TradingView is a popular company among day traders, long-term investors, and other financial services professionals globally. Indeed, in 2021, the company raised almost $300 million from investors, pushing its total market value to more than $3 billion. This made it one of the biggest fintech companies in the world. In this article, we will look at what TradingView is, how it works and makes money, and some of its best tools for forex traders.

What is TradingView, and how does it make money?

TradingView is a financial services company that provides multiple solutions to all types of finance professionals. It is best known for its charts, which are among the best in the industry. Still, as you will see below, it offers more features and tools that traders and tools can use to make good decisions.

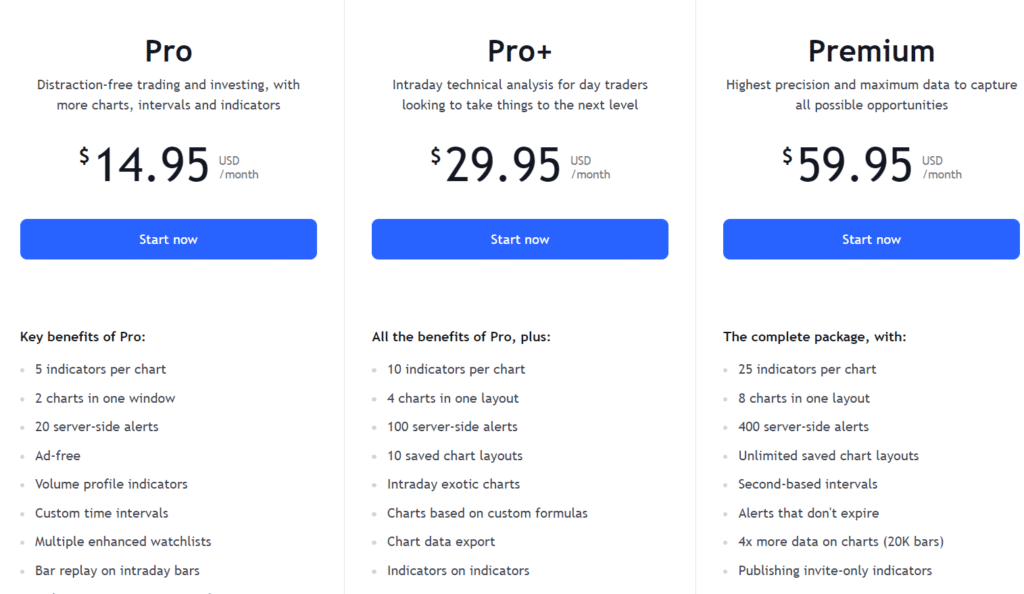

TradingView has three main ways of making money. First, it uses a freemium model, where it offers some of its solutions for free. Customers are then required to pay a monthly or annual subscription for more tools. As shown below, its premium package starts at $14.95 per month to $59.95 per month.

Second, it also makes money from unpaying members of its community. It does this using advertisements that appear when customers are using its platform.

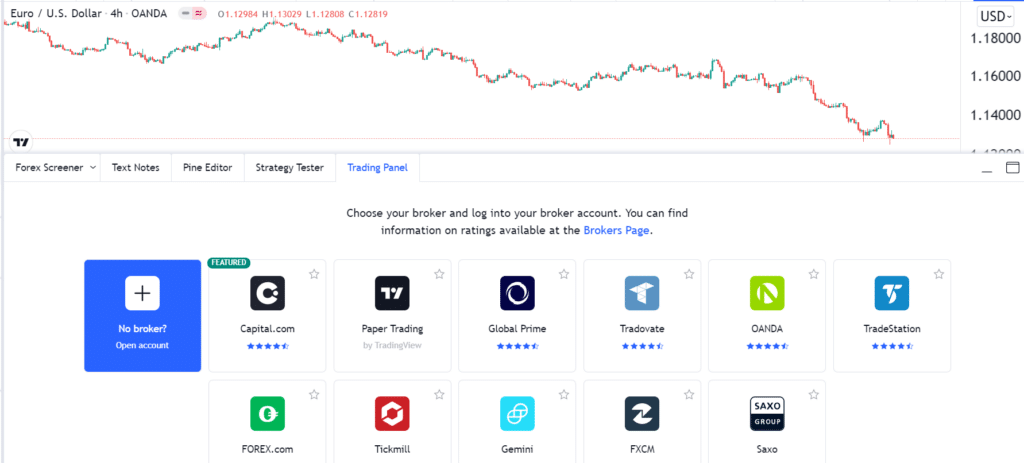

Finally, it makes money by partnering with brokers and exchanges. These companies connect their platforms to TradingView, which makes it possible for people to trade directly. The chart above shows the number of brokers that the charting service is partnering with.

