Introduction

As a trader, you have two approaches by which you create a strategy for winning trades, which are fundamental and technical analysis. There is no doubt that technical traders are many because the approach is often useful in the short-term. On the other hand, long-term traders lean heavily towards fundamental analysis.

Traders who follow the fundamental approach assume that a financial instrument’s price does not necessarily translate into its fair value. The traders also deem fundamentals such as inflation and GDP data as the factors that are crucial to the growth of a given financial instrument.

It is far from technicians who focus on price action because for them, (a) history repeats itself, (b) price is a fair indicator of a financial instrument’s value, and (c) markets tend to trend upwards or downwards.

Fundamental analysis-oriented traders often worry about inflation mainly because it degenerates a currency’s value over the long-term. But the question is, what is the relationship between inflation and forex? What happens between inflation data and the value of a currency? What is the linkage? If you remain keen as you read the paragraphs that follow, these questions have all been answered.

First, what is inflation?

Inflation evaluates price changes of necessities in a given country. The word could also be used about rising prices of essentials in a country within a given time. Goods and services that often fall into necessities include medication, transport, and food.

Inflation data is as critical to traders as it is to central bankers. Its calculation is mainly based on another measure called the consumer price index (CPI). CPI measures the price difference of essentials in an economy over a defined time, often monthly.

Inflation arises from the actions of central bankers, particularly money creation. For example, the United States’ Federal Reserve is in charge of regulating the US economy’s money supply. It includes occasionally printing new banknotes and minting new coins to plug supply holes.

However, money supply sometimes increases at a rate that is faster than that of economic growth, which is measured with the gross domestic product (GDP). When this happens, the overwhelming liquidity generates tremendous demand pressure that overwhelms the economy’s supply side. The consequence of this phenomenon is higher CPI, hence higher inflation.

Inflation and interest rates

Inflation has a direct relationship with interest rates. This relationship happens at the instigation of central banks like the US Fed. The Fed, and all the other central banks globally, watch inflation rates closely because, as earlier noted, the entities are responsible for regulating liquidity levels in their respective economies.

Central banks maintain a certain value, which is the upper limit of acceptable inflation. In a recent BBC report, the media house quoted Jerome Powell, the US Fed’s boss, saying that the institution’s inflation target from August 2020 going forward will be “an average of 2%”.

When inflation for a particular period exceeds the set target, the next logical decision is for a rate rise. More tools are available for the institutions to combat inflation, including money creation and open market operations.

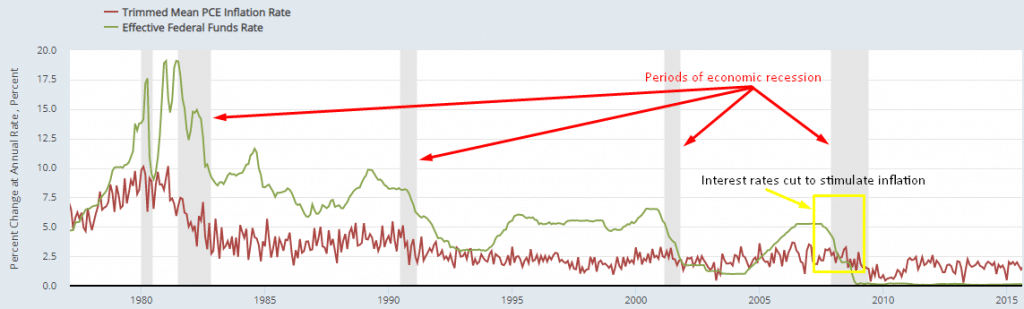

Low inflation will also force the central bank to act. In this case, the institution’s monetary policy committee will decide to reduce interest rates, hence making it easy for consumers to access credit easily. Cheap credit soon floods the economy with money, which drives up demand for goods and services.

As shown in the figure below, the US Fed has always cut interest rates during periods of economic recession. It is because economic recessions are often accompanied by low inflation.

Factors influencing the value of currencies

As explained earlier, inflation drives the interest rate decisions of central banks. Higher inflation indicates an overheating economy, to which the central bank responds by cutting interest rates.

When the central bank manipulates the interest rates, the interest rate of one currency affects its value relative to rivals. It is what traders call exchange rates. If, for example, the US Fed decides to raise the adequate funds’ rate, the US dollar will earn lenders higher returns. Also, traders are looking to benefit from the carry trade.

It means demand for the greenback will up. Increased demand will put upward pressure on the exchange rate between the USD and other currencies in pairs that include the USD. As is apparent, there is a high correlation between inflation, interest rates, and currency exchange rates (currency market value).

Other factors

The economic situation in a country significantly affects the value of its currency. Consider a country – say the UK – that is going through explosive growth. The resulting higher disposable income then enables UK consumers to spend more on discretionary goods and services, which leads to an increase in goods/services prices across the economy.

This price increase does affect not only domestic consumers but also consumers in foreign countries. But if the foreign consumers have plenty of alternatives elsewhere, they will immediately switch to other markets, leading to a drop in demand for the British Pounds. Even domestic consumers might turn to foreign markets in a bid to save on expenditure. The result is a decline in the exchange rate between the GBP and the major rivals, especially the country’s currency to which market consumers turn.

Currency valuations also affect the value of currencies. Say the exchange rate between the USD and the Chinese Yuan (CNY) is 6.72. It means just one dollar can buy an American Chinese product that costs 6.72 yuan.

But suppose the People Bank of China (PBOC) decides that the yuan is overvalued and devalues it to 7.00. In that case, it means an American can buy the same Chinese product for just 96 cents (devaluation of yuan from 6.72 to 7.00 translates to a 4% increase in the USD) value.

Suddenly, the value of the USD against the CNY increases by 4% and not because of anything that happened on the US side.

Conclusion

Inflation is a crucial indicator that traders track to guide their strategizing. An indicator is a fundamental tool that affects the long-term value of currencies. However, the relationship between inflation and forex is not so direct. Central bankers use the inflation data to adjust interest rates in a bid to regulate economic growth. As a result, the interest rate manipulation leads to fluctuations in exchange rate differentials between one currency and another.