Wondering how to get one step ahead in the market? Are you a beginner and struggling with making decisions on a daily basis? Trading signals are here to your rescue! Here is a simple guide to Forex Trading signals so you can learn what they are and how you can use them to maximize your profits. Read on!

What is a Forex Trading Signal?

As the name suggests, forex trading signals are essential ‘trade ideas’ that advise you where to invest. The signals provide you with suggestions to enter a trade at specific prices and times. These signals may be generated by either experienced analysts or automated Forex robots. Trading signals really push forth your trading strategy. They are published through a designated forex signal trading service and in most cases, you may need to pay a nominal fee. You can find these signals from a variety of sources, through email, text messages, on websites and, even on applications made exclusively to generate trading signals. The applications make use of sophisticated charts and graphs to communicate signals to you and make them easier to decipher.

Types of Forex Trading Signals:

Forex trading signals are available in a few different formats and understanding the difference between various signals is crucial to earning optimum profits in the market.

• Manual and Automated Forex Signals

In case of manual signals, a professional trader manually informs you as and when a strong signal appears through the chosen source of communication. In contrast, automated signals are sent automatically by machines or applications when certain pre-mentioned conditions appear in the market. Manual signals tend to be more time-consuming as the trader has to go through different platforms for hours on end in search of the right signals.

• Paid and Free Forex Signals

You need to pay a certain fee to the signal provider to access paid signals whereas, on some platforms, you may have free and easy access. As a best practice, always look for platforms where customer ratings have mentioned their experience and there is an option to contact the service providers.

• Entry and Exit Forex Signals

In this case, you have access to both entry and exit signals, as per your requirements. Entry signals tell you when to enter a position and stay in it and exit signals tell you when to close a position and exit the deal. You should go for signals where the exact time of entry/exit is given.

Choosing Forex Signal Providers

It can be a tedious task to find the right forex signal provider. With varying investment needs, every investor needs to analyze their portfolio and find a signal provider who works the best with their objectives. There is also a growing trend of fraud in the market and you must take precautions to save yourself from getting duped. Here are a few basic things you need to consider while choosing the right signal provider:

- Compare: Use all the resources available at your disposal and compare various signal providers to see which one fits right. Also, see whether you want paid signals or free signals.

- Reviews: Rely on reviews of various users or clients of the particular signal provider to know their experience and about the strength of signals provided.

- Past performances: check the past performances of different signal providers and see how accurate their signals have been.

Reading and Using forex signals

Although it might seem daunting to read and use trading signals, it can be learned with a little bit of practice and background knowledge. Some things you need to keep in mind about forex signals are listed below –

- When a signal becomes available to you, it mentions the instrument you need to invest in – it can be a currency or any precious metals or even commodities.

- You need to know the set of actions you need to take regarding the signal, i.e. whether you need to buy it or sell it.

- Understand the nature of the signal, whether it is active or inactive. Closed signals are those which have already passed.

- Check if the entry/exit price is mentioned. This is the price at which you need to enter or exit a trade.

- On forex signal provider platforms, you have the option to set price limits beyond which the trade will automatically close (stop loss). This prevents you from Incurring major losses in the game and helps you make profits consistently. The same is available for profits too – the trade closes once you reach that profit mark.

- The stop loss and take profit options are available so that you neither incur huge losses nor lose an opportunity to earn any profits at all once the deal is closed. Timing is very important while handling trade signals.

- There are many tools like graphs, charts, etc., available to help you understand the signals. You can always refer to available sources to see how to make the best use of a signal when it becomes available.

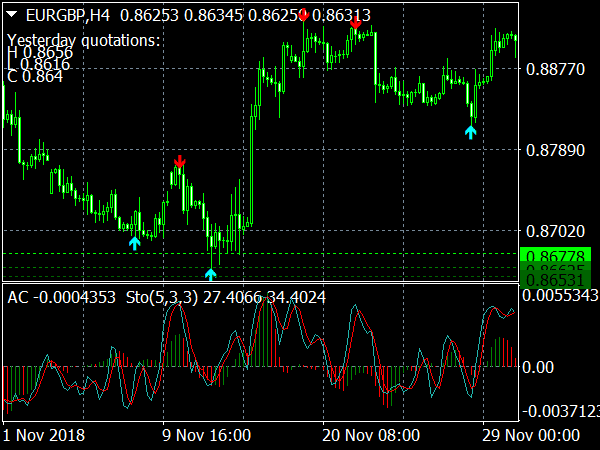

The graph above is a good example of a trading signal – it mentions the currency pair to be invested in (EUR/GBP). It also mentions the high, low, and close price. You can also see the behavior of the candles in the graph and different points where it would be optimal to enter the market. You can see how easily you can use this information to make more informed choices in the market.

Conclusion

Forex Trading signals come as a blessing in disguise for traders of all levels. By knowing when and where to invest your money, you save both time and effort. It also takes away the emotions out of your investment decisions. The downside to this is that even though it helps you out initially, trading signals may actually take away the opportunity to rise the learning curve and master the nitty gritties of trading. To make the best use of trading signals, you need a signal provider that is skilled and credible. For a risk-free trading experience, always beware of frauds who claim to provide unrealistic signals. Always compare different signal providers – check customer reviews and past performances to analyze their authenticity. That being said, a powerful signal at your disposal is all you need to maximize your profits in the forex market.