Economic calendar

An economic calendar is a must-have tool in forex trading. It is a tool that has a schedule of key economic events that will happen in a certain period.

Forex traders use this data to determine the health of an economy and then to predict the actions of a central bank. In most cases, strong economic data lead to talk of more tightening by the central bank, while weak numbers signal that a central bank will turn dovish.

Currency pairs tend to see more volatility when important data comes out in the market. It is not uncommon to see a currency pair rise or fall by more than 1% after a central bank delivers its decision.

TradingView is one of the several platforms that offer an economic calendar. You can tweak this calendar to your specifications. For example, you can exclude countries that you don’t follow and even mute data that don’t lead to substantial volatility in the market.

While TradingView’s calendar is useful, it does not match the one provided by Investing.com. For one, it is relatively difficult to use it to find data that happened in the past. Also, the calendar does not provide a charting tool for you to identify macroeconomic trends.

Strategy tester

Many forex traders are turning to algorithms or expert advisors for trading ideas and implementation. An expert advisor is a tool that is programmed by someone with some experience in trading and coding.

Expert advisors, also known as robots, can help a trader experience strong results in the market. However, they are not perfect. Indeed, many people have lost a substantial amount of money for placing their hopes on bots.

Therefore, before bots are implemented in the market, they need to go through a “quality assurance” process. This is a process where their developers test the bots to see how effective they are.

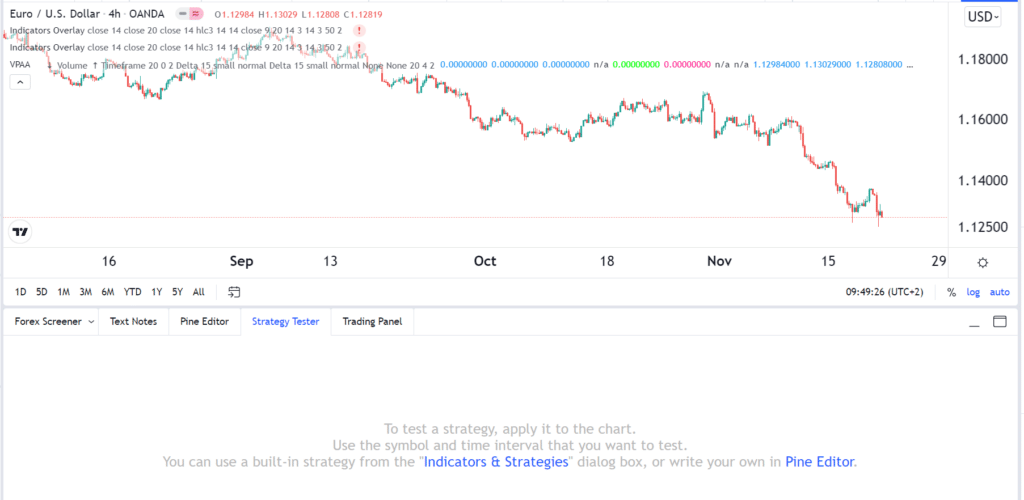

The illustration below shows the Strategy Tester tab in the TradingView software.

To do this, TradingView has a tool known as a strategy tester. This is a tool that you can add any bot or indicator that you have created and then test its performance. If it does not work out well, you can decide to tweak it or even do away with it.

Indicators

Technical indicators are an important part of forex trading. It is often challenging for a day trader to succeed without incorporating these indicators. That is why they are offered by trading platforms.

