Stenvall Mark III is claimed to be better than other Forex robots because its efficiency has been verified by many years of work. According to the developer, the EA’s safety and reliability makes it an attractive option for professional traders. Through this review, we have learned that the system is neither safe nor reliable. Therefore, the vendor is basically misleading the public.

Stenvall was authored by Gennady Sergienko. This developer is also selling a variety of other products on mql5. We have Alexis Stenvall, Ruxzo, North Star, Franc Pacific, and CounterTrend Indicators Systems CIS.

Features

The EA is characterized by the following features:

- It only trades with the EURUSD currency pair.

- The system uses the M5 timeframe.

- This FX robot is compatible with both the MT4 and MT5 platforms.

The trading method used by this robot is a hybrid of a trend and a counter-trend strategy. The developer purports that this approach has a 70% accuracy rate. He fails to mention that the grid method is also used, though.

How to start trading with Stenvall Mark III

A lifetime copy of Stenvall Mark III is currently being sold at $980. This pricing is exorbitant. The one-year renting option is $399 and is very expensive as well.

After you purchase the robot, the next step is to launch it on the EURUSD M5 chart and download the setup file. Check the “”Allow autotrading” checkbox on the “General tab” and then click “OK.” The system will conduct a thorough check on your account, and when it has determined everything is okay, the message: READY will surface. Now it is set to begin trading for you.

Check below how it conducts trading:

- The trading does not occur on day transitions/rollovers at 00:00.

- All trading positions are protected by a stop loss

- It is not sensitive to brokers, spreads, and requotes.

- Engages in algo trading 24 hours daily with an intricate wave analysis and long holding positions.

- The average take profit is 150 points, with the average load on the deposit being 5%

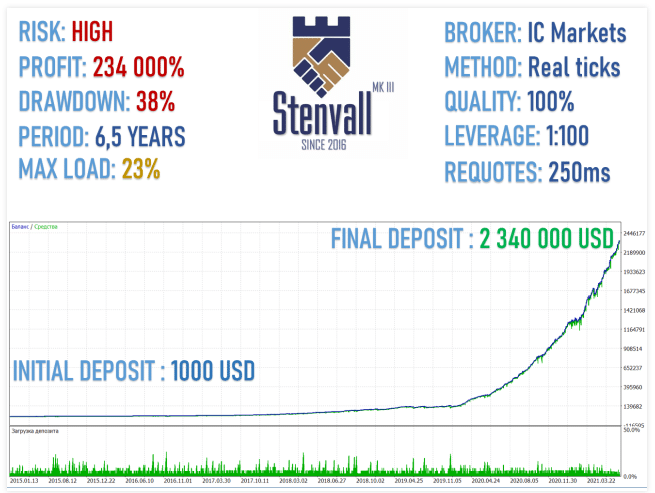

Backtests

We have the backtest results for this EA, but it does not highlight all the performance metrics that you will find in a typical strategy tester report. In any case, we assess what is available. The system began with an initial deposit of $1000, and by the end of the 6.5-year trading period, it had $2,340,000. This is equivalent to a 234000% growth. The drawdown (38%) is huge. Frankly, the strategy that the system works with is innately risky.

