Powerhouse EA is a trading solution that was designed to provide people with automated orders execution. The developers united their solution under the Responsible Forex Trading brand. So, we have decided to check the system out before going ahead.

Features

The presentation includes various details about how the system can perform on our account if we decide to buy it.

- The system can convert us with automatic orders execution.

- We can do nothing in addition.

- The system can be used on the MT5 terminal.

- Developers decided to unite four trading robots at once: The Comeback kid, Ranger, Vigorous and Gopher.

- We remember The Comeback kid and Vigorous.

- As a result, the developers have received the most advanced trading solution.

- The robot can be set to trade easily. Most likely, there’s a user manual provided.

- We have the system released on a retail market.

- The system requires some customizations to start trading.

- It supports cross pair take profit features.

- It’s a quite advanced way to trade.

- So, this can increase drawdowns either.

- We can get the system ready to go within several minutes.

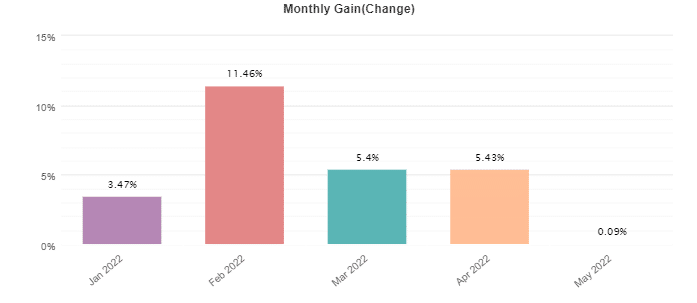

- The devs claimed that monthly profitability can be up to 5-8%.

- It can trade with an acceptable frequency of 15 orders monthly.

- The devs tested the robot on 14 pirs on 19 years of tick data.

- We are allowed to work with several levels of risks.

- The leverage of 1:200 will require $5000 on the balance from us.

How to start trading with Powerhouse EA

The developers provide us with a simple offer of $497 for a single copy. We can expect to receive support, free updates, and a 30-day refund policy.

