In forex trading, it is inevitable to make losses once in a while. It may not be plausible to make a fortune from single forex trade. However, it is possible – nay, more than likely, to make a career-ending loss in one trade. For that reason, it is important to know how to handle losses, lest you blow your account.

What is a drawdown?

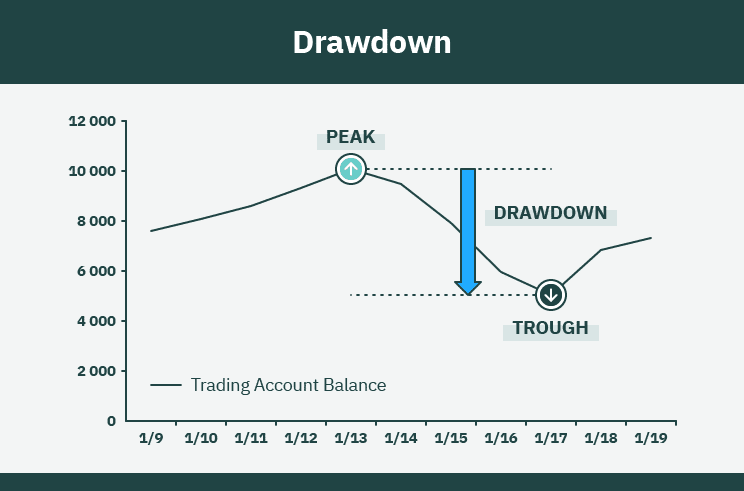

A drawdown is the amount of your account’s equity you have lost from a loss in the forex trade. Usually, it is obtained by calculating the difference between the peak of your account’s balance and its next trough. For a single position, a drawdown occurs when the currency pair’s price falls below your entry price if you’re long on the trade. Therefore, regardless of your trading strategy, a drawdown is bound to happen from time to time.

How to calculate a drawdown

The chart below shows what your account would look like after experiencing a drawdown. The first step in calculating drawdowns is to identify a peak where your account balance was highest and a trough where it hit a new low. If you subtract the trough from the peak, you obtain the drawdown. This can be expressed in monetary terms or in percentages.

For instance, from the above example, our account equity dropped from $10,000 to $5,000. This was a drawdown of $5,000. In percentage, this came down to a 50% drawdown.

Lessons learned from drawdowns

It is no news that drawdowns are undesirable to a forex trader. However, like every dark cloud with a silver lining, drawdowns can give you important insights into the forex trade.

First and foremost, they will show you whether your strategy is plausible in the long term. They could show you that you need to trade a different session or improve your risk management techniques. Usually, the bigger a drawdown you suffer, the harder it is to recover or break even. Therefore, the size of your drawdown will determine how long your account can survive. This way, you can plan how best to use that time to stage a recovery.

| Drawdown | Gain required to break even |

| 10% | 11% |

| 20% | 25% |

| 30% | 42% |

| 40% | 66% |

| 50% | 100% |

| 60% | 150% |

| 90% | 900% |

From the above table, we can see that in our scenario, we would need to make 100% profit from our remaining equity to recover from the 50% drawdown. In such a situation, most traders will result in overtrading in a bid to recover these losses as soon as possible. Other traders may choose to utilize high leverages so as to hit this 100% gain. However, that is a recipe for disaster.

Such emotional and rash trading decisions are the fastest way to blow your account. As any seasoned trader will tell you, after making a loss, this is the time to remain calm and collected. The best practice would be to adjust your risk management techniques accordingly and tweak your strategy where you feel improvements could be made. You may not break even, especially if the drawdown was significant, but you may increase your account’s longevity till you can turn a profit sometime in the future.

A career in forex trading is essentially a learning curve, and the best traders are those that learn from their and others’ mistakes. The drawdown may have been caused by a black swan event or a key economic release that was not factored into your strategy. In such a case, your strategy may not be the problem, but you will be wise not to leave positions open during such releases next time.

Classification of drawdowns

- Absolute drawdown

This is the difference between your initial investment and the account’s trough. For instance, if you initially invested $100,000 in your account, then it grew to $120,000 before dropping down to $85,000, your absolute drawdown would be $100,000 – $85,000 = $15,000. In such a case, the $120,000 would be referred to as your equity peak.

- Maximum drawdown

This is the difference between the equity peak and your account’s trough. Following the above example, the maximum drawdown in that scenario would be $120,000 – $85,000 = $35,000.

- Relative drawdown

Essentially, this is the maximum drawdown percentage. It is obtained by representing the maximum drawdown as a percentage of your account’s peak value. From our example, our relative drawdown would be:

((35,000/120,000) * 100) = 29.17%.

How to manage forex drawdowns

Reduce your risk

As a rule of thumb, you should never risk more than 1% of your account’s balance in one single trade. To understand why, consider two traders, each with a $1,000 account. The first trader takes on a 1% risk per trade while the second risks 3%. After a 5-trade losing streak, trader 1 will have a 5% drawdown while trader 2 will suffer a 15% drawdown.

Manage your emotions

Even after suffering a loss trading forex, you should never make rash trading decisions to recover your capital. Such decisions may include overtrading and overleveraging. Take time off if necessary until you can be objective about your trading decisions.

Set a drawdown limit

It is good practice to set a monthly drawdown limit, below which you cannot enter any more trades for the month. This helps you with discipline as you tend to be more careful with the trades you execute. You could adjust this to set weekly and daily limits according to your strategy.

Conclusion

A drawdown in forex happens when you make losses that eat into your account balance. To that end, drawdowns can be classified into absolute, maximum, and relative drawdowns. The bigger a drawdown you suffer, the more gains you’ll need to break even. The best recovery involves avoiding emotional trading, adjusting your strategy accordingly, reducing your risk, and setting monthly, weekly, or daily drawdown caps.