Planning is crucial in the forex market. While the focus is usually on technical and fundamental analysis to pinpoint ideal entry and exit points, it is also important to plan which trades to take and which to avoid. Consequently, the planning aspect should always focus on the amount of risk on the table and the potential rewards.

What is the risk-reward ratio?

Simply put, it is the amount of risk that one must absorb or contend with to be able to accumulate a given reward. While trading the forex market, there is a degree of risk that one must absorb to generate desired returns.

The risk-reward ratio affirms the difference between when one opens a position in the currency market and is likely to be stopped out or take profit. Consequently, the ratio makes it easy to assess the probability of making a profit or incurring a loss.

Given the amount of liquidity and volatility in play, there is always the risk of losing money while trading risky markets such as forex. The fact that this market is affected by several factors not limited to economic indicators causes significant price swings during the trading day.

In addition to the market that one decides to trade, certain trading strategies also expose traders to significant risks in the market. For instance, scalping, which entails opening and closing positions in minutes to squeeze in small profits, exposes participants to substantial risks.

Partly his is because one looks to profit from when the market is extremely volatile, triggering extreme price swings.

Calculating risk reward

The risk-reward ratio is arrived at by first setting up the amount of profits one is looking to accrue in a given trade, as well as the amount of losses one’s willing to tolerate in a given setup. While trading manually, it is important first to identify the amount of risk to take in a position as well as the reward

Consequently

While calculating risk-reward, there are three possible outcomes; risk being greater than reward, the reward is greater than risk, and finally, risk and reward being the same. For a profitable and long-lasting trading career, it is important to ensure the risk is always smaller compared to the potential reward one is likely to accrue

Consider opening a position on EURUSD and set a profit target of 100 pips from the entry point and a stop loss of 50 pips. What this means is that you are willing to risk 50 pips to gain 100 pips on the trade

The risk-reward ratio, in this case, will be 50:100, which amounts to a 1:2 ratio. For every dollar risked, there is always the prospect of doubling the amount on a trade going in one’s favor.

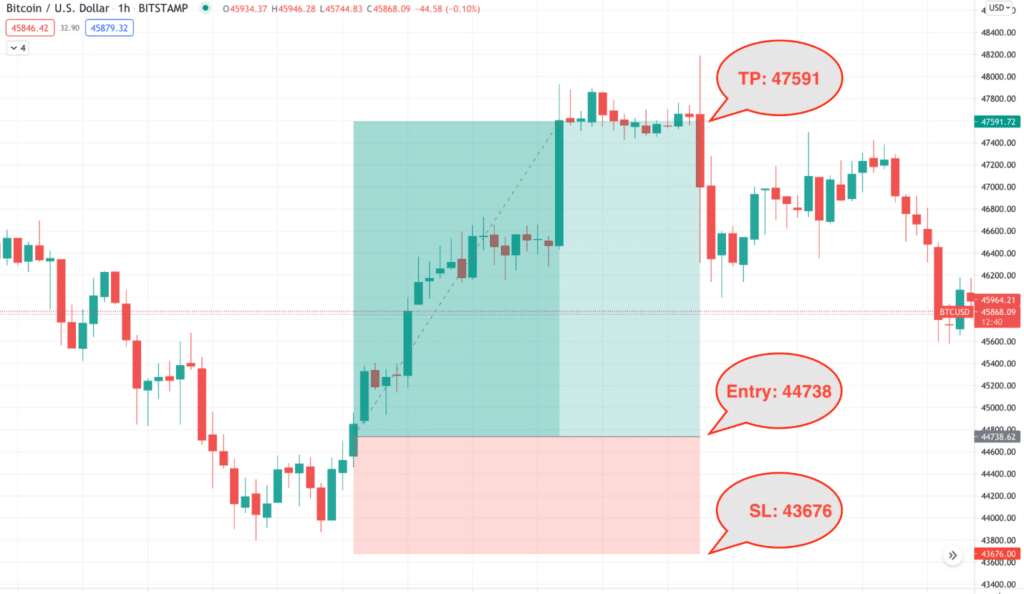

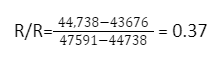

Consider the BTCUSD chart below, whereby a long position is triggered at $44,738 and a take profit level set at $47,591.

Similarly, a stop-loss order is set at $43,676. In the setup above, the risk-reward ratio will be:

In this case, the risk-reward ratio is quite low. In general, a good ratio would fall somewhere between 1 and 0.25.

The best risk-reward ratio

While trading highly liquid and volatile markets such as forex, the risk should never be greater than the reward. This is the only way to protect the capital from the extreme swings that come into play and stay in the game much longer.

Consequently, a good risk-reward ratio ensures the amount of loss one is likely to incur is much lower than the profits up for grabs. For this reason, professional traders settle for risk-reward of 1:3. A 1:3 ratio suggest that for every $1 that one is risking, there is a possibility of earning $3

In some cases, some traders deploy a much lower risk-reward ratio of say 1:1, which simply implies one is risking $1 to make $1. With such a ratio, one is merely risking the same amount as the amount of profit they would like to earn. Such a setup can go either way, whereby one can double up their returns or lose their entire risk amount.

The disadvantage of relying on a much lower ratio is that it leaves one susceptible to losing trades. The fact that emotions are part and parcel of trading can result in one closing position as soon as a loss is incurred without letting the trade play out.

Consequently, the ideal ratio will often come down to ones’ trading experience as well as style and strategy in play.

Importance

Knowing outright the risk-reward before opening a position is crucial. For starters, it makes it easy to determine in advance the amount of money one is likely to lose on trades, making it easy to close a position before too much damage is caused.

Regardless of how experienced one is, the risk of losing money is always there while trading currency pairs. Therefore, staying ahead of the market in knowing the optimal risk to tolerate is crucial to staying in the game longer.

Having a ratio in mind can also go a long way in helping identify an ideal entry point and where a stop loss and take profit order will be.

Bottom line

While a trading strategy is an important ingredient to a successful trading career, it is not enough to bring in consistent profits. Knowing and sticking to a good risk-reward ratio can make a big difference in being a successful forex trader. Conversely, the ultimate goal should always be about ensuring risk is kept low while taking optimum profits in any trade setup.