Waka Waka EA is an advanced grid system that has traded live for a long time. The vendor explains that she created it to take advantage of inefficiencies that occur in the market. The dev guarantees that the EA is not a simple “hit and miss” tool, which survives by using grid. It uses “real market mechanics” to make profits throughout.

This algorithm was written by Valeriia Mishchenko. She is a resident in Russia and is also the creator of Night Hunter Pro. Nothing else is said about her professional background on MQL5.

Features

The robot comes with a variety of features, which we have listed below:

- Only a single chart is required to trade all symbols.

- Multiple currency pairs are supported: AUDCAD, AUDNZD, and NZDCAD.

- It’s very easy to use.

- The recommended timeframe is M15.

- You don’t need to adjust GMT to use it.

- A hedging account is required.

- It should run on a VPS constantly.

- It’s not sensitive to spread and slippage, but you are advised to use a good ECN broker.

How to start trading with Waka Waka EA

The recommended leverage for a $6000 account is 1:30, while a $1000 account needs a 1:100 leverage. Waka Waka is a grid-based system. This means that the robot tactically maps out entry and exit orders at predetermined intervals from the current market price. By doing so, it accounts for all potential breakout cases, ensuring that a pending order will be prompted to enter trades despite the direction of a trend. The robot costs $699, and a refund policy is missing.

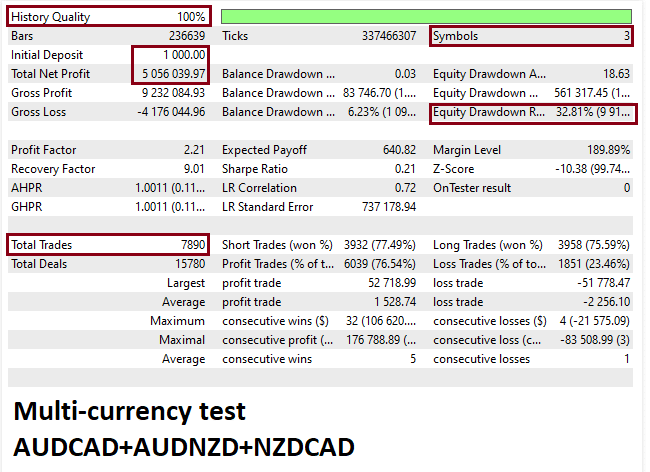

Backtests

This backtest report indicates that the system was tested on historical data using a capital of $1000. Consequently, it carried out 7890 orders after trading on the AUDCAD, AUDNZD, and NZDCAD currency pairs. The profitability rate was 76.54%, which was equal to an income of $5056039.97. The drawdown (32.81%) was equally high, an indication that risky trading was used. So, the robot was likely to end up with losses rather than profits, as illustrated by an average profit trade of $1528.74 compared to an average loss trade of -$2256.10.

