With the expansion of cryptocurrencies to invest in, traders are continuously on the lookout for new tools that can help them spot crypto trends. When it comes to market capitalization and trading volume, Bitcoin is the first and most popular cryptocurrency in the world. These criteria are important since all cryptocurrencies trade against each other, and BTC.D can help you determine whether trading altcoins is more profitable.

What is BTC.D?

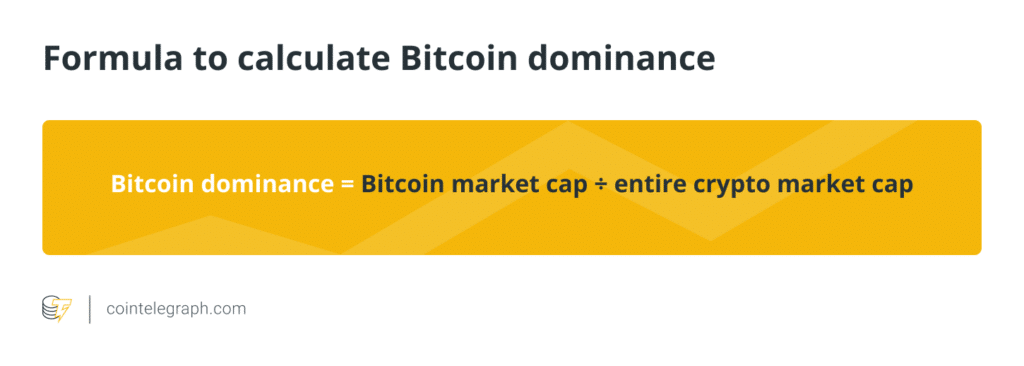

It refers to the ratio of Bitcoin’s market capitalization to the overall market capitalization of the entire cryptocurrency market. Market capitalization refers to the total worth of all the coins that have been mined so far in the case of a cryptocurrency like Bitcoin.

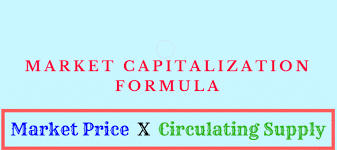

The market cap is computed by multiplying the current market price of a single coin by the number of coins in circulation.

Calculation and interpretation

It’s critical to understand money flow in order to manage your investments. It also allows us to forecast market movements.

- If the BTC.D rises, it indicates that money is entering the Bitcoin market.

- If BTC.D falls, it indicates that money is flowing into altcoins or stable coins.

- When the entire market capitalization rises, it indicates that more money is entering the crypto market.

- When the entire market capitalization falls, it indicates that money is leaving the crypto market.

How does BTC.D affect altcoins?

BTC.D has a direct impact on altcoins since it shows how much of the market’s trading volume is in BTC against how much is in altcoins. If BTC.D is rising, traders advise putting more of one’s crypto assets in BTC rather than altcoins. When BTC.D is down, traders advise holding more altcoins than Bitcoin.

The bear or bull market has a correlation with BTC.D. Bull markets can cause BTC.D to drop, as funds are often poured into altcoins at that time. In contrast, in bear markets, BTC.D may rise as traders withdraw their assets from altcoins and invest them into Bitcoin, which is a more reliable asset.

Some people argue that a lower BTC.D is a good thing since it indicates that the crypto industry is growing and that money is moving through a variety of projects rather than just Bitcoin. However, it’s worth mentioning that the total crypto market capitalization will include pre-mined and forked coins, implying that altcoin numbers may be boosted artificially.

It’s also worth noting that BTC.D can fall in value even if the asset’s price rises. This can happen when money pours into the crypto market, including Bitcoin; however, it’s possible that more money is flowing into altcoins than BTC.

Before making an investment decision, it’s usually a good idea to do some further research. While BTC.D may appear to represent the crypto market in a certain light, there are a number of aspects to consider in order to create an informed opinion.

How to trade Cryptocurrencies using BTC.D

To determine the strongest trend

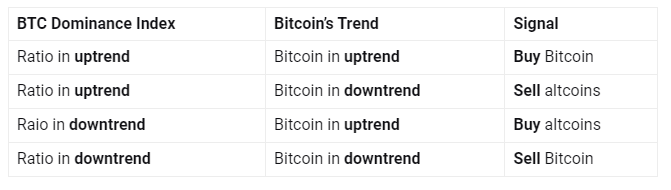

The BTC.D ratio can be used by traders to assess if Bitcoin is the stronger trend or whether altcoins have more potential. The BTC.D ratio determines which trend is likely to surpass the other, allowing traders to position themselves properly.

