Polygon is a layer 2 blockchain that was created with the main goal of solving some of Ethereum’s shortcomings. In so doing, the developers of this network hoped it would secure their network a share of Ethereum’s large following, perhaps even surpassing this first market-mover blockchain. However, the Polygon blockchain was built on Ethereum. Users of Polygon enjoy a multi-chain network, which features around 10,000 transactions per second and transaction fees as low as $0.000248. Compared to Ethereum’s 13 TPS and gas fees upwards of $50, one can see why former Ethereum users would switch preferences to Polygon.

Leading projects on Polygon

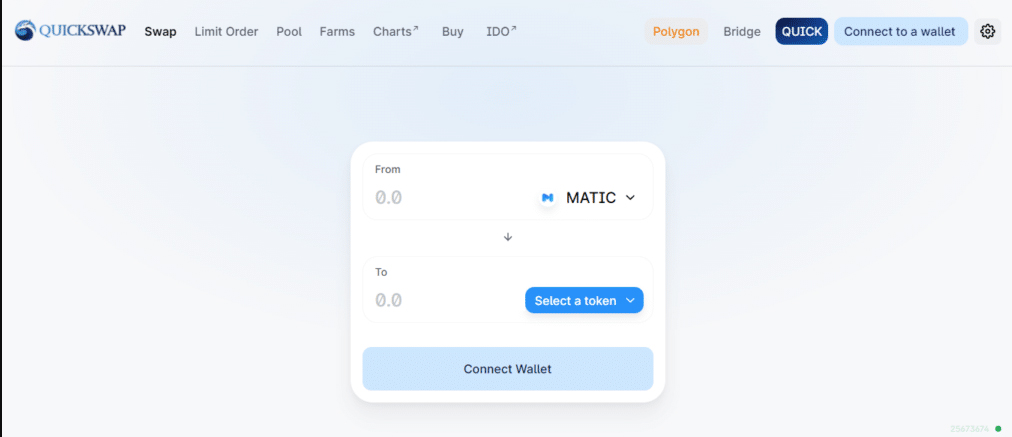

- Quickswap

This is a decentralized exchange platform on the Polygon ecosystem. It runs on the automated market maker (AMM) model, which allows users to stake their holdings in its liquidity pools in exchange for QUICK rewards. This platform bears close resemblance to Uniswap, the most popular DEX on Ethereum. Since its interface and user experience is quite similar to the latter platform, users of Uniswap need not learn anything new to utilize Quickswap.

Additionally, this DEX features low costs and quick transaction settlements. It has a total value locked (TVL) of $723 million, which speaks to its legitimacy and popularity.

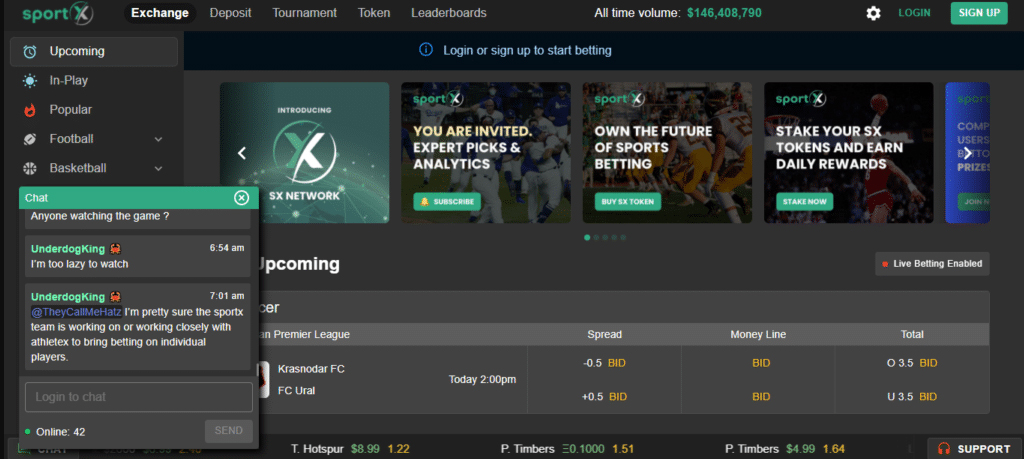

- SportX

This is a decentralized sports betting platform that aims to revolutionize the online betting scene. Rather than bet against the house as many sports betting platforms will have their clients do, users of SportX bet against each other. What’s more, since smart contracts control the settlement of bets, the betting funds are kept in escrow, and outcomes cannot be contested by any central authority. Additionally, no initial deposits are required to participate.

This platform also holds events such as the SportX World Tour, where participants stand to win up to $50,000 in DAI. One can bet using Polygon’s USDC, which is faster and cheaper than other Ethereum stablecoins.

