Ask any professional forex trader, and you will not miss a piece of advice that goes like this: A winner knows better than the market; you can only beat the market if you are smarter than the market. If your ears are not among the blessed few that have caught the words, then there you have it.

But what does the word ‘smart’ refer to in this case? You are smarter if the body of knowledge at your disposal is much larger than your competitors’. For example, you should know how other markets interact with the one in which you are participating. We are dedicating this space to explaining the link between equities and foreign exchange (forex) markets.

What factors influence trading?

For any trader – whether you are in the equities market or FX, or both – trading is an engaging endeavor under the influence of several factors. For instance, an investor in the stock market must consider factors that affect an individual stock’s value. Each investor has a unique trading approach, but they agree in observing the importance of certain fundamental factors, such as earnings per share, dividend rate, and earnings releases.

Extraneous factors that are also worth considering include the prevailing monetary policy, stability of the global economy, and correlations between one financial market and another. Why is it critical to consider these factors, especially inter-market correlations? This has to do with a phenomenon called contagion.

Equities and FX: how do they relate?

The stock market boasts the largest number of participants, while forex leads in liquidity terms. It might seem to a casual observer that these two markets are distinct. After all, the equities market entails buying and selling individual company stocks or an index fund. FX is all about cashing in on the price gyrations of currency pairs.

Contrariwise, equities and FX markets are joined at the hip by something called exchange rates. Exchange rates measure one currency’s value in terms of another, such as the value of one GBP in terms of one USD. Investors in the US stock market come from many parts of the world. For a person in the UK to buy a Microsoft (NASDAQ: MSFT) stock from the NYSE, the person has to exchange pounds into greenbacks.

When the US dollar weakens against the GBP, more UK-based investors would want to snap up more stocks in the US because they are suddenly cheaper. Consequently, the demand for greenbacks will rise as more UK-based investors pour into the NYSE, NASDAQ, and others. Eventually, other FX market players will take notice of the trend and begin to take short positions in the GBP/USD market.

Illustration of how equities affect forex

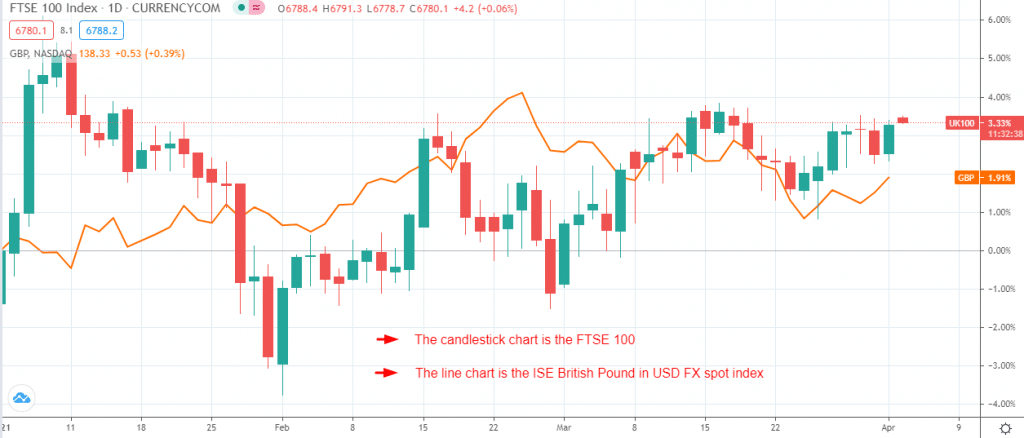

Consider how the Financial Times Stock Exchange 100 Index (the FTSE 100 Index or UK 100) and the ISE British pound in USD FX Spot index have traded so far year-to-date. The figure below shows this relationship. Notice that the charts move sideways; that is, the FTSE 100 tends to rise when the GBP/USD pair declines, and vice versa.

Figure 1: FTSE 100 vs. GBP/USD

Why would the GBP trend downwards when the opposite is happening to the FTSE 100? The following points could help to explain this relationship.

Earnings from foreign countries

Many companies in the UK make a substantial sum of their revenue overseas. Business operations for companies such as Unilever and RioTinto largely happen in Africa, yet they are among the top five largest companies in the UK. Interestingly, these companies transact primarily in US dollars because of the currency strength in global trade. For this reason, most of their revenue is dollar-denominated.

What then happens when the GBP weakens against the USD? First, the profit amount that RioTinto reports increases. Assume the profit generated in a particular business cycle is $10 million. At the time of writing, the GBP/USD exchange rate was 1.39, which means RioTinto’s profits reported in the UK would be about £7.2 million. With a weak pound, say GBP/USD declines to 1.00, RioTinto would report £10 million as profit.

Because of the huge profits, investors are more likely to dump the forex market in favor of the equities market. Consequently, the outflow of liquidity dampens demand in the forex market.

Market strength

Investors in the UK – as it is in many other countries – want to put their money where they are likely to earn better returns. If the equities market weakens at some point, the listed companies underperform in terms of profits – investors will immediately switch to forex to hedge their portfolio. The sudden increase in demand for GBP drives up its exchange rate against the greenback.

Still, on market strength, a strong equities market in the UK could generate a rise in the price of the GBP/USD. The UK equities market is vast, and it attracts investors from all over the world. When UK stocks are trending up, more investors outside of the country want to grab a piece of the action. But these investors need to convert their currency into pounds before making any transaction in the UK.

If the majority of the outside investors are US-based, the need to acquire pounds for buying UK stocks means that many greenbacks will be sold in favor of the GBP. Once the transactions begin to tip the needle in the FX market, other traders will follow suit and deepen the greenback’s decline against the GBP.

Conclusion

Equities and FX markets make up a significant part of the global financial market. More significant is the interconnectedness that exists between these markets. Volatility in one market easily carries over into the other because of exchange rates among currencies. Currencies provide liquidity in the equities market, and the exchange rate differential that arises from the transactions in the equities market generates volatility in FX. However, only a few currencies experience this phenomenon. They include the US dollar, the British pound, the euro, and other major currencies.