Technical indicators are crucial in developing useful strategies that can help traders earn money. The RSI is one such indicator that is being used for a long time by traders. It has proved itself useful time and again.

What is RSI?

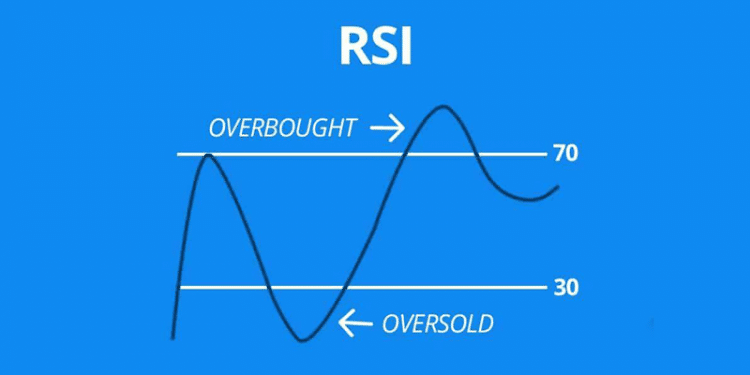

RSI stands for the Relative Strength Index. It is one of the most commonly used technical indicators in trading. Traders mainly use it to indicate temporarily oversold or overbought conditions within the financial market. It also indicates if the market is overextended and there is a possibility to retrace. The RSI is displayed as an oscillator. An oscillator is a line graph moving between two extremes. It can have a reading from 0 to 100. If the RSI value is over 70, then the market is overbought. On the contrary, if the value is under 30. Then it indicates oversold conditions.

Some analysts and traders opt to utilize the most extreme readings that are over 80 or under 20. The drawback of the RSI is that it involves sudden and sharp price movements that can cause the price to spike up or down repeatedly which may give false signals. However, if you compare those spikes with other signals and see a trading confirmation, it may signal entry or exit points. It is common for the price to extend well beyond the overbought or oversold points. This is the reason why trading strategies using the RSI works best when you combine them with other technical indicators. It can help you to avoid entering a trade when it is too early.

History of RSI

The momentum oscillator RSI was developed by J. Welles Wilder. He featured the indicator in his book “New Concepts in Technical Trading Systems” in 1978. This book also includes details about the ADX and SAR. Although he developed the indicators before the computer age, Wilder’s indicators have always remained very popular as they have shown brilliant potential and results. The RSI is especially popular among them. Many articles, books, and interviews have featured it over the years. Constance Brown featured the concept of the bull market and bear market ranges for this indicator in his book “Technical Analysis for the Trading Professional”.

Andrew Cardwell was the RSI mentor of Brown. He introduced positive and negative reversals for the RSI. Moreover, he turned the notion of divergence, both literally and figuratively. According to Wilder’s formula, the basic components of the RSI are RS, Average Gain, and Average Loss. There are 14 periods for the calculation which Wilder suggested in his book. Keep in mind that the calculation expresses losses as positive values; not negative values. You can calculate the average gain and average loss from the simple 14-period averages, the prior averages, and the current gain loss. If you want to go for the RSI indicators, then it is wise to learn about these formulas well.

How RSI Can Be Adjusted

The RSI plays an important role in automated trading with its various features. You can adjust the RSI in your trading many ways, such as:

- Trend line application: The RSI and the closing chart are very similar and sometimes it is difficult to differentiate between them. Whether the closing chart goes up or down, traders apply trend lines in it. Similarly, they can also apply closing trend lines in RSI. The fact that RSI trend lines break three or four days before, is interesting because it gives an advanced signal if the price is going to break the same trend line within a couple of days.

- Pattern breakout: The formation of a pattern is an important factor in building the chart. Patterns can be reversal or continuation. Either way, it can stage a breakout at a specific time. Now, RSI considers the underlying relative strength of an asset over a specific duration. The breakout would take place a few days in advance in RSI and price would follow this breakout.

- Advance breakout and breakdown: Advance breakout means that the RSI indicator has breached the previous top when the price has not yet breached the previous top. So, it is an early signal indicating that the price will follow the RSI in the few upcoming sessions. Similarly, in an advanced breakdown, the RSI breaches the previous bottom when the price is still at the previous bottom. Thus, it gives an advanced signal that the price will break the previous bottom soon and it may show some correction in the upcoming sessions.

Basic Strategies Using RSI

There are two types of RSI divergences, such as a bullish divergence and a bearish divergence. A bullish divergence takes place when the RSI indicator creates an oversold reading position and a higher low matching corresponding lower lows on the price follows it. It indicates rising bullish momentum. Traders can use the break above oversold territory to trigger a new long position. A bearish divergence takes place when the RSI creates an overbought reading and a lower high matching the corresponding higher highs on the price follows it.

Useful trading strategies using the RSI indicator include:

- The 2-period RSI: Larry Connors invented this strategy. It involves an unconventional lookback period that turns RSI into a brilliant short-term timing tool.

- RSI+S/R: People that take trading seriously know that patience is very important to win and this strategy is for a patient trader. It confirms oversold and overbought signals by looking for support and resistance zones.

- RSI divergence + candlesticks: Candlestick patterns are very useful in trading, but they alone are not sufficient to call a market top or bottom. Traders require a tool that is able to point them to what is happening in the broader context. RSI is the ideal indicator to fulfill this role if traders use it the right way for identifying price divergences.

- RSI midline for trend analysis: Although the 70 and 30 lines indicate the overbought and oversold conditions respectively in the RSI interpretation, they are not the only lines traders should observe. There is another equally significant line which is the midline at 50. If the RSI is above 50, then it has a chance of being the bullish market. However, if it remains below 50, then the dominant market is the bearing market. There are two strategies that use the midline, such as the RSI trading strategy with 20 SMA for swing trading and 5 SMA with 5 RSI forex trading strategy. Both strategies combine the RSI indicator with a moving average.

- RSI failure swing: Wilder considered the RSI failure swing strategy as a powerful reversal signal. The independence of price is an important principle for the failure swing. In this strategy, the trader has to ignore the usual RSI divergences. A bullish failure swing is formed when the RSI indicator moves below 30 and then bounces above it, pulls back, and holds above 30 before breaking its prior high. A bearish failure swing, however, forms when the RSI forms above 70, pulls back, and bounces. It fails to exceed 70 and breaks its prior low.

The bottom line

Using the RSI indicator makes trading very easy and simple. However, the novice traders are often tempted to earn easy money quickly and they start using this indicator without educating themselves well. They even skip testing different parameters. Instead, if you understand the interpretation of the indicator well and apply it correctly, then it can indicate the best price for entering and exiting a trade.

It can also indicate the most active time frames for trading and provide the traders with information about key price levels of support and resistance. With the technical trend information, you can do better. Also, make sure to practice the strategies on a demo account to avoid risks if you are a beginner.