The Money Tree Robot is a fully-automated system that claims to avoid any harmful strategies like grid or hedging. According to the developers, the bot can execute trades across 15 currency pairs while maintaining a low exposure risk on its accounts. Let’s give you some other details about this bot to help with the purchase decision.

Features

The robot has the following features:

- The EA is beginner-friendly.

- It is 100% fully automated.

- 4-5 digit auto-quote detection.

- It’s compliant with prop firms.

There is no information on the strategy on the website except for the part that the robot trades on 15 currency pairs without grid or hedging. The history on Myfxbook records shows that the EA is using averaging techniques as multiple positions close simultaneously. We cannot confirm the use of martingale as the lot size is hidden. This leads us to believe that the developers are lying about the game plan of the algorithm.

How to start trading with The Money Tree Robot

To get the robot up and running, traders have to follow these steps:

- Pay for the robot on the EA’s website

- Download the files onto your PC

- Launch the MetaTrader 4 platform

- Enable the auto-trading button

Price

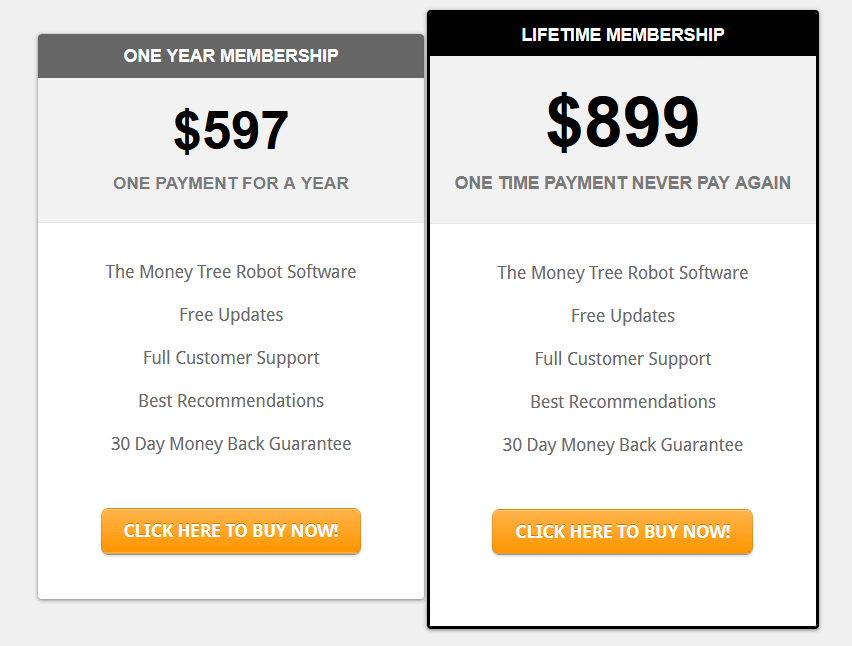

The Money Tree Robot is sold in two packages. One-year membership comes at 597 USD, while lifetime access is sold for 899 USD. Both options come with free updates, customer service, seller’s recommendations, and a 30-day money back guarantee.

Verified trading results of The Money Tree Robot

Backtesting records of the robot have not been provided on the developer’s website. This is a highly unprofessional practice and points toward a lack of transparency by the vendor.

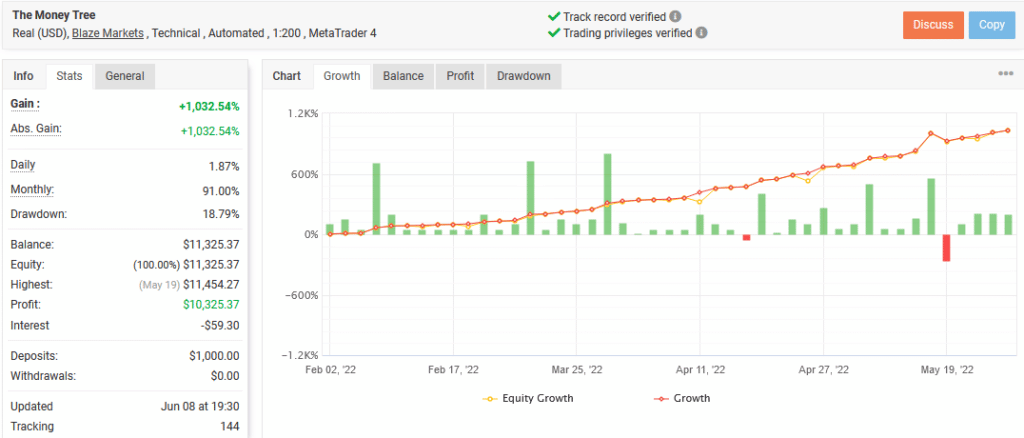

Verified trading results of the EA are provided as Myfxbook links. These cover the performance for the period: February 02, 2022, till the current date. The trades correspond to the Real (USD) currency on the Meta Trader 4 platform with leverage of 1:200. According to these stats, the bot shows a monthly gain rate of 91%, with a drawdown value of 18.79%. Deposits stand at 1000 USD, whereas profits have been stated as 10,325.37 USD.