Verified trading results of Waka Waka EA

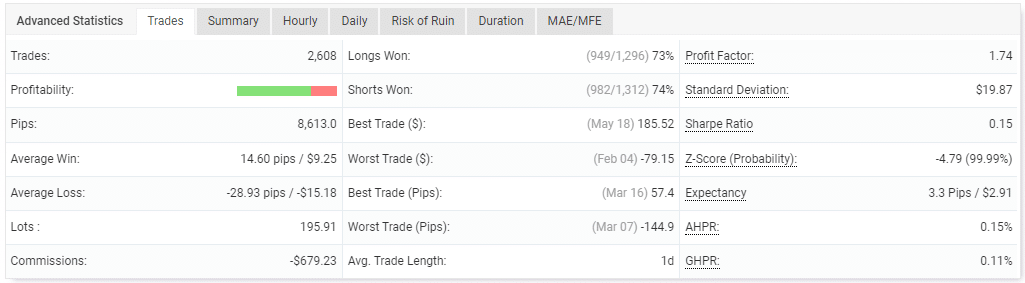

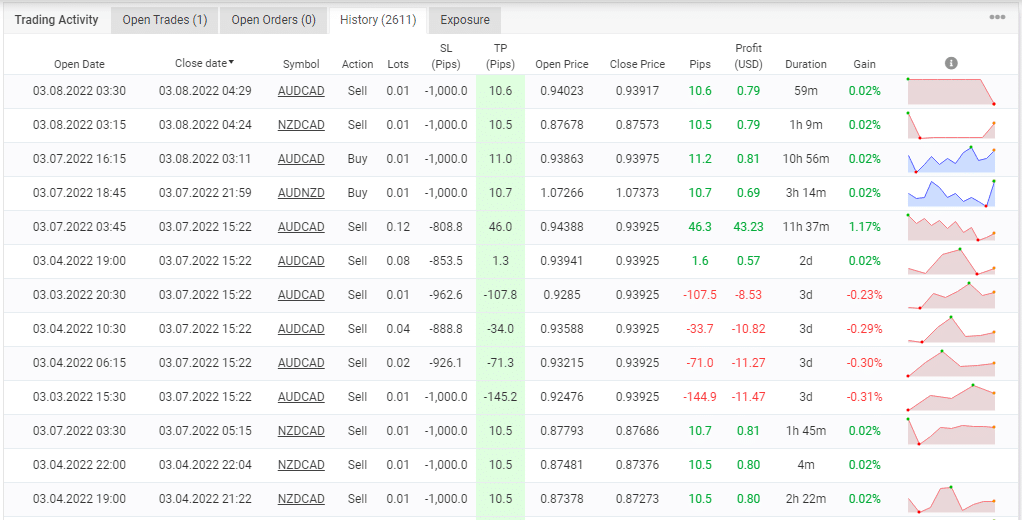

Waka Waka EA has traded on the above account since June 4, 2018. The revenue realized from the 2608 finalized trades is $7589.07. The monthly profit is 8.51%, while the daily profit is 0.27%. The user has taken out $4352.41 from the account.

There are win rates of 73% for long positions and 74% for short ones, along with a profit factor of 1.74. The best trade has reported a profit of $185.52, and the worst one has led to a loss of -$79.15. We have an average trade length of 1 day, and the pips won so far are 8613.

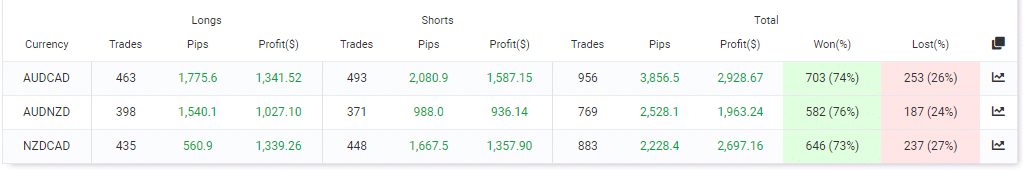

All the currency pairs have generated significant profits for the account.

The EA placed some grids of orders and increased lot sizes to recover after losses (Martingale). The targets set for SL were quite high.

February is the most profitable month this year so far.

Customer reviews

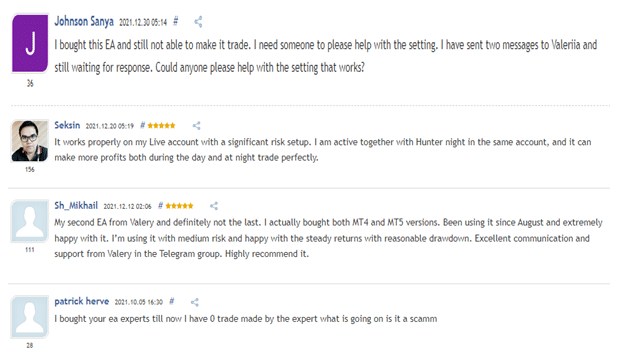

There are about 15 customers who have provided their opinions about the EA. It appears that they love the product, having given it a 4.31-star. From the testimonials below, you can see that the system works properly on a live account and produces steady profits with reasonable drawdown for some users. However, there are those who complain about the system’s inability to make trades.

Is Waka Waka EA a viable option?

Advantages

- Positive customer feedback

- Live trading stats and backtest results are provided

Disadvantages

- Grid and martingale strategies used

- Poor risk/reward ratio

- Expensive pricing

- No money-back guarantee

Wrapping up

The devs are transparent about the robot’s performance as they readily show us the outcomes it produces in the live market. Clients are also happy with the product, a sign that it might be reliable. However, grid and martingale strategies are used. These approaches are innately risky and may put your capital at risk of loss. The EA is costly, and you won’t get your money back in case it doesn’t work for you.