The forex market stands out as one of the largest, with a daily turnover of more than $6 trillion for a reason. For starters, it is home to several currency pairs that people can bet on. Additionally, the financial instruments are broadly divided into three majors, minors and exotics.

Understanding exotic currencies

They are the third most traded in the trillion-dollar marketplace. Exotic currencies are made up of one of the eight major legal tenders paired with fiat from one of the developing nations. People can speculate on them because of the opportunity they offer for diversifying investment portfolios.

However, it should be noted that they don’t come with as much liquidity as is the case with major and minor currencies. Amid the low liquidity, some are worth day trading while leveraging unique price strategies to squeeze optimum profits from the slightest price movements.

Additionally, these instruments can be extremely volatile at times, thus increasing the prospects of generating a significant amount of profit when aligned with the market. The risk of losing money is also high.

Below are the most popular exotic pairs

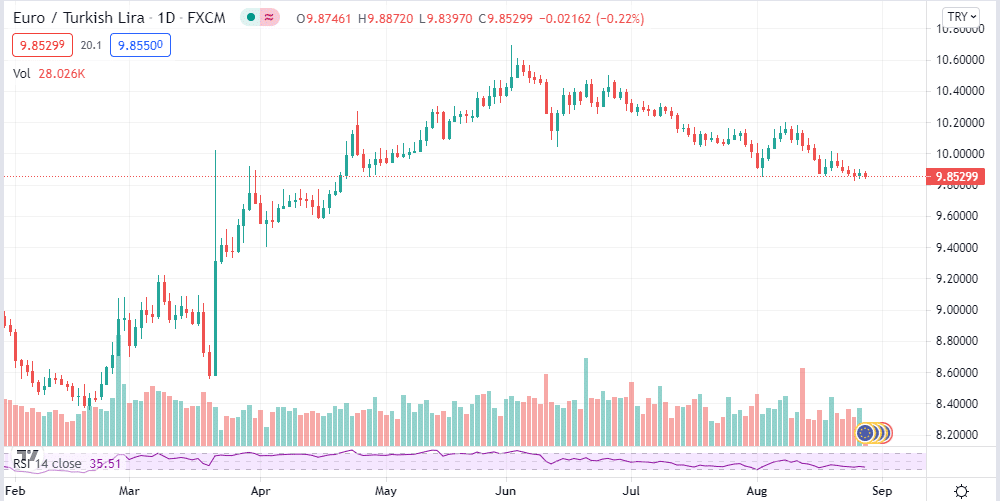

EURTRY

The instrument denotes the euro for the European Union as the base currency and the Turkish lira for the quote. It accrues its edge as it represents one of the largest economies in the EU and, on the other hand, Turkey, one of the fastest-growing developing economies.

Turkey has been trying to enter the EU, given that it is its biggest trading partner. Consequently, it tends to generate unique trading opportunities for anyone not afraid of risk. The Turkish lira continues to elicit strong demand from people and companies doing business in the emerging economy.

However, with the volatility of up to 15%, it should be handled with caution. In addition, high volatility also comes with high swap fees, making it expensive to hold positions overnight with this pair. In addition, the Turkish central bank is known for aggressive monetary policies that influence price action.

For starters, a sharp drop in the value of the Turkish lira is often followed by a spike in interest rates. The central bank also tends to buy euros to prop the legal tender in case it loses significant value.

