The Fund Trader is a newly launched Forex market trading solution represented by a well-known LeapFX team. Although this company has a huge trading experience, it does not mean that all their products are good trading tools. Most of them have already turned into scams, as they use risky and dangerous trading approaches to provide a high win rate. Trading with low risk is certainly a big draw for Forex traders. The Fund trader is an expert advisor that uses an 82%-win rate to lure traders. Guaranteeing verified 29,000% profit, no Grid, no Martingale and ability to work with small accounts, this robot promises it can provide ‘High Returns Being Yanked From Up To 18 Currency Pairs Including GOLD’. How good is this EA? Let’s find out.

Gordon Francis is the developer of The Fund Trader. In his presentation, Francis provides a detailed YouTube video, explaining the key features and principles of the work behind The Fund Trader EA. He shares multiple screenshots of positive trading performance and boasts about his 29,000% profit generated over the last 5 years. He claims that it’s possible and easy to achieve when you trade with The Fund Trader. He claims that since 2006 he has been making himself and his ‘hand-picked investors very, very wealthy’.

Features

Although their website presentation is long and wordy, it could not answer all our questions. It’s built around the hype of an extremely high total gain, not around the knowledge. We’ve gathered all the features of this EA in the list below:

- The EA is a fully automated trading tool that does not need any ongoing performance charge

- It trades 18 currency pairs, including Gold

- It can work with small accounts

- The vendor does not tell about the trading strategy behind the robot. Historically, developers that hide this sort of information use an insane Grid plus Martingale combination

- No information about the timeframe is mentioned

- The vendor mentions that there are only 100 spots available

- It looks that the presentation is hype oriented and is focused on those traders who have never traded on Forex

- Traders can easily ask for a refund if they find the system doesn’t fit their trading requirements

- The software is quick and easy to install

Regarding the trading approach, Francis mentions that his EAs can trade 18 currency pairs and Gold without using Grid, Hedging, or Martingale. We cannot trust him blindly. The dev had to provide detailed trading strategy information to explain the approach he uses. He says that he employs a dualistic two-step approach that includes analyzing market fundamentals and technical levels for each currency pair to determine the trade direction and entry point.

How to start trading with The Fund Trader

- It’s fully automated EA, thus no human interference is needed

- It places trades directly from the dev’s account into traders’. This means everything will be copied

- The system will open and close deals exactly like the main (vendor’s) account

- It can work with small accounts

- It suits both novice’s and professional traders

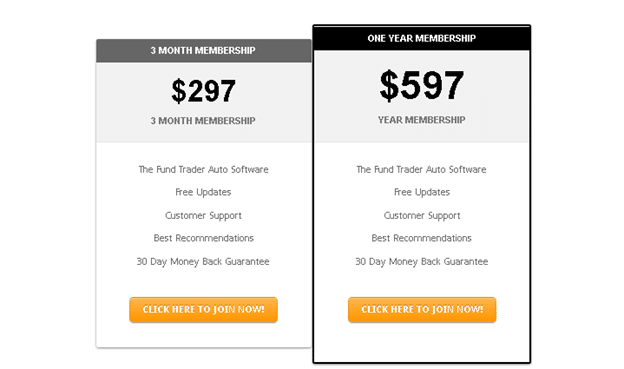

- Traders can set any trade size or maximum risk they want

The Fund Trader is available as a subscription service with a three-month or 1-year membership. The 3 months membership costs$297 and includes free updates, customer support, best recommendations, and a 30-day money refund. The annual membership includes the same features and comes for $597.

Backtests

No backtest reports are provided for this Forex system. Lack of transparency raises a red flag towards the dev who has been trading since 2006. If he were an experienced trader, he’d know that backtesting is a vital part of any trading software in Forex. It helps to analyze how the system performs in the long run and compare its past trading achievements with the ones we have in the present day.

Verified Trading Results of The Fund Trader

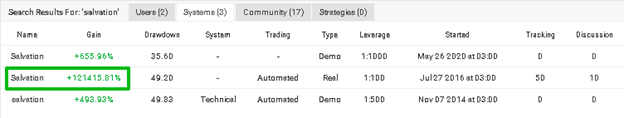

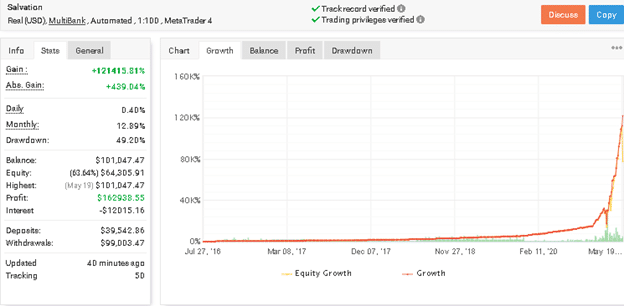

The vendor provides a live trading account under the name Salvation. We do not know why, but the link does not work and we were unable to go to the account page on myfxbook.com. Therefore, we’re obliged to find this trading account on the myfxbook site.

