Vigorous EA scalps EURUSD with an average trade length of two hours. The robot trades an average of 11 times in a day and has been backtested in the market for a significant period. It comes with verified records on Myfxbook that we use in our analysis to predict if the system is profitable for trading.

Features

The robot has the following features coded in its algorithm:

- It comes with backtesting results that have a 99.99% modeling quality for the past 21 years

- Scalps the markets with super quickness

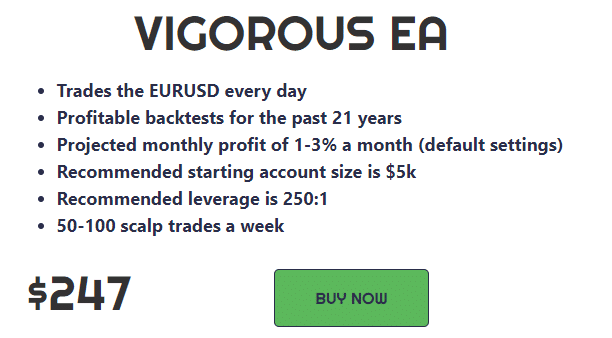

- Projected monthly profit is 1-3% with the default settings

Strategy

The developer fails to provide us with enough information on the strategy of the expert advisor. All we know is that it scalps the market making an average of 11 trades per day on EURUSD. The robot uses the risky grid trading strategy that opens orders in the direction of the initial trades if it enters a negative territory. The mean trade duration is 4 hours and 25 minutes which shows a day trading approach. The developer states that the grid methodology is only active when there is a trend.

How to start trading with Vigorous EA?

After purchasing the trading robot, the developer will send over the ex4 file at your email ID. You have to enable auto trading in the meta trader platform and place the robot in the experts’ directory. Afterward, drag it on one of the charts to begin trading.

The developer suggests starting with a minimum account balance of $5000 and uses a leverage of 1:250 on the account. Both the quantities are pretty high. No further information is present on the settings and recommendations, for eg., the type of broker, requirements of VPS, etc.

The robot is available for $257 for those who’d like to purchase it.

Backtests

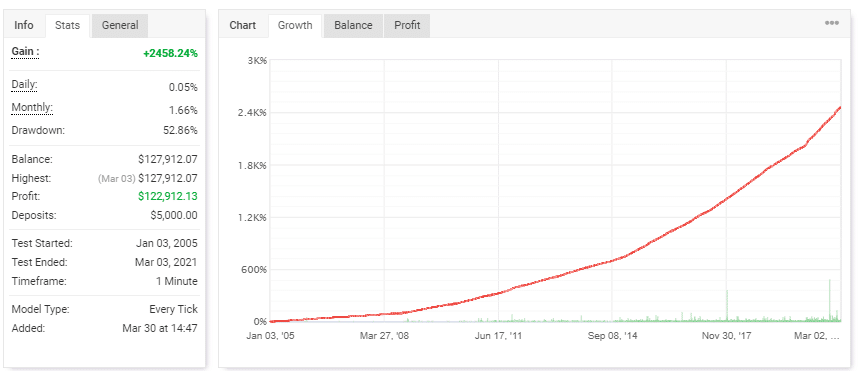

Backtesting results are available and tracked via my myfxbook, showing performance from January 3, 2005. The robot provides a monthly gain of 1.66%, with a drawdown of 52.86%. The value of drawdown is significantly high, meaning that the account loses much of its initial value before giving any profits. It had a winning rate of 75% with a profit factor of 1.63. The average winning trade was 6.43 dollars, while the loss was 112.14 dollars.

