USDJPY is arguably one of the most liquid and most traded pairs in the trillion-dollar currency marketplace. The instrument is known to give rise to unique opportunities as it pits fiats of some of the biggest economies in the world.

On the left-hand side is the base currency, the USD, the legal tender of the United States, while on the right or the quote is JPY, representing the yen as Japan’s official coinage. Second, to the EURUSD, USDJPY boasts of one of the highest traded volumes exceeding over $1 trillion turnovers daily.

The increased volume on the USDJPY has to do with both legal tenders’ roles in the global financial system. While the greenback is considered a de-facto global currency, the yen also acts as a safe haven that traders and investors rush to in times of geopolitical or economic uncertainties.

The favorable trading volume of the instrument is a distinctive attribute that makes it stand out among the majors. The higher the order flow, the easier it is to open and close positions at the desired price points. Additionally, the spreads, which are the costs, are relatively small, making it possible to generate optimum profits.

USDJPY: best trading time

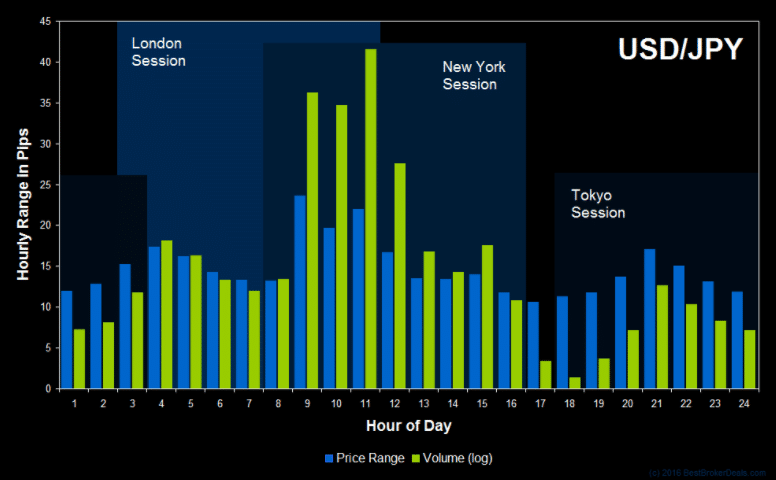

While the USD/JPY is one of the most liquid, it does not generate ideal opportunities throughout the day. Consequently, timing is crucial for anyone looking to profit from distinctive opportunities. Therefore, the focus should always be on when the instrument is likely to experience peak activity in the highly competitive marketplace.

The best time to focus on the USD/JPY is when there are more players likely to trigger increased volatility and liquidity. Consequently, the dollar-yen pair tends to be more volatile between 12:00 GMT and 15:00 GMT.

During this time, the number of participants is high on the opening of trading desks in the US and Europe. Price action activity is even more rampant when both Europe and North American sessions are opened and running concurrently.

During this period, the prospect of getting an order filled is high and within the shortest time, perfect for day traders. Additionally, the spreads tend to be tight given the increased number of people and institutions placing trades, consequently ensuring costs are at the bare minimum.

Economic data release factor

The 12:00 GMT to 15:00 GMT period stands out because it is when most market-moving news releases from the US are made available. During this period, economic releases like Non-Farm Payroll, GDP, Consumer Price Index, or Manufacturing hit the wires, influencing trader’s sentiments.

Traders await the release of these economic metrics to gauge the health of the US economy or the next course of action on monetary policy by the Federal Reserve. Consequently, the information sways trader’s sentiments on the dollar resulting in significant swings.

Additionally, it is important to pay close watch to economic releases out of Japan as it tends to sway traders’ sentiments on the yen, consequently affecting the instrument exchange rate. The Tokyo session, which runs from 01:00 to 04:00 GMT, is also data-packed; thus crucial to be on the lookout as it influences price action.

During this period, the USDJPY also tends to see more action as traders react to the Interest rate decision by the Bank of Japan, manufacturing, and inflation. The data is often used to gauge how the Japanese economy is doing, consequently swaying sentiments on the yen.

Depending on the data out of Japan and its impact, the instrument can also fluctuate significantly during this period, consequently generating exceptional trading opportunities.

Triggers to watch out for

In addition to focusing on the best time, it is also important to be on the lookout for some of the factors that sway price action. Interest rates in Japan are one key factor that drives USDJPY activity.

Japan is best known for keeping interest rates at a record low, fueling demand for carry trades.

Gross domestic product, wage growth, and consumer price index in the US and Japan are other economic metrics worth paying attention to. The metric affects the two currencies’ value, consequently triggering significant swings.

When to avoid USDJPY

The pair should be avoided whenever the Tokyo session is nearing the end, and the London market is yet to open between 0300 and 0500 GMT. The pair sees the least activity as traders in Japan and banks are closed for business, and players in London, another financial hub, are yet to hit their trading desks.

Additionally, the pair should be avoided between 2100 and 2400 GMT when bazaars in the US are closed. During this period, most banks in the US are closed for the day. Therefore, activity tends to decline significantly, resulting in slow price movements and widened spreads.

Whenever the New York and Tokyo sessions are closed, it means quite a time. While it is still possible to make money, the prospects of it being eaten away by commissions are usually high given the reduced liquidity.

Bottom line

While forex is open 24 hours a day, timing is crucial for anyone looking to reduce market exposure and generate optimum returns five days a week. Consequently, it is not efficient to be glued to the screen, scanning for opportunities throughout the day.

The USDJPY is liquid and volatile whenever the New York and the Tokyo sessions are opened. During these periods, it is susceptible to a news release from the two economies known to sway sentiments on the yen or the greenback. However, the pair tends to see the most action when markets in the US are up and running, as the greenback is usually the center of attention.