The EUR/CHF currency pair is driven by two separate currency pairs, namely EUR/USD and USD/CHF. For traders on the forex market, the substantial value of the Swiss franc cannot be ignored. In this article, we look at the factors that influence the EUR/CHF exchange rate and how traders can benefit from the stability of the Swiss franc.

What is behind CHF/EUR?

CHF stands for Switzerland’s Swiss franc, while EUR stands for the Euro, the currency of the European Union. The correlation between the two currency pairs, USD/CHF and EUR/USD, that drive CHF/EUR is more than negative 95%. This means that there is an inverse relationship between the two currency pairs. But, the strength of the currency pairs is much stronger than that of other pairs because of the close ties between Switzerland and the Eurozone.

Nevertheless, since Switzerland is independent of the European Union, it is immune to a large degree to the economic and political upheaval in that region. Since it amounts to a voluminous daily trade, CHF/EUR is one of the four traditional major currency pairs. In the forex market, the CHF/EUR currency pair is also called ‘Swissy’ or ‘Euro-Swissy’.

In the past two decades, the Swiss franc’s value has increased substantially against both the Euro and the US dollar. Lately, the monetary policies of the US Fed and the European debt crisis have further boosted the franc. Other than that, the stability of the Swiss economy and its deep integration with the Eurozone gives the CHF its safe-haven status.

Swiss Economy: A fortress for international investors?

In the financial world, traders see the Swiss Franc as one of the safe havens where they could park their money in times of trouble. One classic example of how investors see the Swiss Franc would be the financial crisis of 2007-08, which saw investors clamoring to buy the Swiss Francs. It has become even more popular due to its stability during the European debt crisis. This stability is a testament to the rock-solid financial system and the Swiss government.

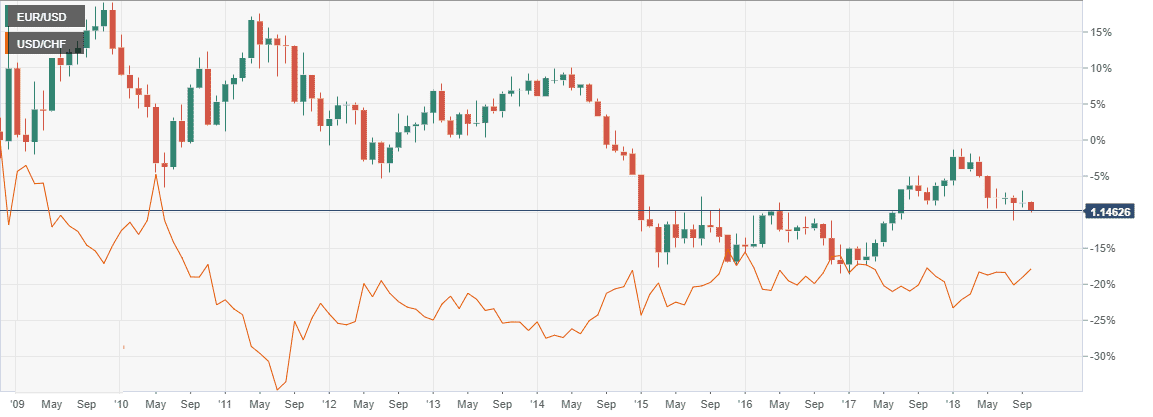

But, the stronger Swiss francs can also hurt the country’s exports. That is why in 2011, the Swiss policymakers capped the currency at 1.20 against the Euro in order to keep their exports competitive. However, this cap was once again removed in 2015. This led the Swiss Franc to soar to new heights.

Many traders and investors even experienced major losses. Even then, the Swiss franc is still seen as a safe haven by traders and investors, thanks to the strong financial system and robust economy.

What moves CHF/EUR?

Let us now examine some of the factors that drive the CHF/EUR currency pair rates. Switzerland has close economic and political ties with its neighbors of the Eurozone, and so any changes in the Eurozone will have ripple effects through the Swiss system as well.

Market Fears

The market sentiment and traders’ risk aversion can drive many to buy Swiss franc because of its safe-haven status during times of trouble. Traders use binary options, for instance, to speculate on the various outcomes. There are many forex currencies among such binary options that allow traders to remain flexible in the forex market.

