Tioga is a fully automated trading tool that focuses on making only small and steady profits. The system is appropriate for both novice and veteran traders and can work on VPS clearly. It does not use dangerous strategies like averaging, grid, or martingale.

Tioga is the creation of Ozkan Kara, a Turkey-based developer. Ozkan has been operating in this market for 4 years, and so far, his portfolio includes 2 Forex products. In addition, he has 1 published signal and 25 subscribers.

Features

The features of Tioga are indicated below:

- It works with all major currency pairs, but the vendor prefers to work with these 11 pairs: AUDUSD, CHFJPY, EURAUD, EURCHF, EURGBP, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPUSD, and USDCHF.

- One chart can be used to trade all the selected pairs.

- It runs on the MT4/5 trading platform.

- The minimum recommended balance is $300.

- The timeframe used is M5.

- ECN brokers and low spread ECN accounts are recommended.

- All leverages are fine, but the preferred one is greater than 100.

- It uses fixed stop loss for every position.

In view of the trading strategy, the vendor says that Tioga is a night scalper. So, it trades only for 2 hours between 21:00-22:59 GMT (London Time). The goal is to profit off small price changes that occur during this period.

Notably, the EA holds only a single position at the same time on each pair. The direction of entering the market is dependent on the mean reversion strategy at the end of the US session. This means that the system also attempts to obtain profits as the price of a pair goes back to more normal levels.

How to start trading with Tioga

Tioga’s asking price is $195. It originally cost $495. The current offer is valid up to January 4, 2022. A renting option is available, and with only $45, you can use the EA to trade for 3 months.

To start trading, you need to attach the robot to the MT4 or MT5 account and deposit a minimum of $300 in the account. Don’t change the EA’s settings, as the dev recommends utilizing it with default parameters on each pair. The last step is to activate the system to begin placing trades for you.

Backtests

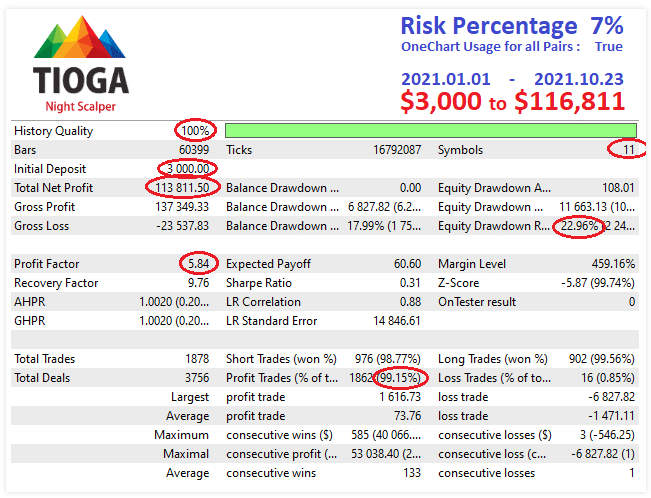

The information on this backtest report is that Tioga was tested from January 1, 2021 to October 23, 2021. During this simulation period, the EA increased a deposit of $3000 to $116,811 after making a total net profit of $113,811. The resulting profit factor was 5.84, a sign that the robot was very lucrative.

A drawdown of 22.96% was reported. This means that the risks taken during trading were not many. From 1878 trades completed, impressive win rates for short (98.77%) and long positions (99.56%) were recorded.

Unverified trading results of Tioga

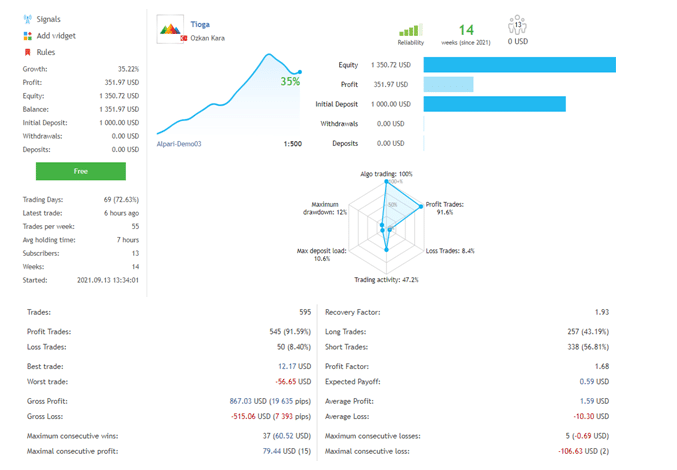

The developer is not using this robot on a verified account. The above account was opened on September 13, 2021, and it has executed 595 trades within 69 trading days. Up till now, 91.59% of the orders have brought in profits. In total, the gains amount to $351.97. This earning is average. The drawdown is 12%.

A profit factor of 1.68 proves that the EA is not as lucrative in the live market as we saw in the simulated environment. The performance of the long trades (43.19%) and short trades (56.81%) are also far from being impressive. In fact, these outcomes tell us that Tiogo hardly identifies profitable opportunities. That’s why it has recorded a higher average loss (-$10.30) compared to the average profit ($1.59).

Customer reviews

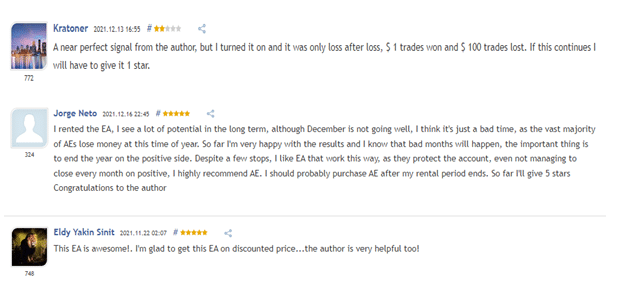

Tioga has 6 customer reviews. Five of the testimonials are positive. Based on the sample we have selected, it is clear that traders are happy with the system’s live trading results. However, there’s one disgruntled client who claims that he has experienced loss after loss since he activated the bot. Only one trade has been successful so far. He threatens to give Tioga a 1 star if this trend continues.

Is Tioga a viable option?

Advantages

- Fair pricing

- Backtest data is available

Disadvantages

- Low rate of returns

- Poor win rates

- High losing streak

Wrapping up

The backtest results of Tioga are impressive, but unfortunately, the same cannot be said about its performance in the live market. We have seen that the system generates small earnings, has poor win rates, and losses a lot of trades.