Robinhood FX EA claims to be one of the most profitable Forex expert advisors for the Metatrader 4 platform. According to the vendor, it has a unique algorithm that allows it to maximize profits and minimize losses. However, the only way to measure the effectiveness of this system is to analyze all its performance factors.

On the official website, the vendor has listed the main features of the system and shared the link to a verified live trading account. We also have the backtesting results, pricing details, and an FAQ section. The vendor has also shared some of their recommendations.

We know little or nothing about the company behind this Forex robot. The vendor has shared the phone number and the email address, but not the physical address of the company headquarters. There is no information on the team members either, which is quite disappointing.

Features

This is fully automated Forex EA trading in the EUR/USD pair. The vendor recommends using it on H1 charts. It is compatible with all brokers and supports different account types like Cent, Micro, STP, and ECN. Robinhood FX EA keeps track of all trades using magic numbers.

The robot has a capital management system where it calculates the size of your trading lots based on your account balance. We don’t know what trading strategy this system uses, since the vendor has not provided an explanation for it. Just mentioning that the EA uses a non-martingale system is not enough when most traders look for technical details pertaining to the strategy. The lack of strategy insight will deter many individuals from investing in this EA.

How to start trading with Robinhood FX EA

There are three lifetime pricing plans for this robot, namely Basic, Regular, and Business. The basic plan is available for a one-time fee of $127 and it gives you access to 1 real and 1 demo account. With the Regular and Business plans, you get access to 2 and 3 demo and real accounts for $147 and $167, respectively. The vendor offers 24/5 customer support and a 30-day money-back guarantee.

Although Robinhood FX EA does not require a VPS to function, it is recommended that you use one. You need to keep the system running 24/7 which can be stressful for some traders. This tells us that the EA uses a high-frequency trading strategy, and as we know, they are often high-risk schemes that can lead to heavy losses.

After completing your payment, you need to send the MT4 account number to the official email address, following which you get the license file. The vendor recommends trading with a maximum of $200 for every 0.01 lot.

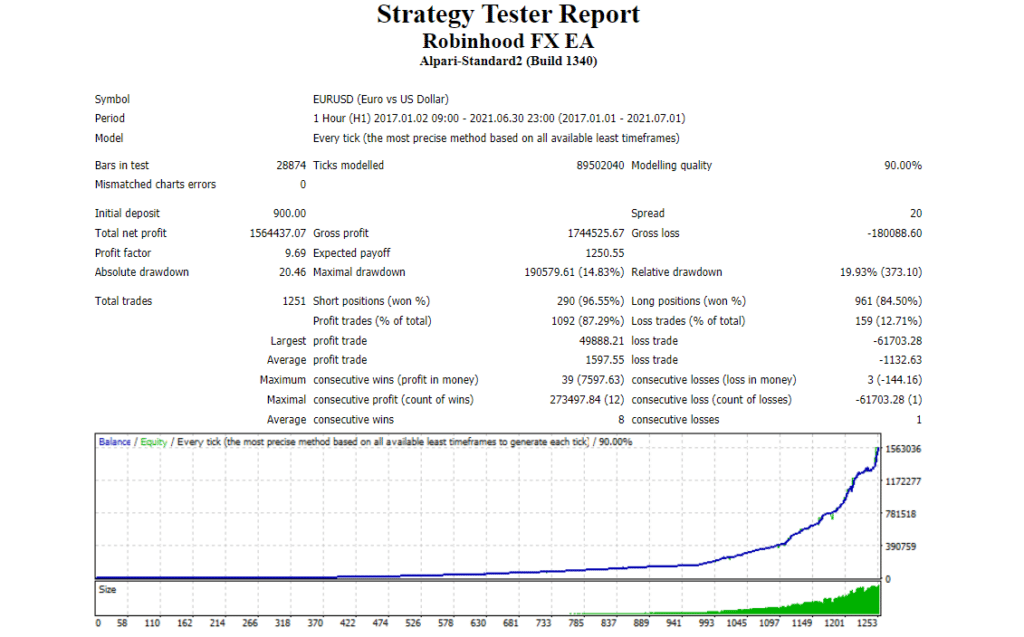

Backtests

This backtest was conducted on the EUR/USD pair from 2017 to 2021. It started with an initial deposit of $900 and after performing 1251 trades, the robot generated a total profit of $1564437.07. Robinhood FX EA won 96.55% of its trades during the testing period and its profit factor was 9.69. It managed 39 maximum consecutive wins and 3 maximum consecutive losses.

