The Canadian dollar is heavily dependent on the commodity market. Any changes in global crude oil inventories and natural gas storage in the US impact the relationship between the CAD and the USD. In this article, we take a more in-depth look at such factors and see how they affect the Canadian economy.

CAD and USD relations

The Canadian Dollar, or the CAD, is the national currency of Canada. It is considered a firm currency as it comes from a politically and economically stable country. It is relatively stable and has become popular as a reserve currency since the financial crisis of 2007-08. Among the forex traders, CAD is known as the ‘loonie’ as the one-dollar Canadian Coin has the image of a loon.

The benchmark for the CAD in the forex market is the US dollar (USD), and the CAD/USD currency pair is one of the major currencies that accounts for a voluminous trade in the forex market. Since the US is Canada’s biggest trading partner, the CAD is sensitive to developments happening with the USD.

The Canadian Economy

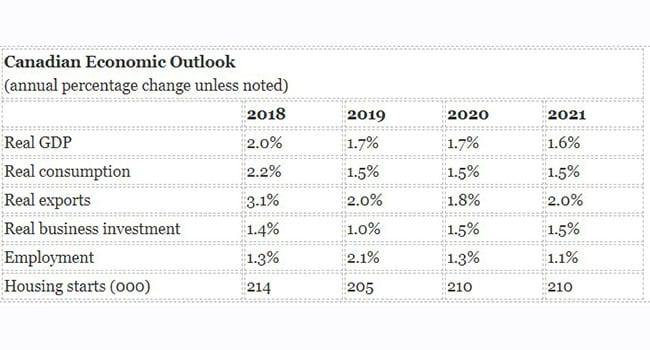

Canada has had strong growth in the past two decades with short-lived recessions in the 1990s and 2009. In terms of GDP, it is ranked tenth in the world. Even though Canada has had high inflation rates, the improved current account balance and fiscal policies have resulted in lower budget deficits and inflation rates.

In order to understand the drivers of the Canadian economy, it is important to reflect on Canada’s exposure to commodities. As a producer of petroleum, grains, and minerals, the trade flows from those exports and influences investor sentiment regarding the Canadian dollar.

The US and Canada are both at the very top of in terms of being export/import markets. They also have a very tight relationship because of which the traders of the CAD have to be watchful of the events happening in the United States. Even though Canadian economic policies are quite different, the ground reality is that the effects of US policies have a ripple effect in Canada.

At the same time, the conditions for the US-Canada relationship do diverge markedly. The Canadian financial market structure allowed it to avoid the housing mortgage problems that devastated the US.

On the other hand, since the Canadian economy does not have many tech companies, during the tech boom of the 1990s, the CAD witnesses relative weakness. Again, the oil boom of the 2000s saw the loonie outperforming the USD.

Major drivers for CAD/USD

Various factors make the CAD/USD currency pair so unique. Here we go through some of the significant drivers that affect the Canadian Dollar and the CAD/USD pair.

1. Commodities – Crude Oil and Natural Gas

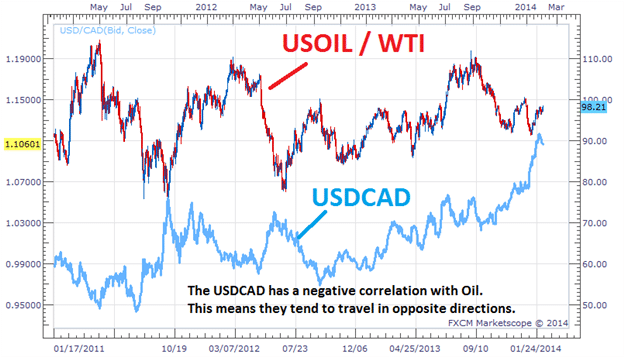

The change in the number of crude oil barrels held in inventory is one factor that can affect the value of the CAD. The report for the Global Crude Oil Inventory is published weekly. It determines the values of currencies depending on the commodities as bigger stockpiles, which can push down the prices. As America increases oil production, oil prices fall further.

When Canada decreases oil production, the price of oil increases, which in turn strengthens the CAD. In the past, there have been extreme fluctuations in the oil prices that have hurt Canada. The Bank of Canada (BoC) in March 2017 decided against raising interest rates as the economy had not fully recovered from the heavy fall in oil prices. If the interest rates were brought back up at that time, it would have led to a recession – such has been the impact of oil prices on the CAD.

Similarly, a Natural Gas Storage report is published weekly. It measures the changes in the amount of natural gas held in storages. Even though this indicator is for the US, its effect on the Canadian energy sector and the CAD is huge. If the natural gas inventory is more extensive than expected, there will be a fall in oil prices due to weaker demand.

2. Canada’s Political Stability

Political stability and change in the North American continent is another factor that influences the CAD and the CAD/USD currency pair. The 2016 US election is the perfect example of this. It was predicted that if Trump won, the US dollar would lose value, but the opposite happened.

Additionally, the anti-trade stance taken by Donald Trump worries Canada. Since Canada is the second-largest trading partner of the US, implementing tariffs would seriously hurt the Canadian economy. That is why the political changes in the US have a significant impact on the CAD.

On top of that, political stability in Canada is another factor that influences its currency. When the country is stable, its currency value increases, while instability leads to depreciation.

3. Economic Data

Some of the markers in primary economic data that impacts the CAD/USD currency pair are as follows:

- Trade balances

- Inflation

- Industrial production

- Retail sales

- GDP

The data on these markers is made available at regular intervals. Brokers and media companies, such as Bloomberg and Wall Street Journal, freely provide this information to traders and investors. They also have to take special notice of the interest rates (including meetings scheduled by the Bank of Canada), employment. Elections, new government policies, and natural disasters can have a major impact on the exchange rates of the CAD/USD currency pair as well.

The loonie is also driven by capital inflows into the Canadian economy. Periods of high commodity prices usually go hand in hand with increased investor interest in Canadian assets, and such a capital influx leads to changing exchange rates.

The Bottom Line

Even though Canada is not a prominent exporter of manufactured goods, its economy remains stable. Canada has found a balance between profiting from the wealth of its natural resource without depending on it heavily.

Over the years, Canada has remained a strong prospect for traders and investors as it is among the world’s major economies.