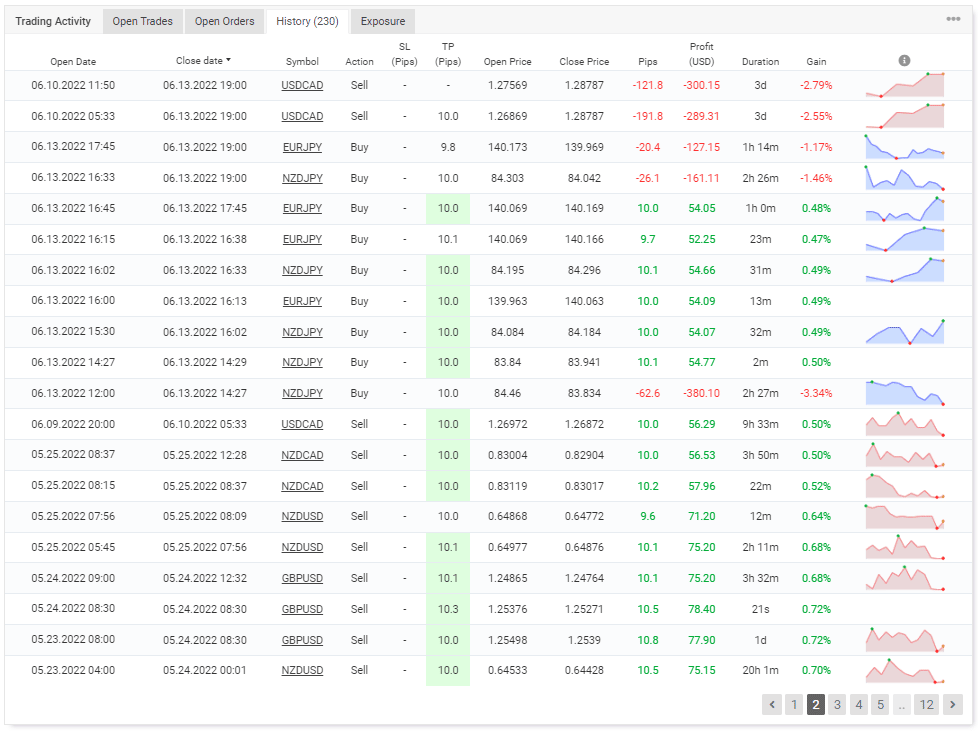

For this time, the EA made a total of 197 trades. Out of these, 8% resulted in a loss. With the worst trade value of -$800.20 and the best trade value of $416.88, it can be inferred that this robot has a poor risk-reward ratio. The profit factor is written as 3.41, and the average holding time is described as 5 hours and 9 minutes.

Customer reviews

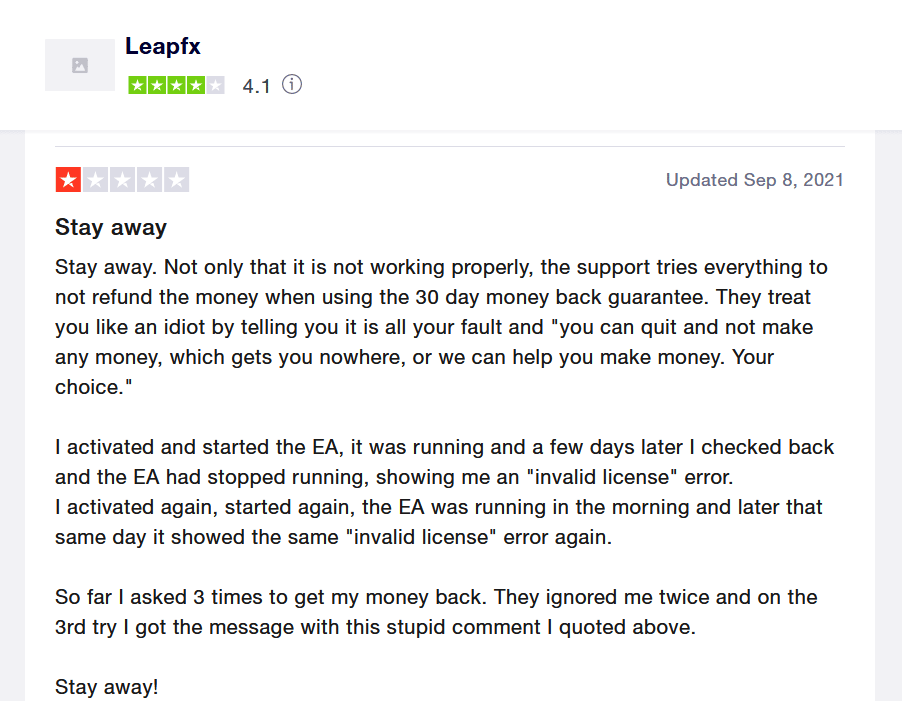

Although there are no specific reviews for The Money Tree Robot on Trustpilot, we were able to trace some negative feedback about the parent company, Leapfx. This company has a rating of 4.1 stars on TrustPilot, a trusted third-party site for customer feedback.

One angry customer remarks at how the company defaulted on its promise of a 30-day money-back guarantee. Also, their bot stopped working after a while. They suggest traders avoid this vendor.

Vendor transparency

According to the info provided on the robot’s website Leapfx is the company behind this product. The Forex firm offers brokering, managed account services, automated trading systems like The Money Tree Robot, and virtual private servers (VPS). There is no information like an address, telephone number, or owners’ identities that might hint at some credibility behind this system. Again this puts the trustworthiness of this vendor into question.

Is The Money Tree Robot a viable option?

Advantages

- It comes with a 30-day money-back guarantee

Disadvantages

- The vendor is not transparent in their portfolio

- Negative customer reviews are present

- It does not provide backtesting results

Conclusion

The Money Tree Robot is not clear about the identities of its sellers in terms of names and personal information. It is using risk grid strategies that go against the statements from the developers. Finally, the developers do not provide backtests, a deplorable practice that raises serious concerns about the EA’s performance.