Employment figures are some of the most-watched in the forex market given their impact on trader’s sentiments consequently price action. The GBPUSD is one pair that reacts strongly to employment and unemployment data from the UK and the US as it paints a clear picture of how the two economies are doing.

Understanding employment figures and their impact on the pound and dollar sentiments is crucial for anyone looking to profit from price swings that come about on the GBPUSD. The Non-Farm Payroll report, The ILO unemployment rate, and Claimant Count Change are the most tracked jobs data report while trading the GBPUSD.

Non-Farm Payroll (NFP)

The NFP is an important jobs data report that gauges the number of paid workers that enter the US economy in any given month. The report does not consider people who find jobs at farms, government offices, or private households.

It is one of the most tracked reports as it paints a clear picture of how the US economy is doing, consequently impacting traders and investor’s sentiments on the dollar. The result is usually wild swings on the GBPUSD pair.

Analyzing the NFP

The report is released every first Friday of a new month, painting a picture of the number of new jobs added to the US economy in any given month. When the print from the NFP report is higher and above estimates, it signals economic growth thus more job additions. The addition of more people into the labor market is a good sign as most of them end up having some income, consequently fuelling consumer spending.

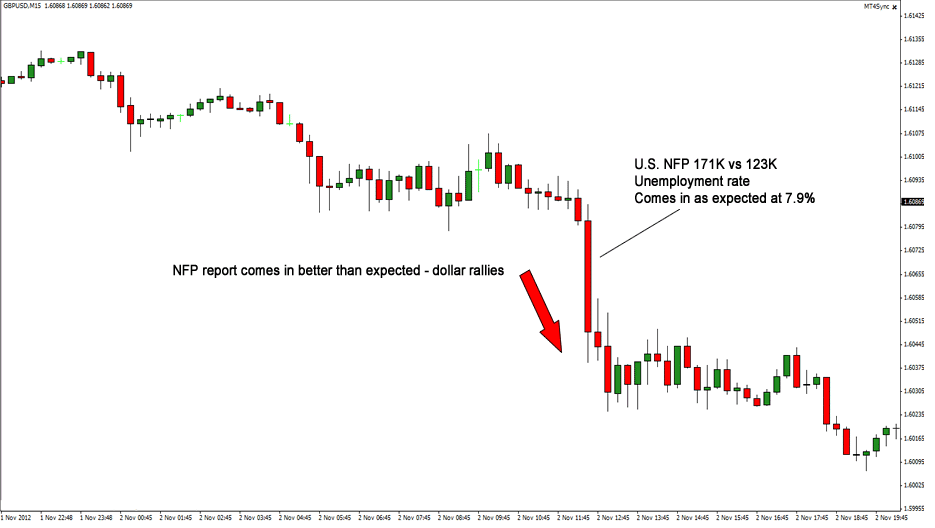

GBPUSD traders look for a positive addition of more than 100,000, as it is interpreted as a positive for the US dollar. A higher NFP print often results in the strengthening of the dollar, sending the GBPUSD lower.

Whenever the NFP print misses estimates, the same is seen as a negative for the US economy interpreted as a contraction. It is never a good sign and often causes weakness on the dollar resulting in the GBPUSD rallying.

Whenever the print comes in line with estimates, it can also trigger wild swings on the pair. In most cases, market players turn to subcomponents of the report to try and gauge the state of the US economy. Some of the sub-components include the unemployment rate.

If the unemployment rate in the month increases, the same is seen as bad for the economy and often causes weakness in the dollar resulting in an uptick in the GBPUSD exchange rate. A decline in the unemployment rate signals more people have jobs, thus good for the economy given the long-term impact on spending. The net effect is usually a strengthened greenback that sends the pound dollar pair lower.

Manufacturing payroll is another subcomponent that traders pay close watch to when the NFP comes in line with estimates. A higher print on this front is positive for the US economy, known to inspire dollar strength.

How to trade GBPUSD on NFP

The NFP report is released at 8:30 a.m. every first Friday of the month. Given the wild swings that accompany the report, it is important to be extremely cautious while trading the GBPUSD heading into the report.