Verified Trading Results of Vigorous EA

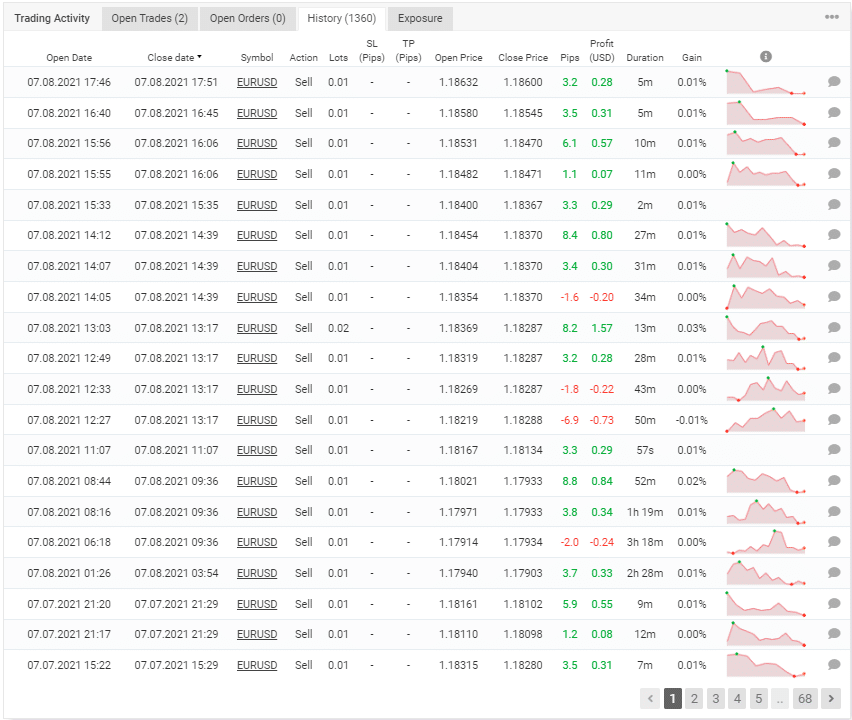

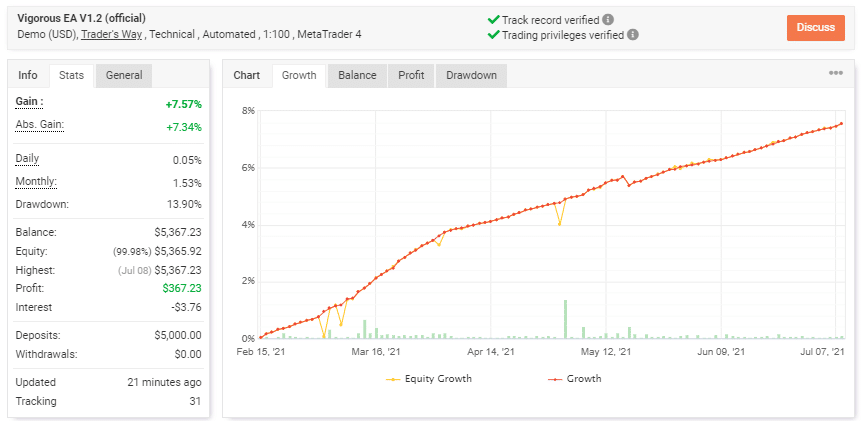

Verified trading records or track on my Facebook, which shows results from February 15, 2021, till the current date. The performance is only available for a demo count, which raises many red flags for the system as virtual portfolios do not respect real market liquidity and slippage. Nonetheless, the system shows a similar winning to it compared with the backtesting results of 71% with a profit factor of 1.49. The average trade duration is a bit more at 4 hours and 25 minutes. There were a total of 1358 trades, with 22.33 lots traded. The best trade tanked in $116.37 while the worst one was -$22.73. There are frequent drops between equity and balance curve which confirms the use of grid trading strategy.

Interesting Facts

The overall output of the robot, in contrast with the drawdown, is extremely low. As the expert advisor uses a risky trading strategy, it is possible to witness the complete liquidation of your trading portfolio. On a real account, the difference in performance can be even more. Other grid trading systems in the market are much more profitable and can be a priority.

Is Vigorous EA a viable option?

The Vigorous algorithm is not a viable option as it does not provide us with real performance statistics. It takes its place among those robots that only perform on a demo portfolio and fill in the live accounts. It might be due to this reason that the developer does not share any actual results.

Advantages

- Backtested for more than 21 years

Disadvantage

- Grid system which can cause margin calls

- No transparency of developers

- Performance is not available on a live account

Conclusion

Doing a deep analysis of the trading system, we conclude that a Vigorous expert advisor is extremely risky as it has a high drawdown value. It can easily cause margin calls onto your account by opening a basket of orders in an unfavorable direction. The trading strategy is not good enough to produce healthy gains.