What are Oscillators?

The term ‘oscillator’ refers to any tool that operates by creating a band of extreme values. They are a group of momentum indicators and function within the area created by a high and low marker. Once the oscillator sets the extremes, it creates a specialized trend indicator that registers any market fluctuations by oscillating within that range. Generally, oscillators take volume and/or price as variables in their operations.

The most popular oscillators available for technical analysis are Rate of Change (ROC), Relative Strength Index (RSI), Money Flow Index (MFI), and the Stochastic Oscillator. Traders can apply these to their trades to analyze and observe market situations which can help them form more informed decisions and improve their trading strategies. When used in conjunction with each other, oscillators give a comprehensive view of the market.

Characteristics of an Oscillators:

Oscillators exhibit different behavior and patterns for various market situations. Traders need to be aware of the following properties of oscillators to understand their signals.

- Divergence: Divergence occurs in an oscillator when the price or volume of the security moves in the opposite direction of the indicator. Under normal market conditions, the indicator and the asset’s price or volume move in the same direction as each other. This indicates trend reversals for securities.

- Midpoint Line Crossing: The midpoint line crossing is a significant marker for an oscillator. It usually functions within a range of 0 to 100. When it crosses the mark of above or below 50, it indicates a trend change for a security.

- Overbought Conditions: An asset is said to be overbought when it appears at a price above or higher than its fair price. Such assets are considered overvalued in the market.

- Oversold Conditions: An asset is said to be oversold when it works at a price below its fair price. Such assets are considered undervalued in the market.

Overbought or oversold assets are commonly followed by trend reversals to achieve their equilibrium prices. Investors need to know as and when securities are overbought or oversold since this decides whether the upcoming trend reversal will lead to an uptrend or a downtrend.

- Extreme Reading: The oscillators mostly remain within a range of 80-20 as high and low respectively. But these values can be crossed during strong uptrends or downtrends. The indicator registers them as overbought or oversold situations. But if the trends are lasting, traders need to readjust the overbought and oversold levels to make use of the oscillators.

Trading using Oscillators

- Rate of Change (ROC):

The ROC is an oscillator that calculates the percentage by which historical prices differ from current prices. While other oscillators have upper and lower limits, the ROC is simply plotted at a zero. It moves above or below the zero line when the price fluctuates for an asset. It is a good indicator to observe divergences, midline crosses and is also good for spotting overvalued or undervalued assets.

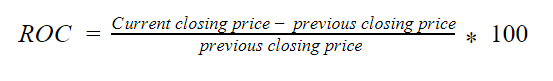

The formula to measure ROC is:

Upward movements denote uptrends while downward movements denote downtrends in the ROC. When the ROC moves below the zero with prices moving up, it is a bearish divergence. When the ROC moves upwards with falling prices, it is a bullish divergence.

- Relative Strength Index (RSI):

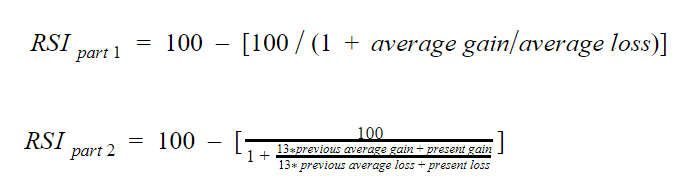

Created by J. Wilder, the relative strength index is an oscillator that is used to recognize uneven trend behaviors in an asset’s price chart. It is majorly used to spot trend reversals and identify the strength of a trend at a particular point of time. By default, The RSI is calculated for a 14-period average, traders can change the time period for their trading goals.

It is calculated in two steps. To calculate the average gain or loss, take the gain or loss values for the past 14 days and see how many days have resulted in higher closing prices and how many have resulted in lower closing prices.

One way to trade the RSI is to enter at low and exit at high RSI. Experienced traders always advise to enter the market when the RSI is at around 30 and exit it when it is around 70.

- Money Flow Index (MFI):

The money flow index or MFI is an oscillator used to check whether a security is oversold or overbought.

The money flow index measures the security’s price and the volume to check its pricing mechanism. Time is a critical variable for the MFI. It marks the extreme figures during a fluctuating market and registers any anomalies in the prices. This lets traders analyze the behavior of both present and future prices. It also helps determine how much money has flown towards or away from the asset. The MFI makes it easy for traders to read the market conditions and make informed decisions.

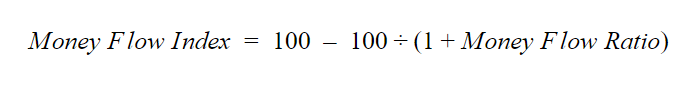

The formula for its calculation is as follows:

where,

- Stochastic Oscillator:

It is an oscillator that uses the closing prices of an asset to analyze its performance. It compares the current closing price to a range of past prices. It is majorly used to check for oversold or overbought signals.

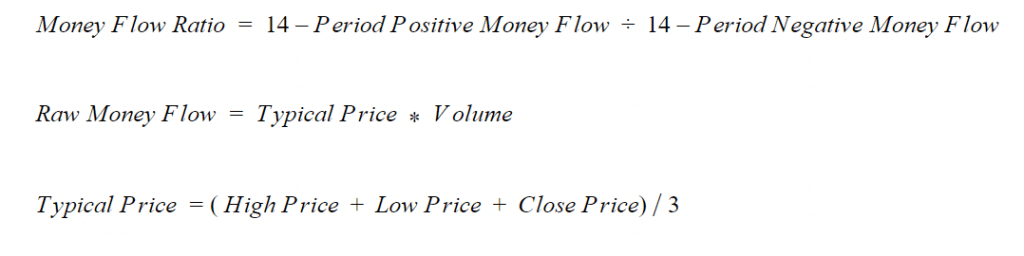

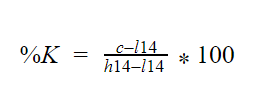

The formula to calculate the stochastic oscillator is:

where,

- C is the closing price.

- L14is the lowest price in 14 days.

- H is the highest price in 14 days.

Final Thoughts

Oscillators are a powerful group of tools for technical analysis. You can apply them to a variety of situations for thorough market analysis. Remember that no single oscillator gives a complete view of the market, you need to use them in combination with other technical and fundamental indicators for the most accurate results. Focus on healthy risk management and risk allocation with a diversified portfolio to prevent losses during trading.