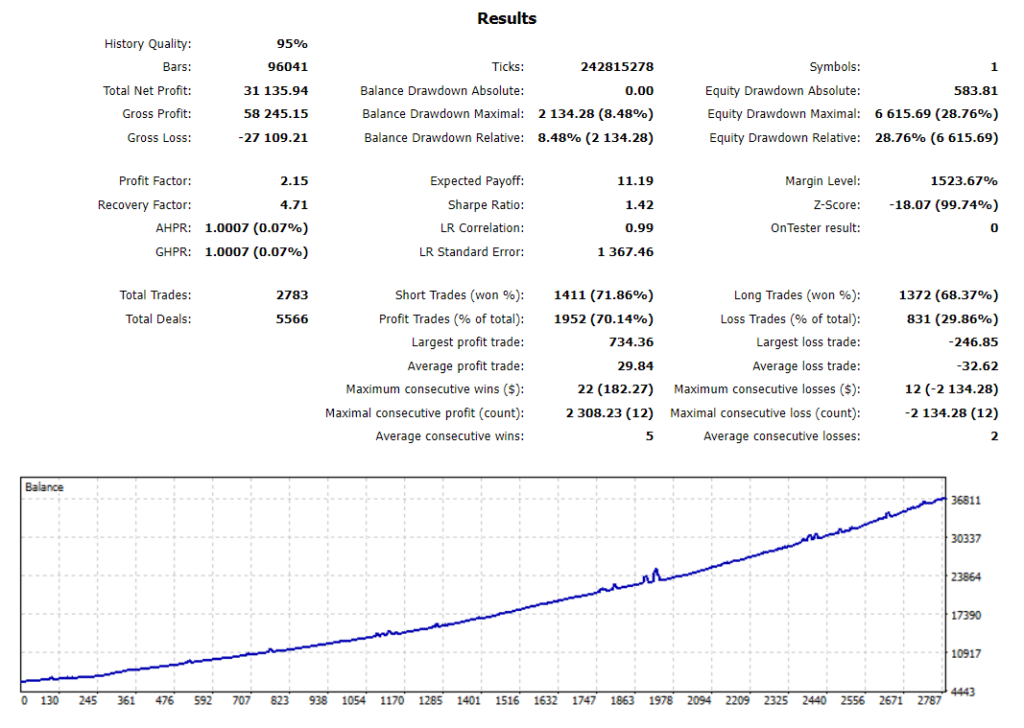

Backtests

The developers shared a test where the data for AUDUSD on H1 was used. They picked it from a period between 2000 and 2022. The history quality was 95%. The robot has generated $31,325 as a result. The profit factor was 2.15. The recovery factor was much higher–4.71. It has executed 2783 orders with the accuracy of 71.86% for shorts and 68.37% for longs.