The best way to play the NFP is to wait for up to 15 minutes after the report is made available for the market to first digest the information and dust to settle. Once the initial swings have occurred, a dominant trend will occur depending on how market participants interpret the print.

In case of a strong print with all sub-components signaling economic growth, the dollar will often strengthen. The net effect is usually a slide in GBPUSD price. Therefore, the idea is to wait for the market to digest the information, and once a dominant trend emerges after the wild swings have settled, enter the trade in the direction of the trend.

The ILO unemployment rate

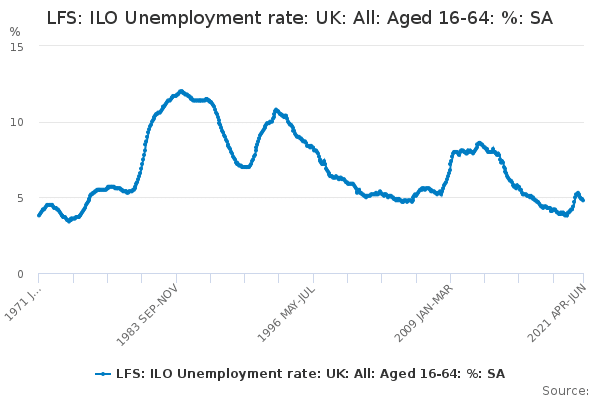

In the UK, the ILO unemployment rate is one of the most followed data for gauging how the labor market is doing. It is released after every three months and tries to paint a picture of the percentage of the labor force that does not have a job. The rate rises and falls depending on the prevailing economic condition.

The ILO unemployment rate tends to increase whenever the UK economy is in poor shape, signaling more people are without jobs. The net effect is usually a slide in consumer spending power interpreted as a negative for the UK economy.

In case of a higher ILO employment rate than anticipated, the British pound tends to weaken against the dollar, consequently lowering the overall exchange rate. Similarly, whenever the ILO unemployment rate declines, it signals a decline in the number of people without jobs.

The same affirmed growth in the UK economy interpreted as a positive for the pound. The net effect is usually the pound strengthening against the dollar, consequently sending the GBPUSD rate higher. In this case, traders and other market players look to enter long positions on the pair.

Claimant Count Change

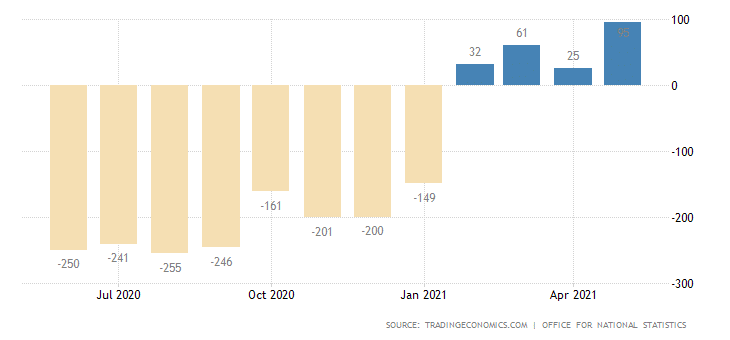

Claimant Count Change is another important economic release known to have a significant impact on the GBPUSD pair. The monthly data provides hints on the number of employed people in the UK during a given month.

A rising trend in the data signals more jobless people in the economy, which indicates weakness in the labor market, known to affect consumer spending and economic growth negatively.

Therefore a higher than expected reading on Claimant Count Change is negative for the British pound. In this case, traders should look to enter short positions on the GBPUSD pair as the pound often comes under pressure against the dollar.

Additionally, with lower than expected print signals, more people are getting jobs hinting at UK economic expansion. Such a print often positively impacts the pound, which strengthens against the greenback, consequently sending the GBPUSD higher. Market participants use this opportunity to enter long positions.

Bottom line

Employment figures are some of the most tracked information while trading the majors. In the case of the GBPUSD, the Non-Farm Payroll report, ILO unemployment rate, and Claimant Count Change tend to be the center of attention.

Any print that signals the addition of more jobs and a decline in the unemployment rate tends to impact the affected currency positively. A print signaling job losses and a spike in the unemployment rate tend to cause dollar or pound weakness.