Verified trading results of Robinhood FX EA

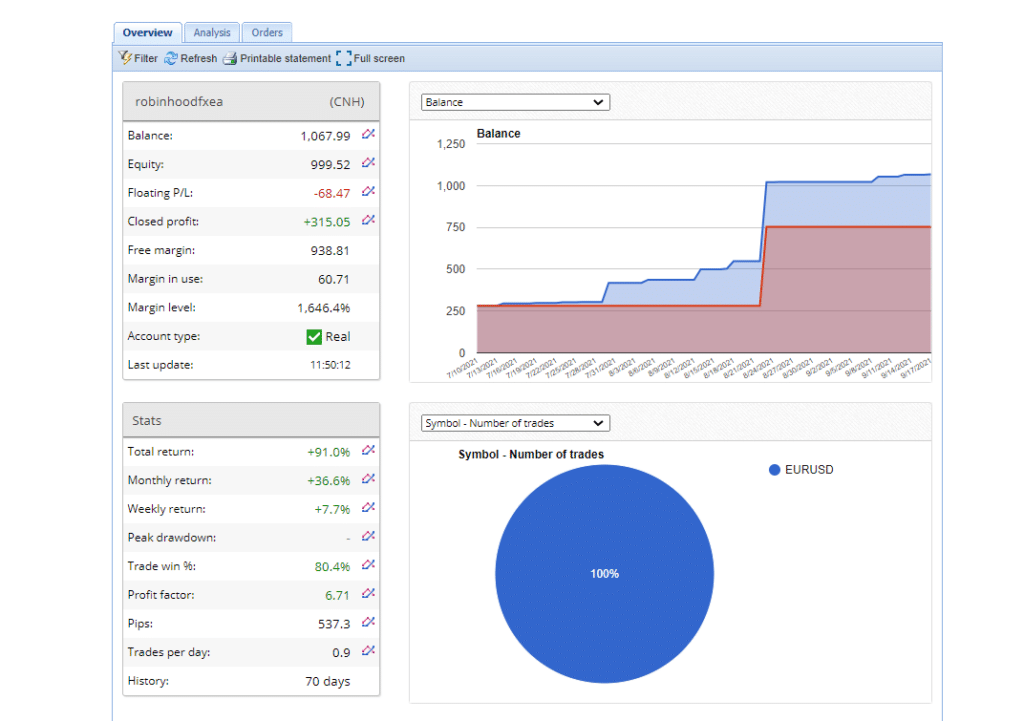

Here we have a verified live trading account on FXBlue that has a short trading history of 70 days. There is no way we can accurately gauge the system’s profitability in 70 days. The EA has placed only 56 trades through this account, winning 45 and losing 11. It has a high risk/reward ratio of 2.38, which means there is a high chance of suffering large losses while trading with this robot.

The daily, weekly, and monthly returns for this account are 1.50%, 7.71%, and 36.63%, respectively. It has a profit factor of 6.71, which is less compared to the backtest, which also has a higher win rate.

Customer reviews

There is only one user review for this expert advisor on Forexpeacearmy, and none on Trustpilot. Thus, it is quite evident that not many traders are currently using this robot for live trading. The lack of reputation is not a sign of a reliable system.

Is Robinhood FX EA a viable option?

Advantages

- Verified trading results

- Money-back guarantee

Disadvantages

- Short trading history

- Lack of strategy insight

- No customer reviews

Wrapping up

You shouldn’t invest in Robinhood FX EA because it doesn’t have a long track record of winning profits in the live market. The vendor has no reputation whatsoever and they have failed to explain what trading strategy the robot uses. Since Forex trading carries a high degree of risk, you should not opt for an EA that doesn’t have several years’ worth of trading statistics.