Proprietary trading is a common approach that many experienced and beginners use to trade the financial market. It differs from the popular method where traders use their own cash to trade. In this article, we will look at what prop trading is and identify some of the top prop trading firms.

What is prop trading?

A common challenge that many people face when starting their trading journey is capital. Many brokers have solved this issue by allowing traders to start their trading careers with as little as $100. But still, with such an amount of money, it is difficult, if not impossible, to make a lot of money in the market.

This is where prop trading firms come in. These are online companies that provide traders with finances that they can use to trade for a small fee.

After being accepted, the trader will do the work and then cost-share the profit with the firm. In most cases, the trader will pocket the bigger share of the total profit.

Prop trading firms create a mutually-beneficial situation. They provide qualified traders with the funds that they need to trade. At the same time, they make income by taking a share of the trader’s profit.

How prop trading works

The concept of prop trading is simple. It starts with a proprietary trading company that has capital that it needs to deploy. Now, instead of this firm deploying capital itself, it turns to other experienced traders.

These traders enroll in their service and pay a small fee. In most cases, this fee is usually a bit low compared to what the trader will get in return.

After verifying that the person is a good trader, the company will provide a fully-funded account to the trader. This trader will use his experience and trading strategy to execute trades. After that, at the agreed time, the company will share the profits as arranged with the trader.

Prop trading companies use a different approach. For example, some, like Day Trade the World (DTTW), don’t discriminate against who they enroll. The company typically offers all the required training to the trader. It then tests their performance using a demo account.

After traders make a small deposit, the company funds their account. It also encourages the trader to hire about five more traders in order to create a good and robust trading floor.

Other prop trading partners receive applications from traders. They then vet them for a few months and then fund accounts of those who qualify. They do this vetting to ensure that they are hiring a good and experienced trader.

How to prop trade

There are a number of steps that you need to follow when becoming a good prop trader. First, you need to have an interest in the financial market since you will spend a lot of time in it. As such, it will be difficult for you to succeed in the industry if you don’t have an interest in it.

Second, regardless of the business model of the prop trading firm, you need to do some studies about the forex market. This will involve reading literature about forex to understand how it works.

Third, you need to have a good understanding of various methods of conducting forex analysis. In most cases, traders use two primary methods to conduct analysis: fundamental and technical.

In fundamental analysis, they focus on news and economic data to predict the future direction of the currency pair. Some of the top economic numbers to consider are the unemployment rate, initial jobless claims, inflation, and manufacturing and services PMIs.

In technical analysis, traders focus on chart movements and then incorporate indicators like the Relative Strength Index and Gator Oscillator to predict the direction of a currency pair.

They also analyze key chart patterns like triangles, wedges, and cup, and handle to predict the direction of a pair.

The next step is to find a good prop trading firm. The best approach to find one is to use Google. By just doing a Google search on the best prop trading firms, you will find some of them.

Finally, you should read more about them to understand their reputation and business model. You should then contact them and get started.

Examples of prop trading firms

There are many prop trading firms. Some of them focus mostly on forex, while others offer different markets like stocks, commodities, and options.

Day Trade the World (DTTW)

DTTW is one of the biggest prop trading firms. The company uses its proprietary trading platform that even provides direct market access (DMA). While most of its prop traders focus on stocks, its platform has forex and other assets.

To get started, you just need to create an account and deposit a refundable fee of $500. After paying this fee, the company will send you hardware known as PPro8 Cube, which connects you to its network. After this, you will need to send a margin fee of $3,000, and then the company will give you a bigger account.

FTMO

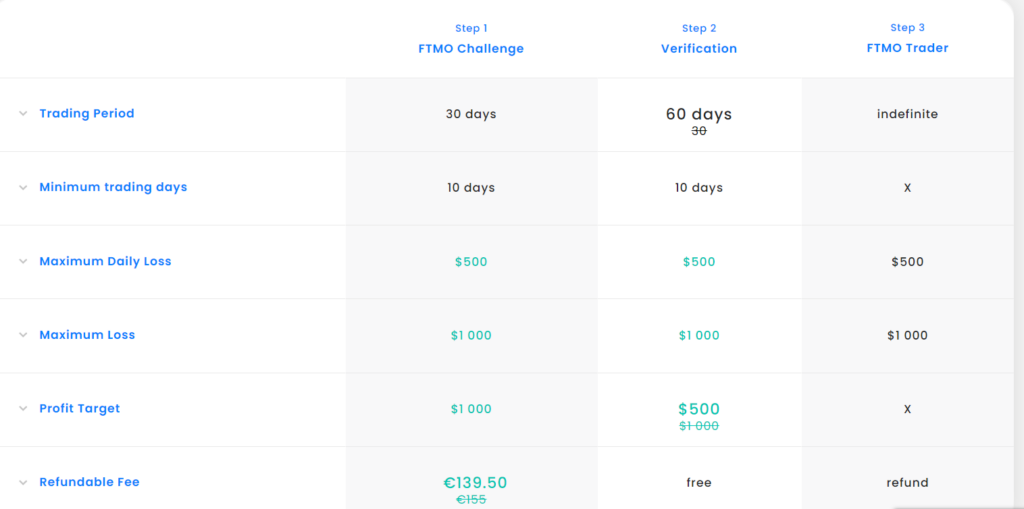

FTMO is a prop trading firm that takes interested parties through a rigorous trading challenge. In this challenge, you will need to prove that you can trade and generate a consistent profit.

Once accepted, the company will provide you with a funded account. Advanced traders take about 90% of their profits.

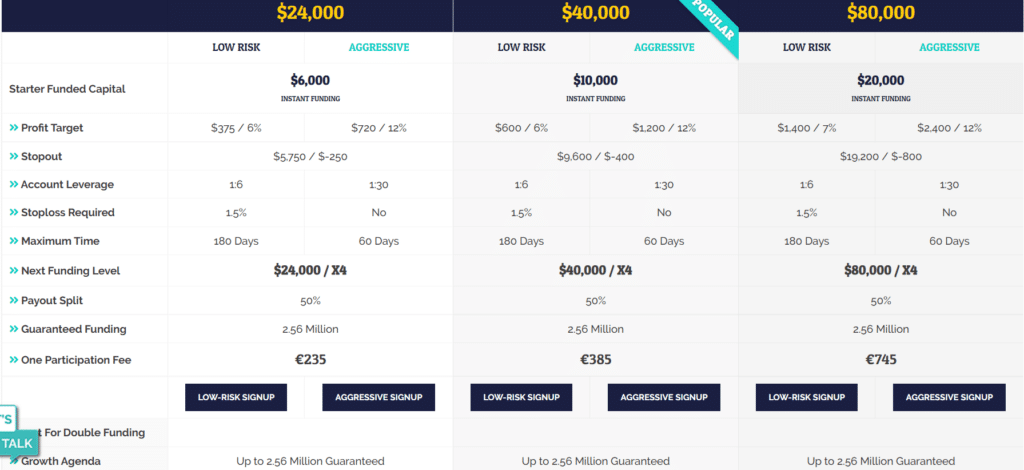

The 5%ers

The 5%ers is another popular prop trading company. The company accepts traders who pay a certain fee, as shown below. These traders need to follow the strict rules that accompany their account types.

For example, the smallest account will use a small leverage ratio of about 1:6 since it is a low-risk account.

Final thoughts

Prop trading has its benefits. For example, it helps to ensure that a trader makes money without risking a lot of their original investments. In addition to the three prop trading firms we have looked at, some of the other popular firms are My Forex Funds and TopStep.