Some of these are as follows:

- The U.S. dollar and Japanese yen (USD/JPY)

- The British pound and U.S. dollar (GBP/USD)

- The euro and British pound (EUR/GBP)

- The US. Dollar and the Swiss Franc (USD/CHF)

- The Euro and U.S. dollar (EUR/USD)

Simplicity is the main advantage of such binary options. A trader needs only to predict how a currency is going to move. Of the various options, the least volatile currency pair is the USD/CHF.

Market downturns almost inevitably lead to investors scampering for the Swiss Franc. In that, it is very similar to the Japanese Yen and gold, which are also stable assets where traders and investors like to park their money, knowing that it won’t lose value.

Some other factors that may trigger a movement of the two currencies can be the GDP of any of the two countries, national debt, unemployment data, and growth figures. Another factor that may influence the currency pair can be the announcements regarding monetary action by the US Fed as well as that by the Swiss National Bank.

SNB Policy Rate

There have been multiple factors that have changed Switzerland’s economic landscape ever since 2011 that led to a change in the monetary policies of the SNB. The expectations that the US Fed may hike interest rates in 2015 led to the weakening of the Swiss franc as well as the Euro against the US dollar.

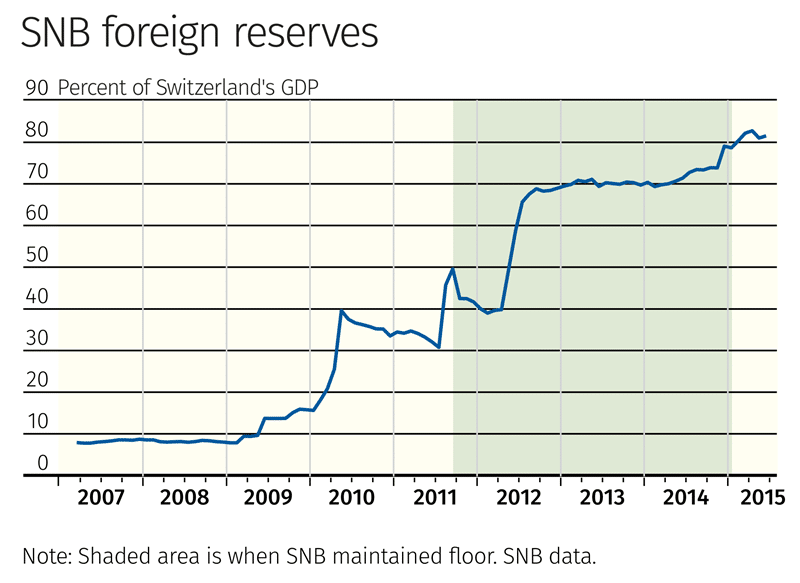

When the quantitative easing (QE) from the European Central Bank weakened the euro’s value, the SNB, to maintain the cap, had to print more francs. These were used to buy euros, so the EUR/CHF would not fall below 1.20. Such frivolous printing of francs led to worries among the Swiss population concerning hyperinflation. The result was that the SNB had to remove the peg.

Short Ties with Eurozone

As mentioned before, the inverse relationship between EUR/USD and USD/CHF (the driving factors behind the EUR/CHF currency pair) indicates that when one goes up, the other sells off. However, this relationship decouples when there are divergent monetary or political policies.

Therefore, if elections lead to uncertainty in Europe, the EUR/USD may slide, and the USD/CHF can rally. If the eurozone increases interest rates and the Swiss do not, the EUR/USD will appreciate more.

The ties between Switzerland and the eurozone began with a free trade agreement in 1972, which was followed by bilateral agreements that led to the opening of the Swiss labor market to EU citizens. However, thanks to Swiss independence from the eurozone, it has been able to avoid the ill effects of a falling euro, while maintaining investor confidence in Swiss Franc. The European debt crisis and the diminishing appeal of the US dollar have caused investors to seek a safe sanctuary in Swiss franc.

The Final thoughts

The Swiss franc has had a complicated relationship with both the Eurozone and the United States. The coupling of the currency pairs, USD/CHF, and EUR/USD that drives the EUR/CHF has resulted in the Swiss Franc’s long-term stability.

Even though the SNB has removed the peg on EUR/CHF to combat the concerns about domestic inflation, it still believes that the currency is overvalued and may require further adjustment. However, even then, the strong relationship between the Swiss market and the Eurozone and the safe-haven status of the Swiss franc ensured that investors remain confident with the currency pair.