Steps

- Determine the BTC.D trend first. The index can be viewed using TradingView’s chart.

- Check the Bitcoin price trend over a similar time period.

- You can use the table below to help you figure out if you have a strategic bias.

Trading the extreme high and low readings

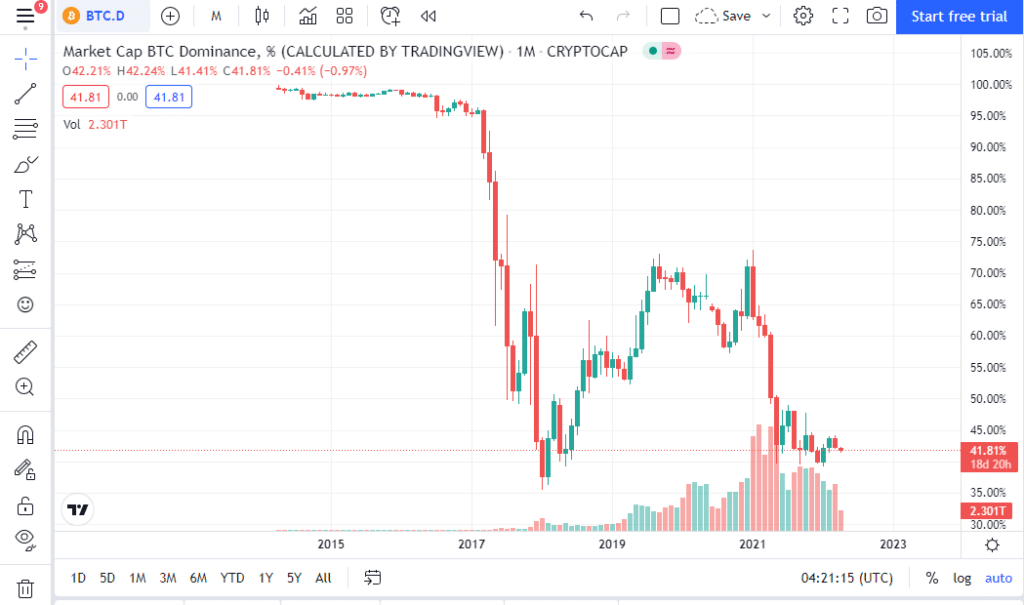

Before the introduction of altcoins, Bitcoin had a market dominance of over 90%. However, because of the prominence of altcoins in today’s market, Bitcoin’s dominance is unlikely to return to that level. But it’s impossible to say for sure because if more countries follow El Salvador’s lead and make Bitcoin legal tender, BTC.D might resurface.

In fact, as altcoin initiatives continue to achieve mainstream acceptance, BTC.D is more likely to hit new lows than new highs. As a result, traders should pay attention when BTC.D is approaching an all-time high, as this could indicate a good level of resistance for BTC.D. On the other hand, users should keep an eye on BTC.D as it approaches new lows and how the altcoin market reacts as a result.

History of BTC.D

Due to the lack of major competitors in 2013, BTC.D was 94%.

However, as additional altcoins were created in 2017, BTC.D began to shift and even fell to 85.4%. This time period marks the start of the altcoin season.

Later, in June 2017, it dropped sharply, reaching 40%. The big change in cryptocurrency liquidity as many individuals began to move to ERC-20 tokens was the primary cause of this massive decline.

In 2018, it fell to its lowest point of 32.85%. It was, without a doubt, the worst year ever for cryptocurrencies. As the price of Bitcoin fell, so did the price of other cryptocurrencies.

BTC Dominance rebounded to 70% in September 2019. It dropped again in May 2021 and has since then been ranging between 39% to 49%.

What are the differences between bitcoin and Ethereum dominance?

Ethereum’s market capitalization was approaching that of Bitcoin in January 2022, as both coins began to be involved in flipping. This word is used in the crypto sector when two or more cryptocurrencies’ market caps are approaching each other.

In comparison to Bitcoin, the market valuation of Ethereum surged dramatically in 2021. Many individuals believe that this huge increase reflects investors’ attempts to find alternative sources of profit.

Nonetheless, according to CoinMarketCap’s most recent data, Bitcoin’s dominance remains at 41.83% as of April 2022. At this rate, Bitcoin clearly outnumbers Ethereum, which only has a 19.6% market share.

Summary

The Bitcoin Dominance Index is a metric that traders may use to rapidly determine how valuable Bitcoin is compared to the rest of the digital currency market. It directly impacts altcoins since it shows how much of the market’s trading volume is in BTC against how much is in altcoins. You can use it to trade as long as you do in-depth research and employ other fundamental or technical analyses.