‘Take our capital, keep the profit!’ is the slogan of The 5%ers (pronounced five percenters), a forex prop firm that’s gradually been growing in popularity over the recent years. A prop firm (short for ‘proprietary firm’) is a company with a large pool of funds outsourcing (on a commission basis) other traders to trade and grow this capital.

These firms have become increasingly abundant with the intention of large capital allocation only to the most disciplined and talented traders. However, there are still risks involved, although The 5%ers deserve a comprehensive review that should conclude as to whether they are worthwhile or not.

Who are The 5%ers?

The 5%ers is a registered private prop firm originally from and based in Israel (with a London office). Despite this physical presence, the company provides its services strictly online.

Two Israeli entrepreneurs, Gil Ben-Hur and Snir Ahiel (who are the CEO and COO, respectively), co-founded the firm.

This brand has existed since 2016 with the sole mission of ‘funding the top 5% of traders’. As the forex market is notoriously known as a place where only a small percentage consistently succeed, The 5%ers tests the skills of the most talented and disciplined traders stepping into the prop firm world.

Furthermore, they exist to be part of the solution to large capital allocation many traders face. One of the main reasons forex participants fail is due to excessive leverage on small trading accounts. Although traders aren’t restricted to just The 5%ers funding, this opportunity allows them to expand and leverage their skills.

What do The 5%ers have to offer?

The 5%ers are a forex-only prop firm, allowing clients to trade all the combinations of the major currencies (AUD, CAD, CHF, EUR, GBP, JPY, NZD, and USD). Users trade on the highly popular MT4 platform through their designated broker.

This firm proposes traders first pass an evaluation phase done on a real account before being officially funded with a significantly higher balance. Their objectives are outlined later in this section.

Packages

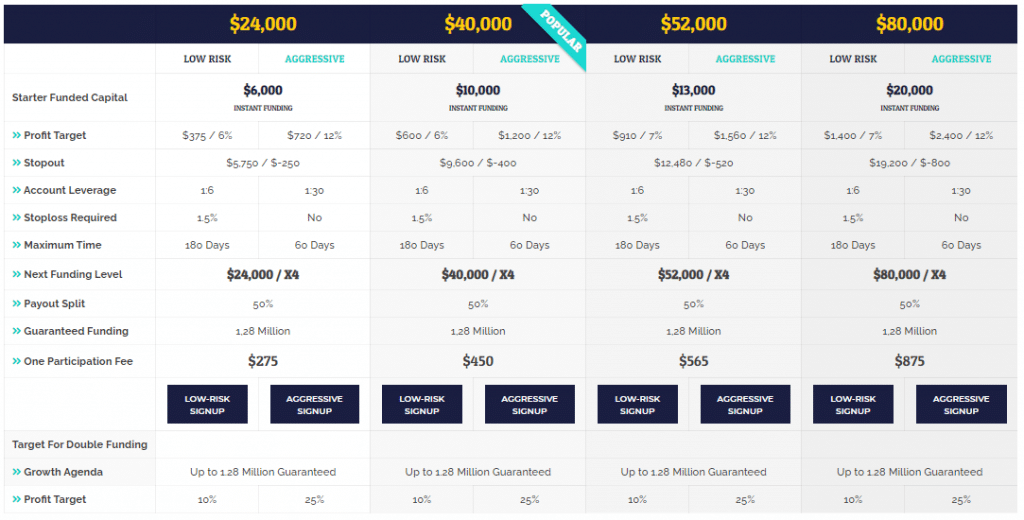

The 5%ers offer four distinct packages broken down into ‘Low Risk‘ and ‘Aggressive,’ each requiring a one-time participation fee.

Low Risk vs. Aggressive packages

The Aggressive package suits higher-risk or high-frequency traders. As one can observe, the profit target is twice as high as the Low Risk packages, in addition to greater leverage (1:30 compared to 1:6), and the maximum time to complete the objectives is thrice as short (60 days instead 180).

Lastly, The 5%ers promise to double the account size at the funded stage for every 10% growth on the Low Risk and 25% growth on the Aggressive.

Objectives in the evaluation phase

One of the beautiful things about The 5%ers is their few and fair objectives, which traders must meet in the evaluation phase before progressing further. Even at the funded stage, clients should meet nearly all the same specifications set in the evaluation account.

- 4% maximum drawdown

- 6% profit target (12% on Aggressive)

- 40 minimum positions (overlapping positions or multiple entries on the same trade count as one order). The purpose of this metric is to test how traders handle different market conditions.

- Minimum 20 trading days (this constitutes where a trader executes one position and not a calendar trading day). However, the actual time limit is six months (two months on Aggressive).

- Stop loss required for every position (not applicable on Aggressive).