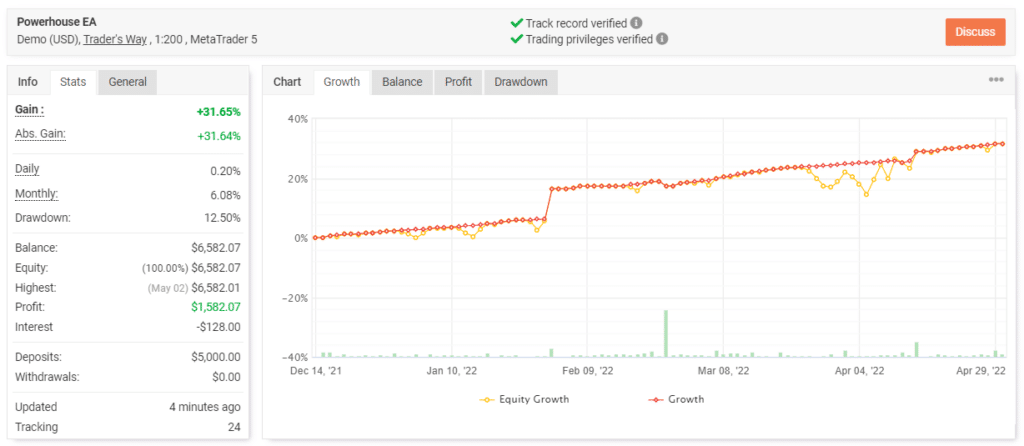

Verified trading results of Powerhouse EA

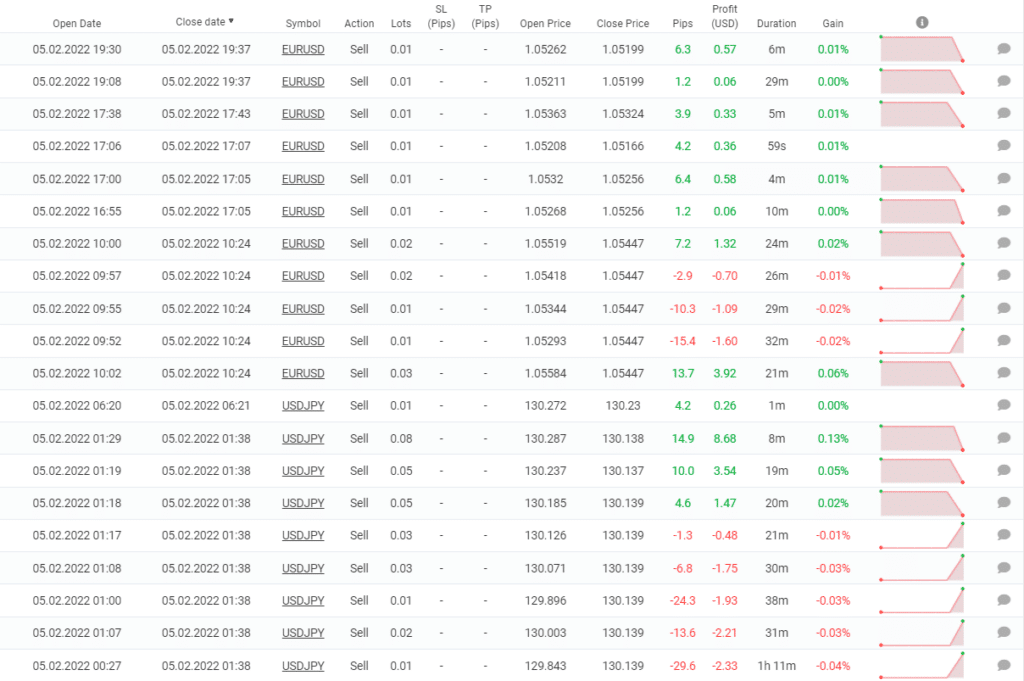

Powerhouse EA keeps managing a demo account. The broker has an average reputation for automatic trading, Trader’s Way. The data we see is trustworthy because the account has a verified track record badge. It was created on December 14, 2021, and deposited at $5,000. Since then, the total gain has amounted to 31.65%. An average monthly gain is 6.08%. The maximum drawdown is 12.50%.

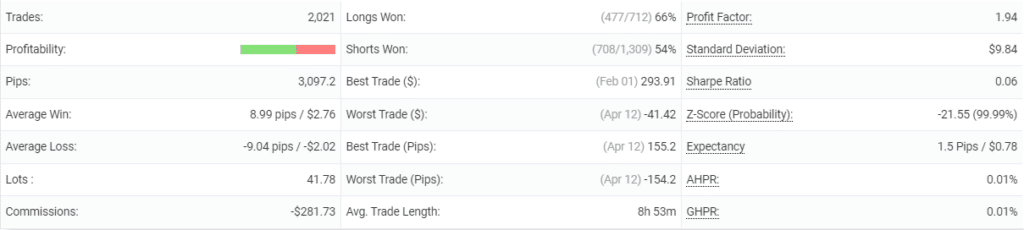

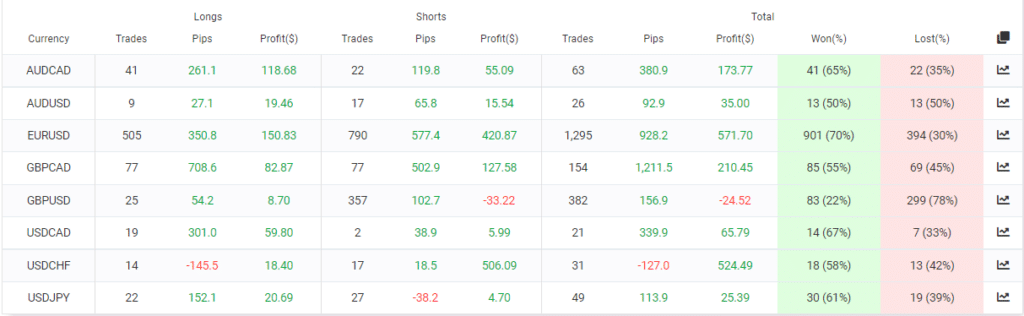

The system has closed 2021 orders. It could manage to generate 3097.2 pips. An average win is 8.99 pips when an average loss almost equals -9.04 pips. The win rate is between 54% and 66%. It keeps deals on the market for almost 9 hours. The profit factor is 1.94.

The system won 7 pairs and lost GBPUSD (-$24.52). .

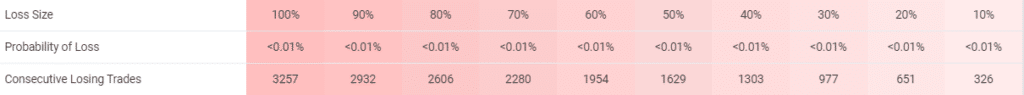

The system cares about accounts because it works with low risks.

We may note that the robot works with extended Grids of orders with Martingale applied.

The robot closed the first four months of 2022 with profits.

People feedback

The developers don’t provide us with feedback from real clients about if the system performs that well on their accounts.

Review summary

| Advantages | Disadvantages |

| A backtest report provided | No team revealed |

| Trading results shown | No money-management or risk advice given |

| A refund policy applied | The robot works with a highly-risk combination of a Grid with Martingale |

| No testimonials from clients provided |

Powerhouse EA is a trading advisor that manages a risky combo of Grid and Martingale. Working with it requires much more margin to keep orders on the market. The presentation provided information about what the system has behind. A positive addition is if we don’t like the robot, we can get our money back within 30 days.