Let’s analyze this trading account in detail:

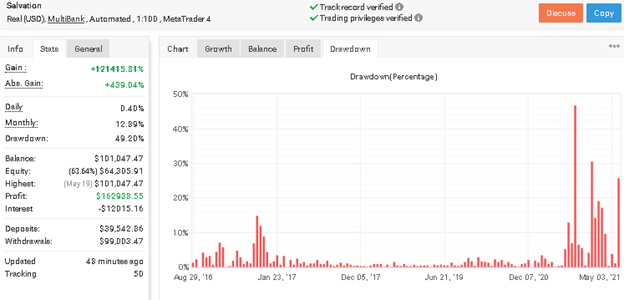

This is a live USD account using a MultiBank broker with the leverage of 1:100. It works on the MT4 platform fully automatically. It was created on July 27, 2016, and was deposited at $39, 542. 86. For less than 5 years of trading activity, the gain profit has grown to 121415.81%. The absolute gain of 439, 04% is present which is confusing as it is not possible to have such a huge difference in the two values. The average daily and monthly gains are 0,40% and 12,89%, which also do not relate well with the total gain. The peak drawdown was 49, 20% which looks dangerous for this trading account. Although the dev mentions that his EA trades with low risks, the high drawdown proves that the claims are false.

As you can see, the EA is not the best option to trade with since March 2021:

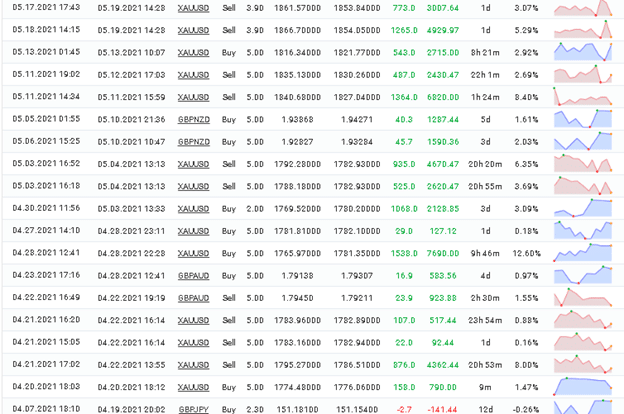

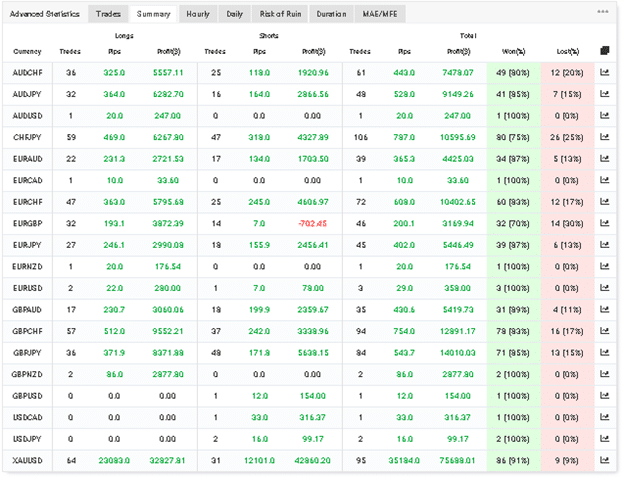

Out of the total amount of 737 deals, the EA has won 613, representing a win rate of 83%. The win rate for Long and Short trading positions is 84% and 81% respectively. The profit factor is high – 4.90. It trades with medium risks to the account balance with an average trade frequency of 5 hours and 48 minutes.

It does not trade with a fixed lot size. There is no explanation what the reason for this is. As you can see, most of the trades are opened for XAUUSD (Gold) – 95 trades and CHFJPY (106 trades).

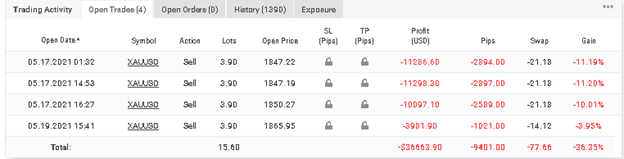

Four open XAUUSD deals are sitting in drawdowns. It looks like a Grid of orders. Losses are high ranging from -$3,9K to -$11,2K.

Customer reviews

Unfortunately, there is no customer review for The Fund Trader provided.

Is The Fund Trader a viable option?

Advantages

- 100% automated Forex system

- 30 days money-back guarantee

- Live trading results

Disadvantages

- No backtest reports provided

- The link to myfxbook results does not work on the dev’s website

- Undisclosed trading approach

- No money-management advice given

- The EA trades with high drawdowns

- No customer reviews

Conclusion

The Fund Trader is a recently launched FX market tool, that offers nothing except a wordy presentation designed to hype people. The lifetime copy of the expert advisor is not sold. There are only subscription plans offered. Although the dev claims that the robot trades with low risks, high drawdowns prove that his claims are not true.