The blockchain industry has moved from one grace to another in slightly over a decade. Today, some projects built using technology like Brave and Audius have gone mainstream. Analysts expect that the industry will keep growing in the next few years. In this article, we will look at the concept of smart contracts and then identify some popular oracles for 2022.

What are smart contracts?

Smart contracts are the building blocks of most decentralized projects. They enable people to make agreements without even meeting or interacting with one another. It is the same technology that powers Decentralized Finance (DeFi) projects like Anchor Protocol and Uniswap.

The simplest definition of a smart contract is that it is a piece of software that is tied to a blockchain project. It is a self-executing contract that is written in a code.

Most blockchain projects currently have a concept of smart contracts. For example, Ethereum was one of the first ones to have these features. As a result, developers are now able to build projects in all industries like gaming and lending.

What are oracles?

A common challenge in building blockchain applications is that there is a need to have accurate off-chain data. For example, if you are building a decentralized exchange, like Uniswap or an Automated Market Maker like Bancor, you need accurate data on thousands of cryptocurrencies.

Similarly, some DAPPs will have a need external data on things like weather, the stock market, and even the commodities industry. For this data to work out, it is important for it to be accurate and reliable. Without that, users of a DAPP will not have trust in the platform.

This is where oracle platforms come in. They are blockchain projects that provide off-chain data to the blockchain in an easy way. As such, instead of a developer building their private oracles, they can just use a few steps to do that. Here are the top oracle projects for 2022.

Chainlink

Chainlink was the first blockchain project to provide oracle services in the blockchain industry. As a result, it has a first-mover advantage that has been embraced by most developers.

The platform has tools that enable people to connect all types of data to their projects. It is widely known for the price feeds that it offers to developers in the Decentralized Finance (DeFi) industry.

Over the years, Chainlink has inked deals with some of the best data providers, such as Binance, Huobi, CoinGecko, and Brave New Coin.

The team has also expanded its ecosystem to boost its market share in the blockchain industry. For example, it recently launched the second version of its Verified Randomness Number Generators that are widely used for gaming, NFTs, random entity selection, and ordering processes.

Chainlink also has other products like Keepers and Proof of Reserve. According to DeFi Llama, Chainlink has a total value secured (TVS) of $56 billion. Some of the biggest platforms using it are Achor, Aave, and Compound.

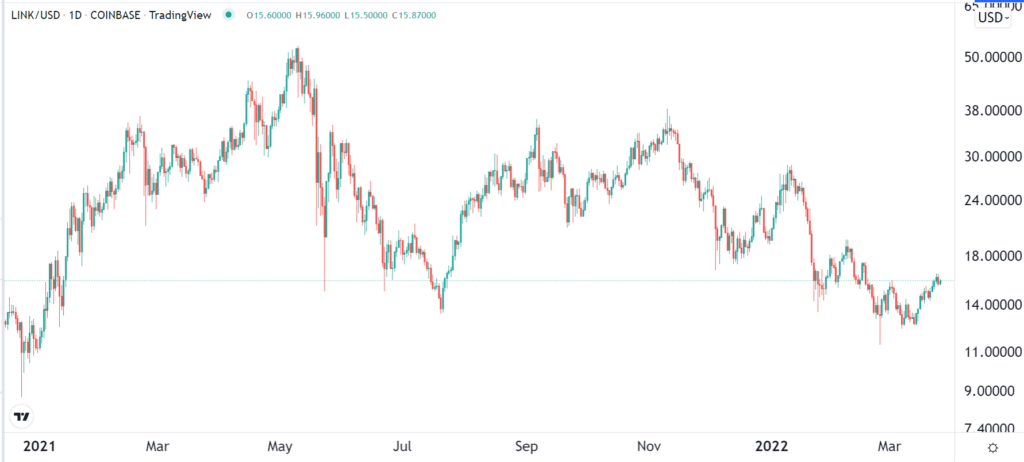

Its token is known as LINK and has a market cap of over $7.3 billion.

Maker

Maker Protocol is a widely-known DeFi protocol that stands out among peers. Its uniqueness comes from its own stablecoin known as DAI, which has a market value of over $9.6 billion. As a result, Maker’s lending marketplace is usually stable.

Another little-known feature about Maker is that it also has an oracle solution. In its protocol, every collateral offered has a corresponding oracle that writes a reference price in the system. At the same time, every oracle has an Oracle Security Module and a Medianizer. The latter tool sends data using a system that includes feeds and layers.

Another unique tool in Maker’s oracle is known as Seltzer, which gets the median price of data from leading exchanges and then publishes it to a secure network that other developers can get.

According to DeFi Llama, the MakerDAO oracle has a total value secured of over $16 billion. It is mainly used by Maker itself and the Keeper Network. MKR is the native token for the MakerDAO ecosystem and has a market value of $1.8 billion.

WINKLink

Tron is a blockchain project that was established by Justin Sun. Today, it is one of the leading blockchain operating systems in the world. For example, at times, the amount of Tether in its circulation in its ecosystem is usually higher than that in Ethereum. Its DeFi TVL is about $4.3 billion.

WINKLink is an oracle network that is built for the Tron ecosystem. As a decentralized oracle network, it ensures that its data is substantially safe.

Some of the data that WINKLink supports are bonds and interest rates derivatives, insurance smart contracts, and hard data on shipping and logistics.

WINKLink has a total value secured (TVS) of over $3.1 billion and is used by Tron DeFi applications like JustLend and Just Stables. The WIN token has a market cap of over $288 million.

Pyth

Pyth is another leading oracle project that targets the decentralized finance industry. Its goal is to provide accurate and safe data to all DeFi projects. It achieves this by partnering with institutions that provide their valuable data to it. It then provides this data to developers through simple code. Some of the data providers in the network are Binance and Coinbase.

Pyth has three main types of participants. There are publishers who normally use data feeds from providers, consumers, and delegators. Consumers are ordinary people who read these data feeds while delegators stake tokens and earn data fees.

Pyth is widely used by many upcoming DefI projects like Solend, Tulip Protocol, Mango Markets, and Latrix. It has a total value staked of over $1.8 billion.

Summary

The field of smart oracles has almost matured and is not seeing a lot of fresh entries. That’s mostly because of the significant amount of market share that Chainlink has. In this article, we have identified the most popular oracles. The other popular ones are Band, TWAP, and Harbinger.