Red Horse EA uses a top-bottom strategy dependent on volume and volatility. This is combined with a signalling system that places a buying or selling position at profitable times. The algorithm is not reliant on only one timeframe. We will cover the advantages and disadvantages of the EA in our review below so you can make a better purchase decision.

Features

The robot has the following features:

- The robot is a fully automated trading solution.

- The bot uses a risk/money management system.

- It trades best on the XAUUSD currency pair on MT4.

- This system requires an ECN or standard account.

The developer states that the robot uses a top-bottom strategy which is based on volatility and volume. It uses a customizable news filter with technical and fundamental analysis.

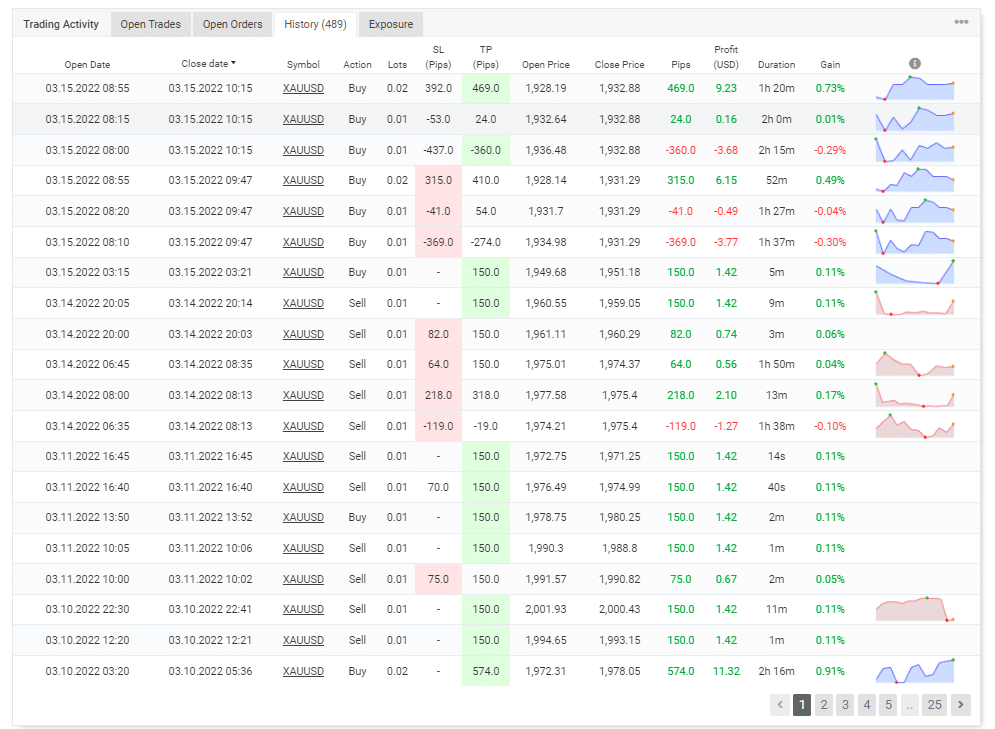

From the live records on Myfxbook, we observe that the product uses averaging and martingale strategies on gold. The trades may or may not come with a stop loss or take profit.

How to start trading with Red Horse EA

To get the system up and running, traders must do the following:

- Purchase the robot from the developer’s site

- Download the system on your PC

- Launch MT4 platform

- Drag the EA files onto your charts and enable the auto-trading button

Price

The robot is sold in two packages. A monthly subscription costs 59 USD, while a yearly subscription comes at 495.6 USD. The sellers provide a full refund if the system malfunctions and generates a loss. A 14-day free trial is provided before purchase.

Verified trading results of Red Horse EA

Unfortunately, the backtesting results could not be located on the robot’s website. This points towards the lack of transparency by the vendors and raises some concerns about historical performance.

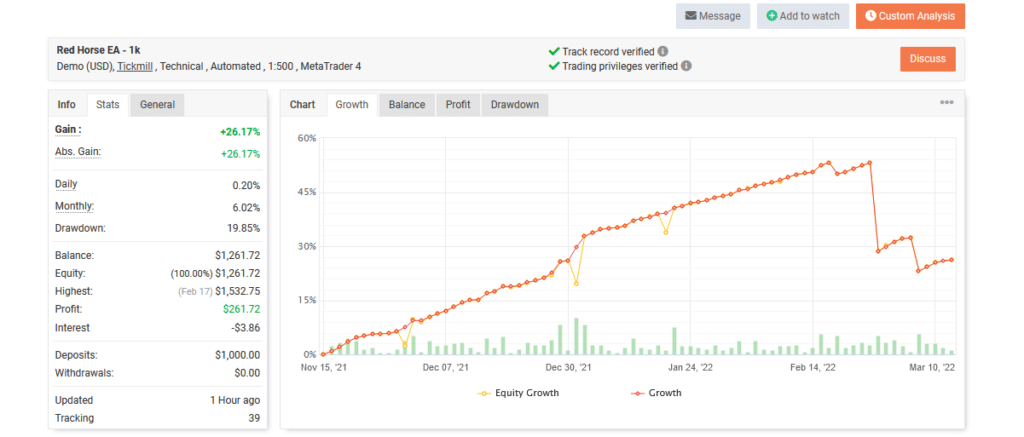

Verified trading records are available for the algorithm on Myfxbook. The account has a leverage of 1:500. It tracks performance from November 15, 2021, to March 16, 2022. The monthly gain stands at 6.02%, with a drawdown value of 19.85% which is quite high. Deposits stand at 1000 USD, whereas the profit is 261.72 USD.

The EA has participated in 479 trades, out of which 21% were non-profitable. This points towards doubtful performance. The profit factor stands at 1.35. The system has an average trading length of 4 hours and 38 minutes. The dollar value for the best trade was 52.82 USD, while the worst one was -50.35 USD which does not make a convincing argument.

Customer reviews

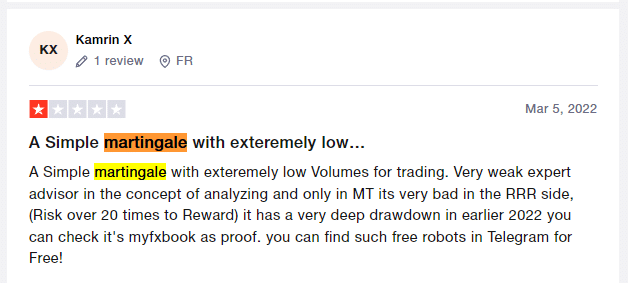

The parent company of the robot, Red Horse EA, has an average rating of 4.0 stars on TrustPilot for 116 reviews. An angry customer hurls their anger on the robot by stating how the company uses a martingale strategy with a very low risk to reward ratio. They are also very dissatisfied with the high drawdown shown by the system.

Vendor transparency

From the website, it is clear that Red Horse EA has been developed and produced by Sinry Advice. They are a company of forex traders that sell EAs and indicators on the market. Customers may contact them through their email, live chat box, WhatsApp, mobile phone, etc. The company is registered and headquartered in the UK. They have an active community of 8600 that is still growing, as per their website.

Is Red Horse EA a viable option?

The robot has the following benefits and demerits.

Advantages

- The EA is fully automated

Disadvantage

- No detailed backtesting statement

- Short live records

- Very high drawdown experienced by the system

Conclusion

Red Horse EA is not very transparent about its performance as it fails to provide backtesting records. This makes us blind from knowing whether the algorithm generated any meaningful profits in the past. There is a high drawdown of the system, which is shown by Myfxbook results that is corroborated by very negative customer reviews on Trustpilot.