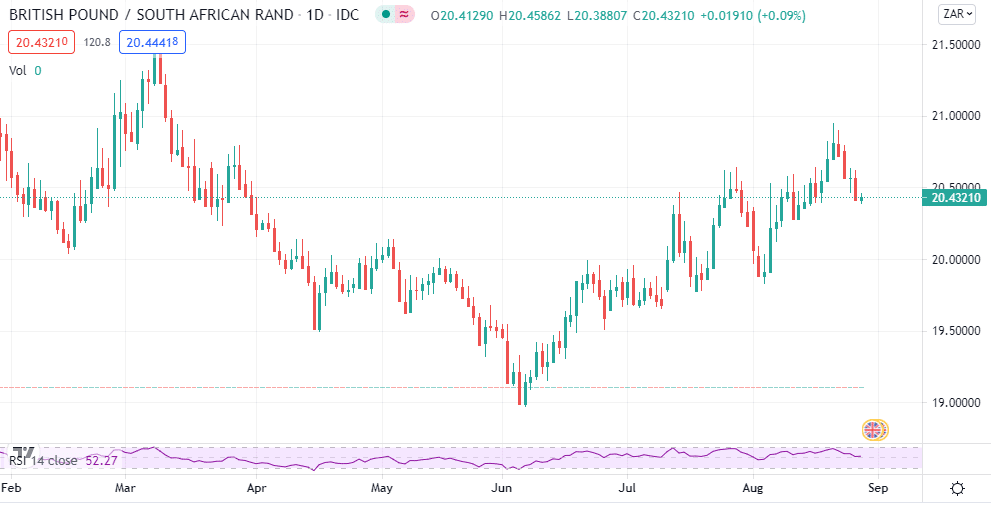

GBPZAR

The pair comprises the British pound (GBP) as the base fiat and the South African rand (ZAR) as the quote. The South African economy was one of the fastest-growing economies, given its ties to gold. Before the 2008 financial crisis, the rand value was closely tied to the precious metal as the nation’s biggest export.

Consequently, the pair is traded, taking into consideration how the pound reacts to economic releases and interest rate changes as deployed by the Bank of England. Additionally, gold and platinum, being South Africa’s biggest exports and sources of revenue, also influence the GBPZAR’s price action.

South Africa has experienced significant political turmoil that has taken a toll on the ZAR in the recent past, consequently influencing the instrument’s price action.

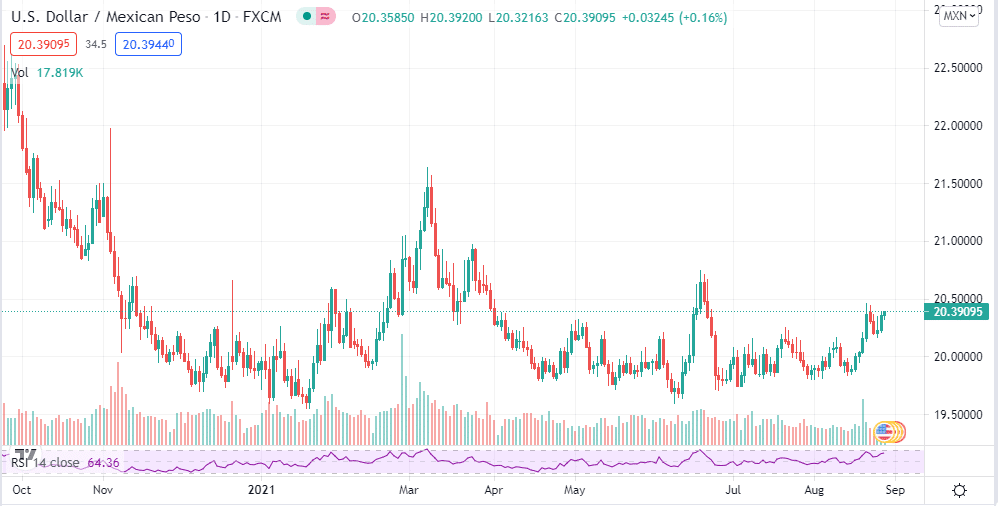

USDMXN

The pairing features the US dollar as the base and the Mexican peso as the quote. Its popularity has been growing driven by the growing Mexican economy, one of the biggest among emerging nations. The cross-border trades between the two countries are also a catalyst in its increasing popularity.

While economic data for trading USDMXN are readily available, some of the data has not always been on target, especially in the case of Mexico. Consequently, it can be tricky to trade the instrument purely on data. In addition, one can speculate on the pair based on the geopolitical development between the two neighbors.

USDMXN tends to accrue significant liquidity whenever the London and New York forex sessions overlap.