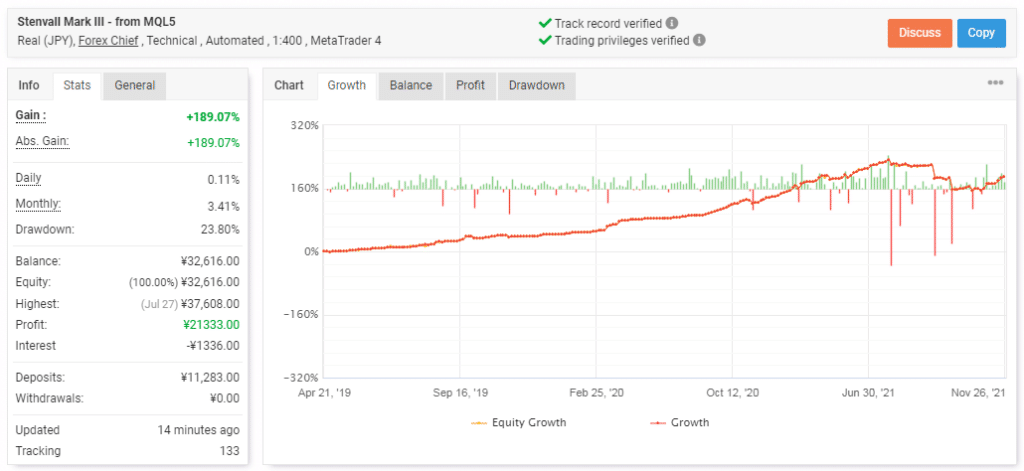

Verified trading results of Stenvall Mark III

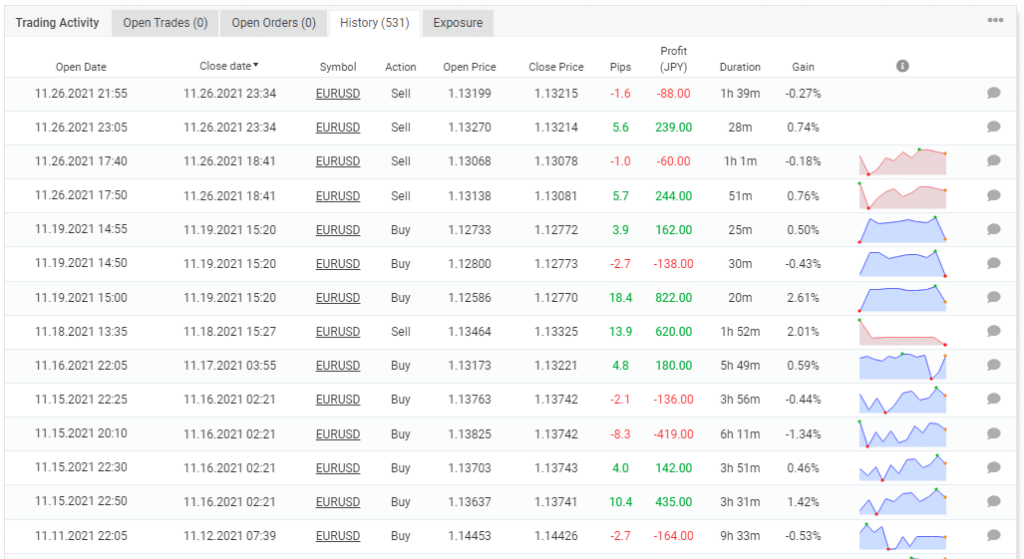

The developer is using the software to manage a real JPY account, which can be found on Myfxbook. The EA’s trading activities are healthy. This is because it has been generating fewer profits than losses, as shown by a monthly profit of 3.41% and a drawdown rate of 23.80%. Therefore, we have a bad risk/reward ratio of 6.9:1. The initial deposit was ¥11,283, and to date, it has grown by ¥21,333, increasing the balance to ¥32,616.

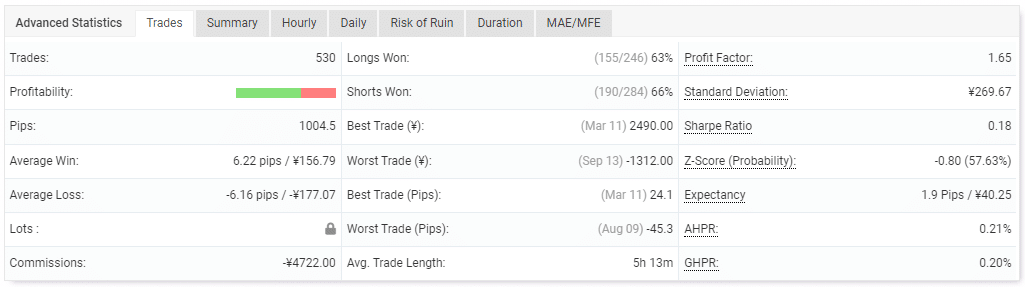

There are 530 trades with poor win rates for both long (63%) and short (66%) positions. The profit factor, which is 1.65, shows us the robot isn’t that productive. The best trade was $2490, whereas the worst one had -$1312. The average trade length is 5 hours and 13 minutes.

The system trades the EURUSD currency pair using short timeframes and several grids of orders. As a result, some of the trades have been successful, while others have not. We don’t see the take profit and stop losses that the vendor says are applied on each trade.

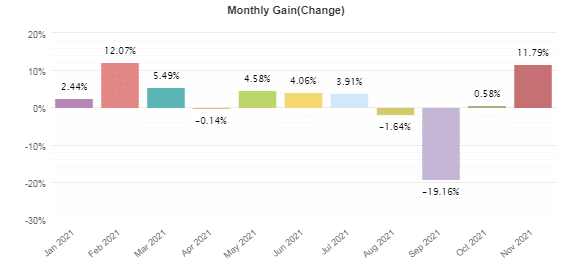

To date, February has been the most profitable month (12.07%), followed by November (11.79%). September recorded the highest amount of losses (-19.16%).

Customer reviews

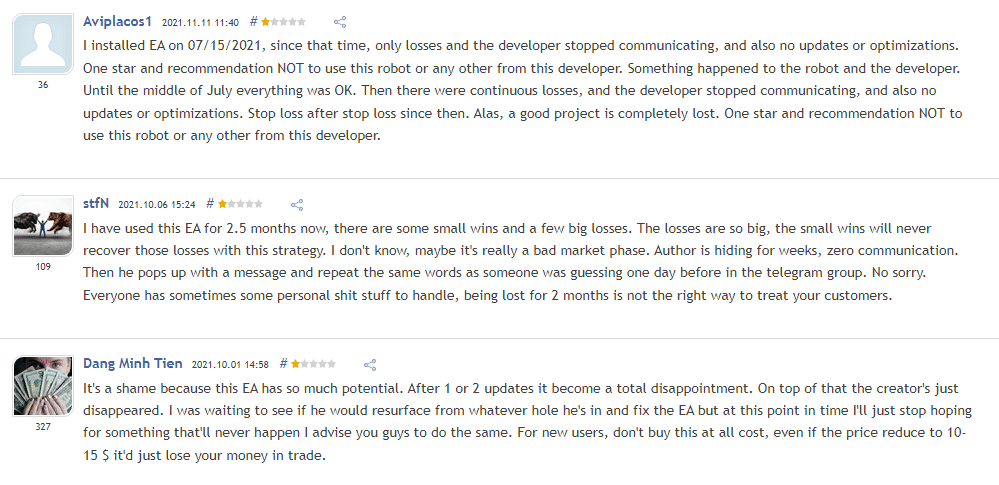

Many customers using Stenvall EA are not happy with it, going by the numerous negative reviews they were written on mql5. The main message is that the system makes small wins and huge losses. Also, customer support is pretty much non-existent because the vendor can vanish for months.

Is Stenvall Mark III a viable option?

Advantages

- It is operating a live account on Myfxbook

Disadvantages

- Zero customer support

- Poor risk/reward ratio

- A risky strategy is used

- Small profits

Summary

Stenvall Mark III is not a feasible option. The author lies about the efficiency and reliability of the system from the word go. His main goal though is to trick you into investing in the product. Those who have fallen into his trap have learned the hard way by losing a lot of money. The small profits made are even too small to recover the losses. Don’t be the next victim.