Growth schedule

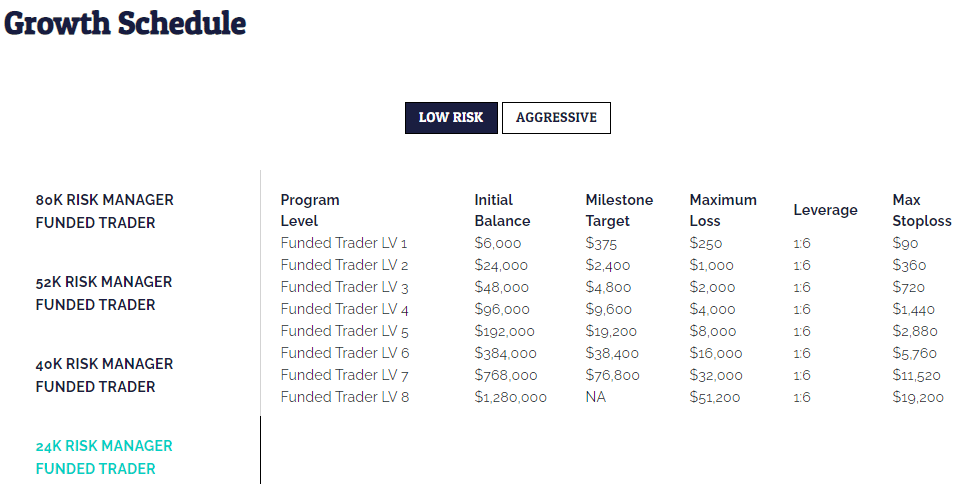

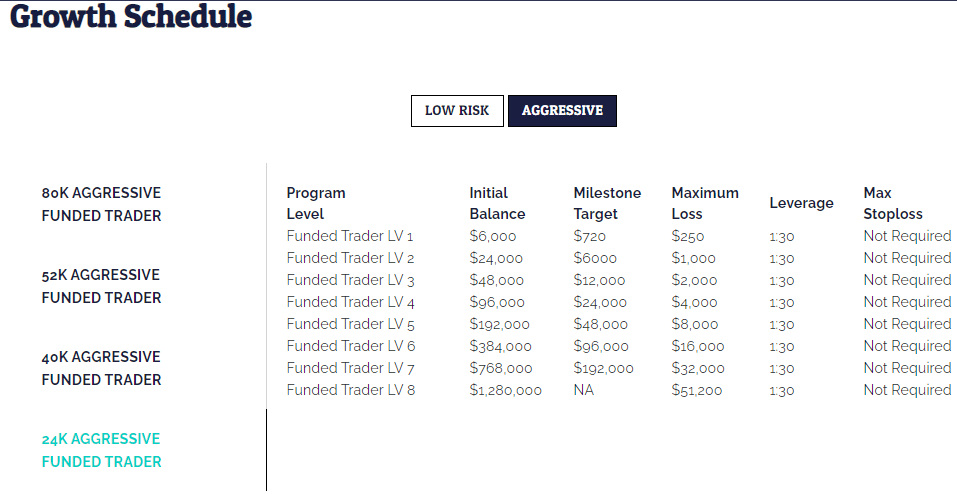

There are only two stages to trading with The 5%ers: evaluation and growth. The long-term goal is for traders to gradually ‘climb up the ranks’ up to the $1.28 million point.

Depending on the package they’ve chosen initially in the evaluation, there may be fewer levels to go through. As a trader continually increases their account by 10% (25% on Aggressive, the firm promises to double the initial capital.

To be conservative, below are images showing the growth phases if one were to opt on the lowest evaluation accounts ($24k-funded) for both the Low Risk and Aggressive packages.

Profits

As with most prop firms, traders earn a 50-50 split of the profits they’ve generated. This commission structure exists in both the evaluation and growth phases. The firm states they pay profits monthly with no minimum. Payments below $1,000 go through PayPal, while those above go through a bank wire transfer.

Pros and cons

After establishing the credentials and reputation of a prop firm, the next factors to look at are whether they provide favorable conditions for traders to succeed.

Pros

- From day one, you trade a live account in their evaluation phase rather than a demo. Thus, you are allowed to withdraw real profits after meeting their objectives during this stage.

- Traders only pay a one-time price (no monthly fees).

- Unlike many other prop firms, The 5%ers allow traders to hold trades over the weekend and overnight, making it a particularly considerable choice for swing and position traders, to whom holding over these periods is compulsory.

- The 5%ers offer ample time for traders to pass their evaluation (six months for Low Risk and two months for Aggressive). Their objectives are achievable and clearly defined.

- The 5%ers offer numerous comprehensive trading resources to support their traders, such as a regularly-updated blog, one-on-one performance coaching, frequent online trading rooms, webinars, live trading events, videos, a free trading course, etc.

- The company allows for all trading styles and strategies (including hedging, scalping, expert advisors, etc.), making it compatible with everyone.

Cons

- Their 4% maximum drawdown rule seems too low and could detract traders from signing up (also, a low 1:6 leverage). Some may feel trading their personal accounts could offer the same amount of risks without any restrictions.

- Traders can only trade major and minor forex pairs (29), limiting the selection of other markets.

- As with most online prop firms, the cost is one of the main ‘push factors’ preventing many from considering them, although the price of The 5%ers’ packages are competitive and not unusually high compared to others.

- We should also bear in mind there is a lot more The 5%ers offer aside from the live account. However, there is still a risk of failing to meet the objectives, at which point there is no refund.

Conclusion

With so much information to consider, the question then becomes, are The 5%ers worth the risk? Although the participation fee is warranted due to the other services provided, prop firms are a contentious issue within the trading community due to the somewhat low success rate.

In general, only a few traders globally survive in the markets over the long term. The main advantage of trading your own account is there are no limitations and milestones, although the equity size itself may be lower than desired. The strict drawdown percentage is probably the biggest disadvantage with The 5%ers.

Though because traders can continue trading their own funds and the firm’s simultaneously, ideally, their profits naturally increase because they would have two accounts. From assessing numerous prop firms, we can conclude The 5%ers provide favorable trading conditions, meaning they are recommended, despite a few drawbacks.