Stop loss hunting is the phenomenon in financial markets where major traders drive the market in an attempt to trigger the stop loss orders of smaller traders, consequently forcing them out of markets. To achieve this, the whales employ several stop loss orders, and once those orders have been fulfilled, the market turns around.

Stop loss hunting is a common forex market concept that has gained a lot of traction in recent years. Some Forex traders often believe that they are targeted for stop loss hunting by brokers working on behalf of large institutions.

How it works

stop loss hunting is a strategy used by large institutional traders in financial markets to muscle their way to profitable opportunities. It is common practice for these whales to drive the market through stop loss orders when they spot a concentration of them at a given price point. Leverage increases the magnitude of the market trades, making this method even more effective.

To reverse the tide, the whales continue to close down their position when a successful stop hunt is done. Retail traders are particularly irritated by this since they are forced to exit positions only to watch the market reverse and resume trending towards the direction they had predicted.

Initially, the stop loss hunting process begins with a group of stop loss orders that are all located near the same market price.

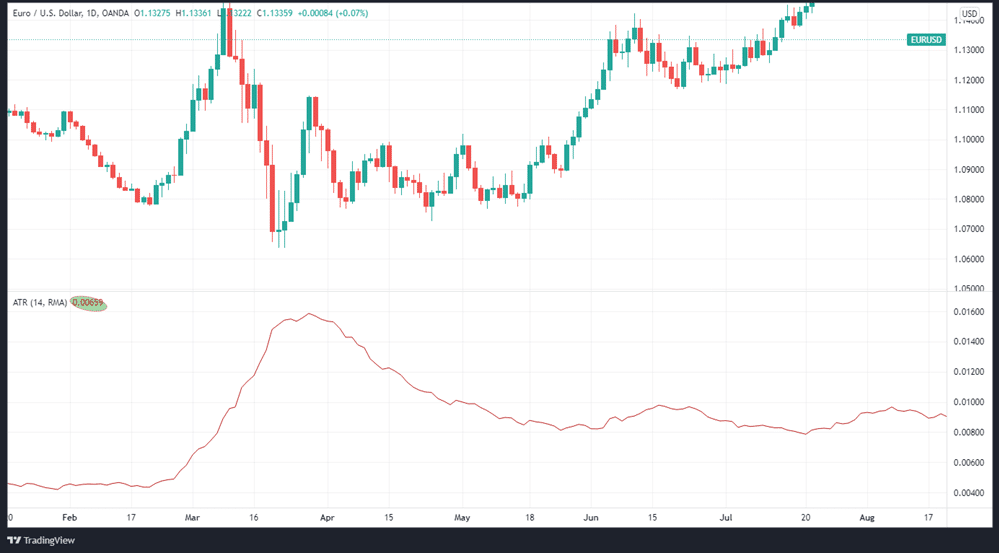

Using the illustration above, we can see that the downtrend in the EURUSD price has been halted at 1.0639. Traders who anticipate a rise in price may decide to go long and set a stop loss close below the support level of 1.0655–1.0725 to protect their profits. In the following days, the price retraced back to the 1.1400 mark. Many traders are likely to place stop loss orders in the 1.0650–1.0725 price range.

This results in several stop loss orders accumulating around the 1.0650–1.0725 range. These thousands of stop loss orders could be triggered by a whale entering the scene and pushing the price down to 1.0645–1.0725. That would force retail traders to exit the market, and the whale would terminate their short position, following which they would need to repurchase the asset. As a result of this, the next rally gets a boost from the increased demand. There is a trigger in place for the retail trader’s stop loss order, which causes a market rally.

Are dealing brokers conspirators?

There are a large number of dealing Forex brokers in the market that do not hunt your stop losses or engage in raising your Stops. There are, however, a few dishonest brokers out there that may try to sabotage stop loss orders. This means you must engage with a trustworthy forex broker who is also subject to government regulation. This is your best defense against unscrupulous tactics at smaller, unlicensed bucket shops.

It’s not worth the risk for most licensed brokers to engage in such deceptive methods, which might result in huge fines and perhaps the loss of their license.

Why do institutions use stop loss hunting?

To generate liquidity: Large institutions cause ripples in the market by triggering the stop loss orders of thousands of traders. To begin with, they are establishing a supply of all these sell orders, and they are also encouraging new traders because they sense some kind of market breakdown and are eager to open new short positions. The institutions ensure that their demand is met by stocking up on this supply.

To create a sense of danger: There is a correlation between the option price and volatility because large institutions are typically option sellers. The more the volatility, the greater the option premiums. So, to sell these options, major institutions need a higher amount of volatility. To get that surge in volatility, they trigger the stop losses of regular traders, which cause option prices to rise.

How to hedge against stop loss hunting

Don’t rely on the most visible levels for your braking points. As a rule of thumb, round numbers are a lousy choice for determining support and resistance.

- Employ Average True Range: With ATR, you may put your stop loss at a distance away from support, making it impossible to get hit by whales.

The Average Trading Range (ATR) is what we’ll get by looking at the ATR indicator. You should get the distance between your stop loss and entry point by multiplying the ATR value by that number. Setting a stop loss at a 1.5 times factor of a currency pair’s ATR reading on the EURUSD pair would be an example of this strategy. In that case, the stop loss would thus be put at 150 pips from the entry position.

The ATR indicator is represented on the lower window of the EURUSD daily price chart below, with the pip value being 65.

- Use multiple stop losses: Scaling out of positions is a common practice among expert traders. Most retail traders, on the other hand, employ an all-or-nothing strategy for both entry and exit. Stop loss orders can be broken up into smaller orders and scaled out of trades, which can help improve your win rate. This is an exit plan worth experimenting with. Your stop loss orders are spread out over multiple levels, reducing the danger of being taken during a stop run

- Don’t be obvious: A support or resistance level that is clearly visible in the chart is more likely to be exploited as a manipulation zone for liquidity runs. Make sure to keep in mind that other traders are probably thinking the same thing if you spot an area that looks “perfect” for setting your stop loss.

Because of this, the stop loss orders in that area will also be reinforced by these traders. These types of orders can be spotted fast and easily by traders who are looking for liquidity in the market. Using these stop losses, they can take advantage of a supply of liquidity. When setting a stop loss level, it is vital to attempt to avoid making it too obvious.

In summary

Stop loss hunting is a method whale investors use to make quick gains in the short term. These investors can utilize their buying power to drive markets into stop loss zones, pushing smaller investors out of their positions. Whales benefit from the cluster of stop loss orders, which serves as a pool of potential buyers for short positions. A number of the methods listed above can assist shield you from the effects of stop loss hunting.