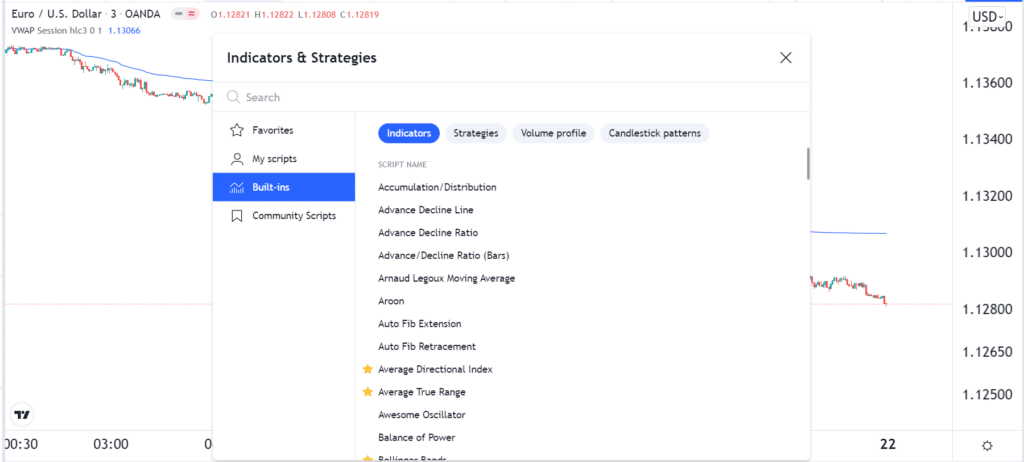

The beauty of TradingView is that it offers a variety of indicators. These indicators range from the widely-used tools like Moving Averages, Relative Strength Index (RSI), and Volume-Weighted Average Price (VWAP). It also offers indicators and scripts that have been built by the community.

In addition to the baseline indicators, TradingView also offers strategies that have been built by the community. This means that you don’t need to have coding knowledge to create your trading bots in TradingView. You can use those ones that have already been built.

Therefore, TradingView offers hundreds of custom and inbuilt indicators, making it an excellent trading platform for forex traders.

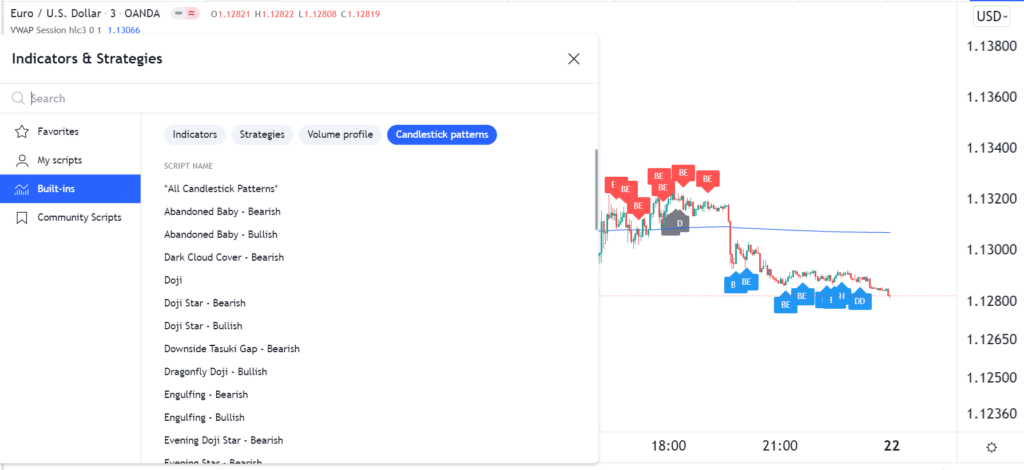

The illustration above shows the list of indicators that the platform offers.

Candlestick patterns

In addition to technical and fundamental analysis, price action is a popular trading strategy in the market. The idea is relatively easy to grasp. Instead of using indicators and fundamental data, you can make decisions by looking at chart arrangements.

There are two main ways of doing this. First, you can use chart patterns like triangles, head and shoulders, flags, pennants, and wedges. Second, you can use candlestick patterns like doji, morning and evening star, engulfing, and three dark crows to predict the future direction of the currency pair.

The best way of identifying these patterns is to look at candlesticks and use them to find the direction. However, having an automated tool can help simplify this process.

TradingView has a tool that can show you the candlestick patterns automatically. All you need to do is to enter the pattern that you want to study and then look at it in the chart.

You can press all candlesticks, and the tool will add all those it can see. An example of this is shown in the chart above.

Summary

TradingView has additional tools that are essential to forex traders. For example, it has a pine editor tool that enables traders to create their personal trading bots, indicators, and strategies. Further, it has a news tab that gives them the ability to see breaking news in the market. Additionally, it has an idea stream that enables you to see the ideas of other traders.