Purchasing Managers Index (PMI) measures the productivity of manufacturers and services industries in an economy. In essence, it gives a picture of how much the firms have spent in the period under review.

PMI is a composite of key manufacturing and service delivery determinants, including production volume, new orders, jobs created/lost, inventory levels, and suppliers’ delivery levels.

These parameters are assigned different weights, depending on their contributions towards the sector’s growth. PMI reports typically come out at the beginning of each month, usually on the first business day of the month. The Institute for Supply Management (ISM), a private association of various firms, is responsible for compiling PMI reports.

PMI is computed from a survey of a sample of about five hundred purchasing managers, who give their assessment of the business environment based on the parameters highlighted above. The PMI is measured on a scale of 0 to 100, with 50 used as the mean measuring level. Measures above 50 are interpreted as growth, while those below it are interpreted as a decline in productivity. A reading of 50 means that growth has stagnated during the period under review.

Implications of PMI on the economy

While PMI is primarily a measure of productivity in the manufacturing and service sectors, the figures obtained from the index have far-reaching implications. PMI reports are essential tools for investors and traders because of the intrinsic link between the index and the performance of the wider economy.

For example, if a report reveals a rise in new orders, then that can be interpreted as a sign of a potential increase in manufacturing output in the coming months. This is indicative of possible growth in GDP. It follows, therefore, that PMI can be used as a foreshadow of GDP. In fact, the index is often used by economists to readjust their previous estimations of GDP.

Historically, PMI and GDP have a strong correlation, making PMI a reliable metric in assessing GDP. Most analysts consider manufacturing PMI as an advanced and reliable indicator of economic performance.

PMI-derived GDP forecasts are usually released several months before the actual GDP is released. Suppliers largely rely on manufacturing PMI to estimate the optimal operating margin. They can estimate the potential demand volumes and adjust their prices in good time to remain profitable. For example, if the manufacturing PMI grows, ethanol suppliers can increase their prices in anticipation of an expected increase in demand.

Application of PMI in trade

Investors and traders count on PMI as a tool for making important decisions. The different components of PMI reports indicate the potential performance of certain securities in the market. For example, a rise in supplier deliveries may mean that commodity prices improved, thus pointing to a forthcoming rise in inflation.

A rise in inflation means that more money is circulating in an economy, making it a good time to invest in cyclical stocks. Inflation also leads to lower returns from treasury bonds. In case a country’s PMI reduces, investors will often readjust their positions to reduce their holdings in the country’s bonds.

If, for example, the PMI of the United States falls from, say, 53.7 to 51.2, it paints a picture of a contracting economy. Therefore, in that case, traders are likely to sell the dollar.

Some countries release their PMI reports using a sectoral approach, with manufacturing, services, and construction PMI released separately. It is worth noting that PMIs of different sectors have different implications on the economy.

For example, a service-based economy will be more affected by a decline in service sector PMI than a reduction in its manufacturing PMI. This means that if the manufacturing PMI is released first and indicates a decline in manufacturing, the country’s currency may initially fall. However, if the service PMI follows after that and shows a rise in service PMI, then the currency may rise back up.

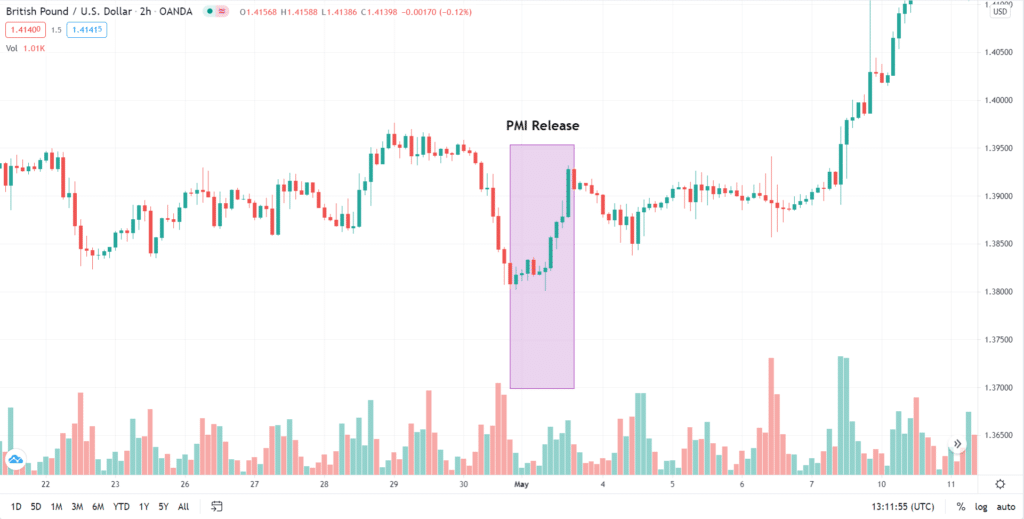

In the chart shown above, see how the GBP gained against the dollar upon the release of the UK PMI on May 3rd, which rose from 58.9 in March to 60.9 in April. Note that the U.S. PMI grew by a smaller margin from 60.5 in March to 60.6 in April.

Bottom line

PMI is an important indicator of the performance of the economy. It incorporates the most significant contributors to economic growth. Notably, the index assesses the manufacturing and service sectors and gives essential pointers for measuring GDP growth. Traders and investors should therefore incorporate PMI in their financial assets analysis.