Hong Kong has been in the news over the past couple of years as mainland China asserts more dominance in the region. Hong Kong is officially known as the Hong Kong Special Administrative Region (SAR) of the People’s Republic of China (PRC). Historically, it was a British Empire colony, and because of its geographical location, it became a major hub for economic trade. It has a separate economic system from that of mainland China under the principle of ‘one country two systems.’

Due to its emergence as a major global trade centre and because of its capitalist economic policies, Hong Kong per capita income is among the highest and gets top ranks for the human development index. Given its importance in global trade, it ranks in the top 10 countries in both imports and exports. As a result, its currency, the Hong Kong Dollar (HKD), also becomes critical to the global economy. In fact, HKD is the 8th most traded currency in the world.

Currency crisis and introduction of the peg

Hong Kong achieved this level of economic dominance and prosperity after decades of high growth. In fact, it is among the famous ‘Asian Tigers’, a group of four Asian economies that saw rapid growth. In the 1970s and 1980s, the Hong Kong economy was still struggling. Given a significant part of its economy was based on global trade, currency played an important role.

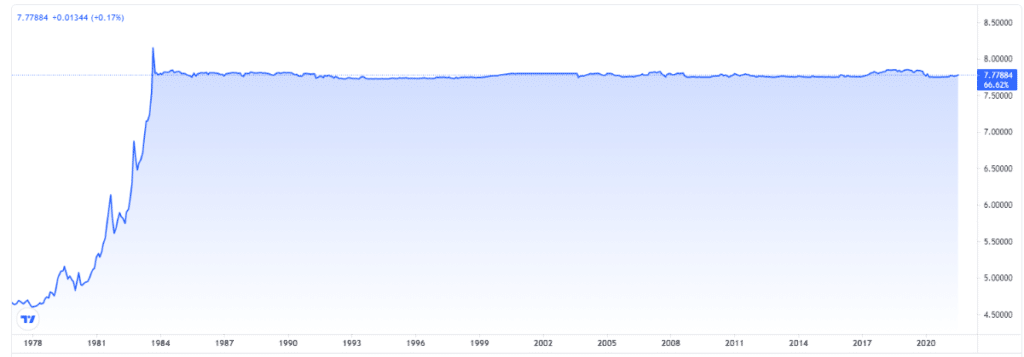

At that time, there was still a lot of uncertainty over the transition of Hong Kong from a British colony to a China administered reason. As a result, there was a panic selling of the Hong Kong dollar, and it reached an all-time low of 9.6 USDHKD in September 1983.

This was a meltdown, especially given USDHKD was trading at just 6.5 at the start of the year. Locals lost trust in the currency and refused to accept HKD notes. Given the public unrest, the Secretary of Finance, Bremridge John, introduced a USDHKD peg the same year in October.

This meant that the USDHKD would always be at a fixed rate. While the peg was introduced at 7.8 USDHKD, since 2005, it has been allowed to trade in the 5 cent range in either direction that is between 7.75 and 7.85.

How to maintain a peg in free markets?

The currency rate is usually determined by demand and supply. So, if one wants to artificially control the currency, they will have to artificially manipulate the supply and demand. The Hong Kong Monetary Authority (HKMA) does this job by buying and selling HKD held in reserve by the banks.

For example, there are sudden capital flows out of Hong Kong; this would mean a drop in demand for HKD, and consequently, it’s weakening. In this case, the HKMA will step up and buy the HKD in banking reserves. This will lead to a drop in banking liquidity, forcing the market to push up the interest rates due to a lack of money supply. The higher rates then will make investments in Hong Kong more attractive, which will attract capital flows, thus reversing the earlier move.

Taking the opposite case, if there are sudden capital inflows, the USDHKD rate might see sudden depreciation. To offset this, the HKMA will sell HKD back to the banks. Banks essentially will be sitting on top of excess liquidity. To get rid of these excess funds, they will be forced to lower the rates. Once rates fall, investments in HKD will become less attractive and thus lead to outflows.

While this process sounds simple, it is, in fact, a massive undertaking. This becomes especially difficult as there could be long periods of sustained inflows or outflows. To counter this, the HKMA might have to buy or sell large amounts of HKD. The HKMA is amply prepared to meet this challenge. At the time of writing, the HKMA is expected to have a war chest of nearly HKD 4 trillion, which is equivalent to $570 billion. This is also one of the world’s largest reserves of foreign exchange, and it shows both Hong Kong’s preparedness and ability to defend the USDHKD currency peg at 7.80.

Economic implications of the currency peg

If you have studied international economics, you might be familiar with the concept of the ‘Impossible Trinity’. The ‘Impossible Trinity’ dictates that it is impossible to have the following three things at the same time – a fixed exchange rate, free capital flows, and an independent monetary policy. As we saw above, Hong Kong already has the first two attributes, which means that it is impossible for Hong Kong to have an independent monetary policy.

This is true in practice as well. Since the HKD is pegged to the USD, Hong Kong’s monetary policy, in fact, shadows that of the US. So, it adjusts its benchmark interest rates to match the changes made by the central bank of the US, the Federal Reserve. It cannot set the rates as per its domestic economic needs but is compelled to follow the US rates, thus giving up its monetary independence.

While this might sound like a negative impact of the peg, there also have been several positive implications. The stable exchange rate makes Hong Kong an ideal investment destination as there is no uncertainty over currency rate fluctuations.

The Asian currency crisis in 1998 brought about serious turmoil in most major Asian markets. However, Hong Kong was relatively much better off as its currency was almost completely immune from any volatility. It was also spared any major shocks during the 2003 SARS outbreak despite the

The currency peg brings a mix of advantages and disadvantages to the Hong Kong economy, but overall it has worked well so far.