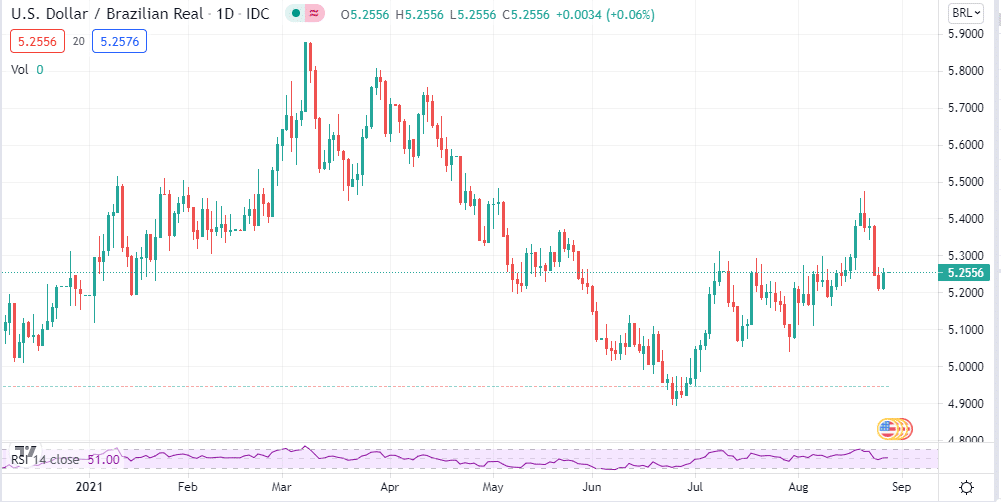

USDBRL

The combination features the US dollar and the Brazilian Real. The Brazilian economy has historically performed well and boasts of an expanding balance of trade with the US. The increasing trading activities between the two economies make USDBRL ideal for anyone looking to absorb some risk.

The pair attracts the most action when markets in Europe and North America are open. Volatility during this period can increase significantly, making it possible to profit from significant price movements.

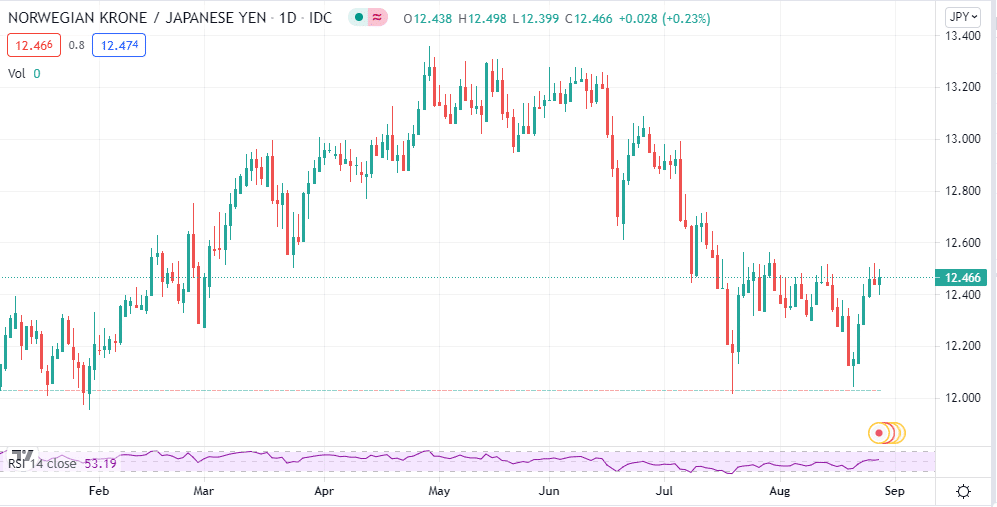

JPYNOK

The combination denotes the Japanese yen (JPY) as the base currency and the Norwegian krone (NOK) as the quote. It is a popular exotic pair partly because of the yen’s role in the global financial system.

Yen comes with some of the lowest borrowing costs, given Japan’s record-low interest rates. Additionally, the yen serves the role of a safe haven that investors rush to in times of global uncertainties.

On the other hand, the Norwegian krone is one of the most tracked instruments partly because of the nation’s booming oil export business. Consequently, the krone value is highly tied to the oil prices. Additionally, the country is a major exporter of metals and chemicals.

Exotic pair’s pros

The pairs have less correlation to other financial instruments such as stocks and bonds. Consequently, they are less affected by macroeconomics or development in other markets.

In addition, they can be extremely volatile, which can be a double-edged sword. In case one is on the right side of the trade, there is always a high prospect of generating significant profits. However, losses can accrue faster if things go wrong.

The cons

As these instruments are some of the least popular, they are less liquid, a condition that makes it hard to enter and exit positions at desired prices.

High spreads are another headwind that one must contend with, which can make the cost of trading them quite high.

In addition, they are prone to big government interventions in policies. When such changes occur, they can trigger significant risks.

Bottom line

While exotic pairs give rise to some of the best trading opportunities given their heightened volatility, they should never be tried by people with little experience in the business. In addition, they are far less liquid and subject to unexpected changes in monetary policies that can trigger heightened risks.