Spread betting is a form of forex trading whereby traders speculate on gains or losses of currency pairs. Like any other form of betting, spread betting earns participants winnings when the market movement favors their positions and losses when the market moves against their positions.

When spread betting, traders don’t own the assets they bet on. Typically, currency pairs with major pairs have tighter spreads and are charged lower transaction costs.

The key components of spread betting include three main elements. First, there’s the spread size which is the price paid for participating in the bet.

The spread is the difference between the selling price (bid price) and the buying price (ask price). Secondly, there’s the bet size which refers to the amount allocated for every point in market movement, and thirdly there is the bet duration, which is the length of time during which a position is kept open.

Example: Netflix spread bet

Let’s say that Netflix is currently selling at $405, and its buying price is $410. If we assume that you expect the stock to rise in the coming days, you buy Netflix shares for $5 per point at $410.

If Netflix’s stock price appreciates and you decide to take your profit when the price reaches $420, it means that the market will have risen from the previous price by 10 points. Therefore, you will make a profit of $100 (10×$10) before deducting other costs.

Strategies for spread betting

1. Reversal spread betting

This strategy is based on assessing the market to determine whether the current trend is likely to continue or change its trajectory. When you think that the market will continue gaining, you bet on a bullish trend.

When you think that the current market uptrend is likely to lose momentum and become a downtrend, you will bet for a bearish reversal.

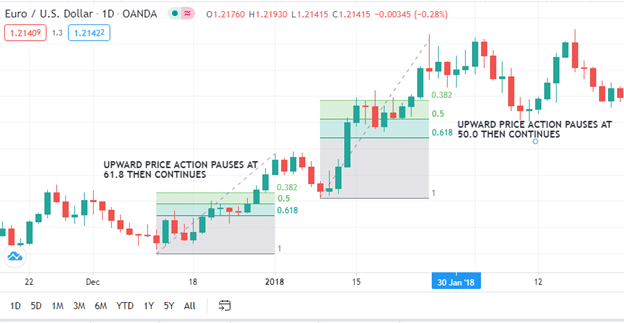

Traders place their entry points in positions against the current trend. One of the most effective technical analysis tools to use is the Fibonacci retracement tool.

With this tool, the most important levels are at 50.0%, 61.80% and 38.2% of the defined price swing. When the price hits any of these levels, it signifies an impending reversal.

2. Trading the trend in spread betting

In this strategy, traders must first find out if there is a current established trend and thereafter start trading in the direction of the trend. When trading with the trend, you are not restricted by the direction of movement.

All you have to do is to align your position with the trend’s direction, regardless of whether it is bullish or bearish.

Two of the most effective tools include Moving Average Convergence Divergence (MACD) and Simple Moving Average.

3. Breakout spread betting

This involves positioning yourself in preparation for the price to break out from some sort of consolidation. A breakout can result in a bearish or bullish move. The key to succeeding in trading breakouts is timing your entry point early enough to optimize your returns.

Risk management is also a key aspect of spread betting with breakouts. To minimize your potential losses, you should place stop losses at prices where you believe the established trend will lose momentum and reverse. A stop loss order essentially means that your broker will close the trade once the price reaches a specific price against your position.

We can tell when breakouts are imminent depending on the formation of consolidation patterns and price movements away from consolidation patterns.

Below are technical indicators that can help you evaluate a breakout.

Relative Strength Index – This indicator can tell you whether the currency pair has been oversold or overbought, using a scale ranging from 0 to 100. The two important reference points on the scale are 70, which is the threshold beyond which an asset is overbought, and 30, which is the scale below which it is said to be oversold. Therefore, whenever an indicator moves beyond these two levels, it signals that a breakout is imminent.

Moving Averages Convergence Divergence – Traders track the movement of the MACD line and find trading opportunities when the MACD intersects with the signal line for the currency pair.

Bollinger Bands – The narrowing of the bands enveloping the price signals an impending breakout.

Pros of spread betting

- No commissions are paid in spread betting.

- The profits made from spread betting are not subjected to capital gains tax.

- Spread betting allows you to hold a position regardless of whether the market is on an upward or downward trajectory. You can go long or go short, depending on the market condition.

- You can spread bet using margin.

- You can spread-bet 24 hours a day, seven days a week.

Cons of spread betting

- Spread betting is a high-risk investment that can lead to losing the entire sum invested if the market goes against you.

- Spread betting cannot be counted on as a long-term investment strategy.

- Spread betting markets are very volatile, making them hardly unpredictable.

- The margin of spreads in these markets is wider than standard market spreads.

Bottom line

Spread betting can be profitable if you have a good understanding of the market and how to integrate changing fundamental factors and technical analysis. It is a basic concept that beginners can easily understand. However, mastering the strategies requires practice and experience.