1. Breakout

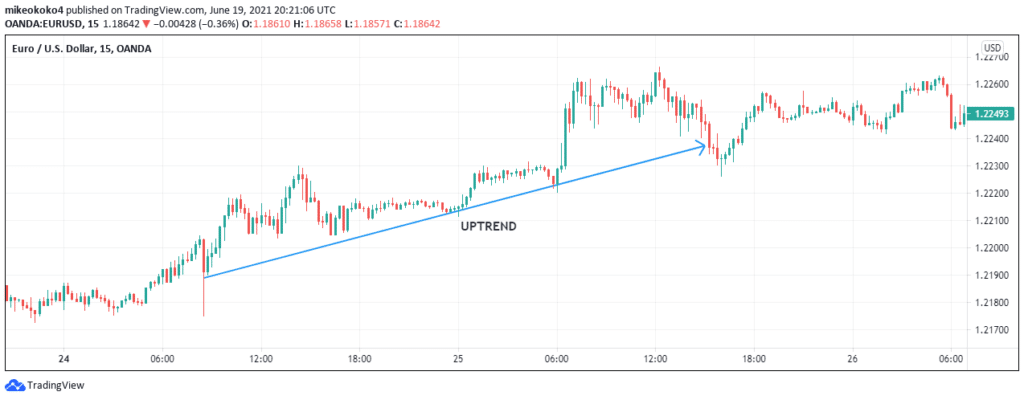

With this strategy, you will keep your eyes on the price action towards key levels of support and resistance. The basic principle for trading breakouts is going long when the price breaks a resistance and going short when downward price action touches a key support level. This trading mechanism is based on the belief that once a key price pivot point is broken, it sets in motion price action towards the direction of the new trend.

Two of the key things to keep in mind and which a trader has to get right with this strategy are the support and resistance points. Once you have them, you will then have to watch out for the price action between the marked points. The more a resistance or a support level is touched, the higher the likelihood of a breakout.

Entry points for breakouts

Breakouts denote the potential start of a new trend. The trend can either be bullish or bearish. The breaching of a resistance level gives way to a bullish run. Therefore, the entry point for a long position should be just below the resistance level. Conversely, the breaching of a support level signals a potential bearish run. Therefore, the entry point of a short position should be just below a support level. Find out more about managing your entry and exit points.

Planning for your exits

Each time you open a position, you should have a specific profit target in mind. The profit target should not be arbitrary, but you should be guided by recent price action. This will help you determine your most appropriate exit point and protect your profits. For example, if a currency pair has moved by an average of 20 pips in the most recent ten trading sessions, then you should place your exit 15-17 pips from the last price. Having a predetermined exit in mind will also help you to be disciplined and help you stick to your plan.

2. Scalping

This is a particularly popular strategy used in forex trading. Its profitability is based on making small profit margins over several hundreds or thousands of trades happening within minutes or a few seconds.

With this strategy, you should close your position as soon as you make a profit. However, the risk levels are comparatively higher because trading within short time frames may not allow you adequate time to recover from losses.

An equally important factor in scalping is to trade in highly liquid currencies, especially majors, because they will offer you many trading opportunities and are less volatile. Due to the high number of positions that you will open when scalping, you should know that your risk exposure will be significantly increased.

3. Trading momentum

There are two ways to look at momentum: you can assess the volume of trade or the price momentum. When trading momentum, fundamentals are key determinants that can either propel the asset higher or drive it lower. Therefore you need to identify the important dates on the economic calendar and enter into positions based on past price actions following the release of PMI, CSI, etc.

For you to increase your profit margins with this strategy, you should go for pairs that typically move by several pips a day, such as uncorrelated pairs like AUD/NZD. Once you open a position, watch out for changes in trading volume and exit as soon as you notice a decline.

4. Profit from the news

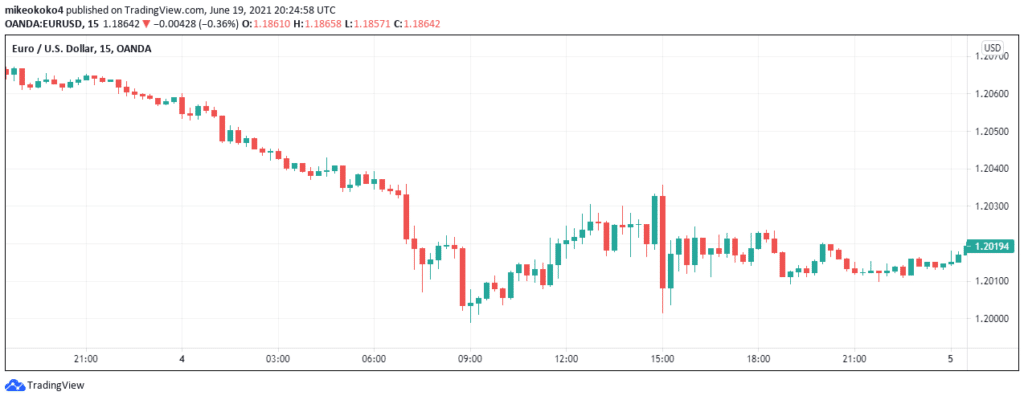

News releases have a great impact on the price action of assets / securities. In particular, the economic calendar has a great influence on the behavior of traders. Normally currency pairs and other assets tend to trade in the range ahead of the release of key economic data. This is because traders are often undecided on their next move before key data is released.

The reason for the formation of a consolidation pattern ahead of the news release is the anticipation for the breakout that follows. Usually, traders follow the trend established after the breakout from a consolidation pattern after a major development is announced.

When doing technical analysis, you can utilize the width of a triangle pattern consolidation and use an equivalent distance from the breakout to take profit. In case the consolidation was in the form of a range, then the range’s width should guide you on the distance from the breakout point where you should take profit.

In times prior to the release of important news, prices tend to fluctuate a lot, leading to a significant spike in volatility. The same is true after the release of the news. An experienced trader is aware of the key fundamental indicators affecting the market overall as well as a particular asset and knows exactly what news to look out for and when.

Therefore, you should use analysts’ projections and historical movements of the asset under similar circumstances to guide you on where to place your stop losses. The chart below shows the market action of the EUR/USD pair after Non-Farm Payrolls data was released on 4th May, 2021.

Bottom line

There are several strategies you can implement when day trading. Each strategy has its strengths and you should identify the ones that can work best for you, depending on current market conditions.