PZ Divergence is a Forex trading indicator that is compatible with the MT4 and MT5 trading platforms. The vendor claims that it has a very high win rate of 90%. Of course, we cannot simply trust the words of the vendor. For this reason, it is necessary to analyze the various performance aspects of this indicator.

On the official website, the vendor has explained how the indicator works. They have listed some of the oscillators supported by this indicator and shared multiple screenshots of trade setups. We also have the pricing details, an FAQ section, and an installation guide. The data provided is not adequate and at first glance, this does not look like a reliable trading system.

This is a product from Arturo Lopez Perez, a developer based in Andorra. This person is the director of Point Zero Trading and possesses experience of more than 8 years. We don’t know much about the developer’s service history and it is unknown whether he works alone or as a part of a team. Other indicators launched by this person include PZ Multi Oscillator, PZ Order Block, PZ Swing Trading, PZ Support Resistance, PZ Super Trend, PZ Reversal Fractals, etc.

PZ Divergence is capable of finding both hidden and regular divergences. It supports several oscillators like RSI, CCI, MACD, OSMA, Stochastic, Momentum, Accelerator Oscillator, Williams Percent Range, Relative Vigor Index, and On Balance Volume. Before signaling the trade, it stands by for a donchian breakout to occur.

While the vendor has mentioned several indicators, they haven’t elaborated on how the indicator utilizes them as a part of the Divergence scheme. There is a clear lack of strategy insight which we find concerning.

How to start trading with PZ Divergence

PZ Divergence is available for the price of $299. This is a hefty price tag for an indicator and we don’t think you ought to be spending this much. There are three rental options available if you don’t wish to make a long-term commitment. The 1-month rental costs $49, while the 3-month and 6-month rentals will cost you $99 and $199, respectively.

There is a free demo version of this indicator available for download. You can use it for testing purposes. The vendor offers a 7-day money-back guarantee. This is an extremely small refund window because you cannot judge the performance of an indicator in just one week.

The vendor recommends using longer timeframes for this indicator to avoid getting false signals. You should use it on H4 charts or above. PZ Divergence uses different colors for indicating different types of divergences. While regular bullish and bearish divergences are indicated by blue and red respectively, the colors light blue and pink are used for hidden bullish and bearish divergences.

Backtests

EA vendors often test their systems using historical data. These tests are carried out over a long time period and therefore reveal the robustness of the system. Since PZ Divergence is an indicator and not an expert advisor, we don’t need to analyze the backtesting data.

Verified trading results of PZ Divergence

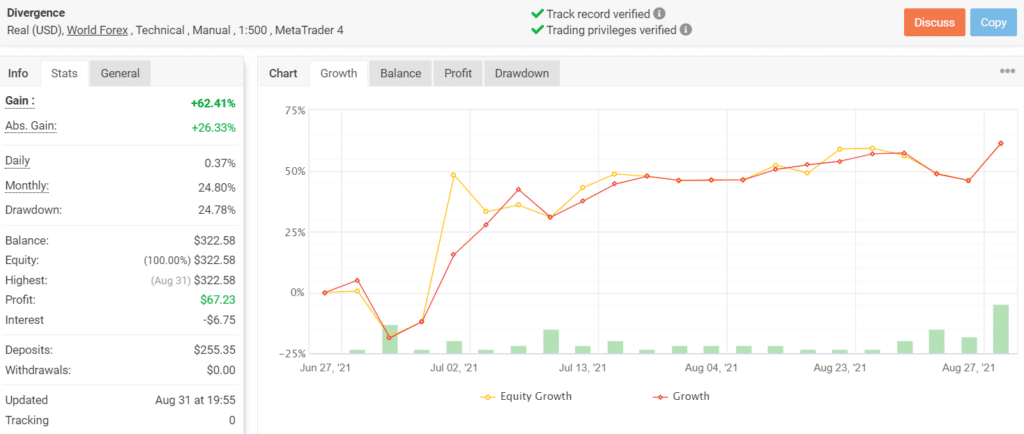

This trading account on Myfxbook was launched on June 27, 2021. During its short trading history, the indicator has placed only 57 trades. The vendor has not updated this account since August 31st, which tells us they don’t have enough confidence in their system.

The win rate for this account currently stands at 65%. While the daily and monthly gains are 0.37% and 24.80% respectively, the drawdown is a bit high at 24.78%. This means there is a significant chance of losing money while trading with this indicator.

Customer reviews

Currently, there are user reviews for this indicator on websites like Trustpilot, Forexpeacearmy, Quora, and Myfxbook. This indicator clearly does not have a decent reputation and not many people are aware of its existence. On the MQl5 product page, there is a single customer review. However, we cannot consider it for the purpose of this review, since the vendor could have manufactured it.

Is PZ Divergence a viable option?

Advantages

- Verified trading results

Disadvantages

- Discontinued trading statistics

- Small refund window

- Hefty price tag

- Lack of strategy insight

Wrapping up

We cannot recommend PZ Divergence to Forex traders. It has an extremely short live trading history and the vendor has not updated the trading account for several months. The performance does not justify the hefty price tag, so you’d be better off avoiding this system altogether. Another reason for staying away from this indicator is the small refund window.