUSD is the world’s 7th most traded Forex pair by volume. NZDUSD transactions accounted for 4% of all the FX transactions globally. In terms of standalone currency transactions, NZD is the 8th most traded currency accounting for 8% of the total transactions.

The NZD transaction proportion is twice of proportion to NZDUSD’s market share. This is because there are a lot of transactions in AUDNZD as well, given Australia and New Zealand are practically neighbors and strong trade partners.

Trade and investments – key drivers for NZD

As with any currency, capital flows, both in terms of the current account (trade) and foreign investments (FDI), play a major role in the strength of the currency. Over the past decade, New Zealand has been aggressive in welcoming foreign investments.

As a result, several of New Zealand’s listed companies have high foreign ownership. This is not limited to just stock markets. Nearly 7% of the country’s agriculturally productive land was in the hands of foreign investors. The real estate market was also seeing a similar trend.

However, over the past few years, the government has had some concerns over the impact of high foreign ownership, especially from Chinese investments. A flood of Chinese investments in real estate drove up prices in the domestic market.

In response to this, New Zealand introduced rules putting certain restrictions on foreign investments in the sector. Concerns over the nature of Chinese investments have also grown as these investments have the potential to be used as strategic leverage rather than mere financial investments.

These recent moves, coupled with the evolving geopolitics of the US-China rivalry, might weigh on foreign investments in the country. Since capital inflows typically drive up the value of a currency, NZD might see some weakening should further restrictions materialize. Thus, any active NZDUSD trader should be on the lookout for any new rules being introduced by the New Zealand government or regulator.

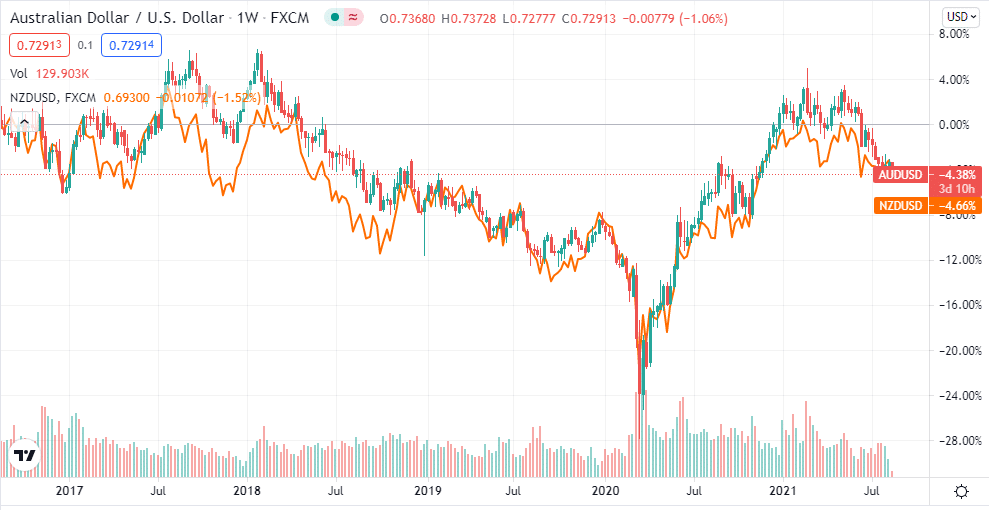

Coming to trade, New Zealand has a number of free trade agreements, primarily with countries in Oceania and Asia. Owing to geography, Australia is by far New Zealand’s biggest trade partner. The two countries exchange goods and services worth nearly $42 billion. This strong relationship also creates a correlation between the two currencies. As can be seen in the below chart, NZD and AUD demonstrate a strong correlation in their price moves over the past five years.

Thus, traders actively participating in AUDUSD might find it more intuitive to trade NZDUSD as well. On the other hand, investors looking for cues or triggers for NZD might look for price moves in AUD. The strong correlation also opens up opportunities for mean reversion trades between the two pairs.

China is the largest importer of New Zealand products, mainly buying agricultural and dairy products among other countries.

The bilateral trade deal is also in the works with India, another major consumer market. Any progress on this front can be a positive trigger for the NZD.

The central bank and monetary policy impact

Any FX pair with USD has a very high sensitivity to the Federal Reserve’s actions. It decides the money supply and the interest rates for the US dollar. The higher the money supply, the weaker the US dollar, and, similarly, the lower the interest rates, the weaker the US dollar. The present chairman of the Federal Reserve is Jerome Powell.

When the Federal Open Market Committee (FOMC) meets every six weeks, traders watch this event very closely. While the FOMC seldom changes rates or money supply, it does provide guidance for its future actions, which keeps on changing in nearly every meeting.

The massive quantitative easing undertaken by the Fed has put a lid on the USD strength so far, but any tapering on that front might lead to USD strength, thus driving down the NZDUSD pair. Traders should closely watch the FOMC meeting and the subsequent minutes of the meeting to gather clues for any impending decisions by the Fed.

The Reserve Bank of New Zealand (RBNZ) is the central monetary authority for New Zealand. The RBNZ holds a meeting every seven weeks to decide on key monetary parameters such as interest rates and liquidity. Similar to the Federal Reserve, RBNZ too has been proactive in taking easing measures to support the economy. Traders should track RBNZ announcements and meetings closely to predict NZDUSD moves.

Covid-19 impact and outlook

Unlike large countries, New Zealand has adopted a zero-Covid-19 policy. The government undertook a strict lockdown at the onset of the pandemic and plans to keep borders closed at least till January 2022. While such drastic measures helped the country keep its Covid-19 cases to a minimum, it also meant that the population has little to no immunity from the disease.

The slow pace of vaccination means that it will take several months to reach herd immunity. The rise of the Delta variant has raised concerns about vaccine efficacy. This has raised questions about New Zealand’s future in the post-pandemic world.

The government continues to enforce a sweeping lockdown in case of even a single Covid-19 positive case. This has led to high uncertainty in regard to the economy. A lack of immunity and the current conservative policy raises the risk of New Zealand falling behind other nations in reopening its economy, which could weigh on the NZDUSD.