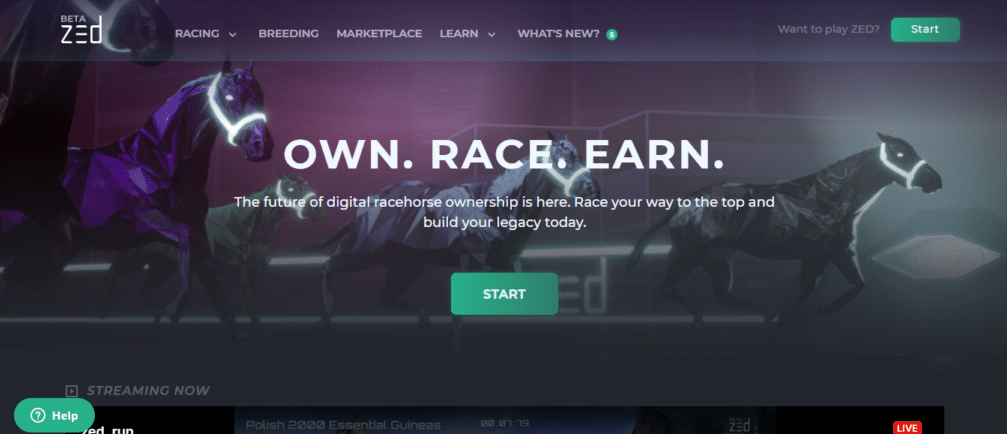

- Zed Run

This is an NFT play-to-earn game hosted on Polygon. In it, users get to buy, breed, and sell racehorses. These horses are then raced against each other for in-game rewards. Just like real-life racehorses, Zed Run horses have varying bloodlines, which determine their rarity levels and thus their value. Some of these bloodlines include the Nakamoto and Buterin.

Users who win races increase the value of their horses, while regular winners can qualify to become professional breeders on the game. This game has also entered into a partnership with renowned entertainment brands in the racing industry, such as NASCAR and Atari, the video game company. This speaks to the legitimacy of the project.

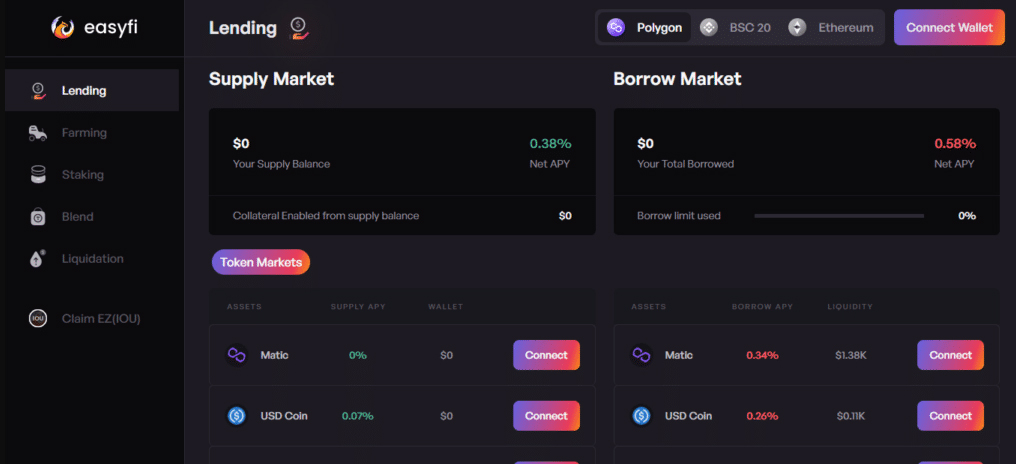

- EasyFi

This is a decentralized lending and borrowing platform, where lenders provide liquidity and transactions are completed at high speeds and low costs. EasyFi is compatible with Polygon, Ethereum and Binance chains. It stands out from its competition by its unique offering of undercollateralized lending. This means users can borrow more than what they hold. In most other platforms of its kind, users must hold more funds than they can be allowed to borrow.

EasyFi manages to offer these low collateral loans by utilizing TrustScore. You can think of it as a decentralized credit rating system. It uses algorithms to gauge the creditworthiness of any ERC-20 wallet address connected to the EasyFi platform. This way, your data is kept private and secure on the blockchain, with no risk of company exploitation. You can also get yield farming, conventional overcollateralized loans on the platform, as well as regular airdrops if you hold the EZ token.

- Beefy.finance

This is a multichain yield optimizer that automatically chooses the best yield farming opportunities for its clients. This way, users stake their holdings into yield farms, then the platform autonomously reinvests these holdings into the best yield farms for maximum gains. No input is required from the user to exponentially increase their investment gains. It can be thought of as a digital vault. What’s more, they have a variety of token options to invest in – from new, high-risk releases to known tokens which carry less risk.

- Curve

This is a decentralized exchange platform that runs on Ethereum and Polygon. Like Uniswap, it runs on the AMM model. However, users of Curve can only exchange stablecoins on the platform. The Polygon part of the platform sees daily trading volumes of around $20 million, but it is growing rapidly. By providing liquidity to the platform, users also stand to earn impressive stablecoin returns.

- Polymarket

This is a betting site that allows users to speculate on the outcomes of real-world events. Though it is built on Ethereum, it utilizes Polygon technology which allows its transactions to be processed on sidechains, thus reducing their cost and increasing their speed.

Users of Polymarket can stake tokens and bet on outcomes of events such as elections, sports, and other current debatable events, provided their results can be verified by external sources. The platform is non-custodial, which means it does not benefit from user bets. Only those users who win bets receive crypto rewards.

- Dfyn

This is a multi-chain decentralized exchange hosted on Polygon. Like most other DEXs, it utilizes the AMM model. Notably, it is capable of plugging into liquidity pools of multiple chains. This allows its users to trade assets seamlessly from a variety of blockchains. It stands out from other popular DEXs in its high-speed transactions, zero gas fees, and enabling transactions across multiple chains.

Conclusion

Polygon is a blockchain that was built as a layer 2 solution to Ethereum’s main shortcomings, which were its slow transaction speeds and high gas fees. By utilizing parallel side chains that connected to the main network, Polygon was able to reduce congestion on the main network. This helped it achieve speeds of up to 10,000 TPS and gas fees at a fraction of a dollar. For these reasons, Polygon positioned itself as a popular destination for dApp developers.