The Japanese yen is one of the most traded currencies in the $6 trillion forex market. It elicits strong interest and sentiments on being the legal tender of one of the biggest economies in the world. Additionally, it is relatively stable, thus producing some of the best trading opportunities when paired with other fiats.

Many things impact its sentiments and value fluctuation. Top on the list is policy measures passed by the Bank of Japan. The central bank implements policy measures designed to ensure economic stability consequently impact its value against the majors.

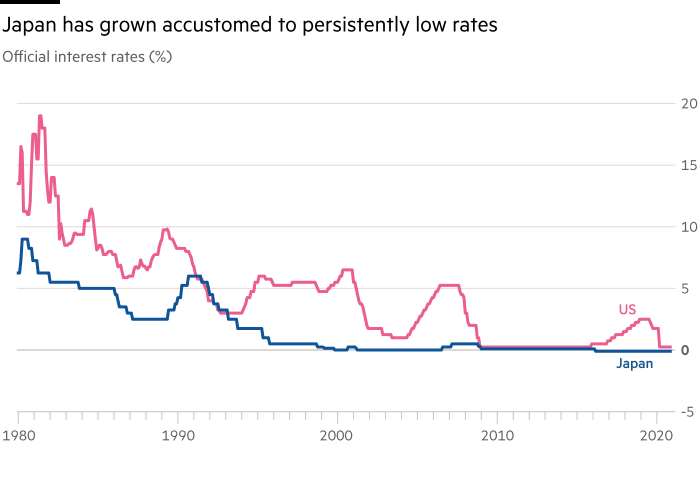

While the central bank strives to impose policies that encourage growth and minimize inflation, which has not been the case. The native fiat has felt the full force of deflation over the years. Lower interest rates have been the driving force behind the fiat strength and sentiments.

Japan economy situation

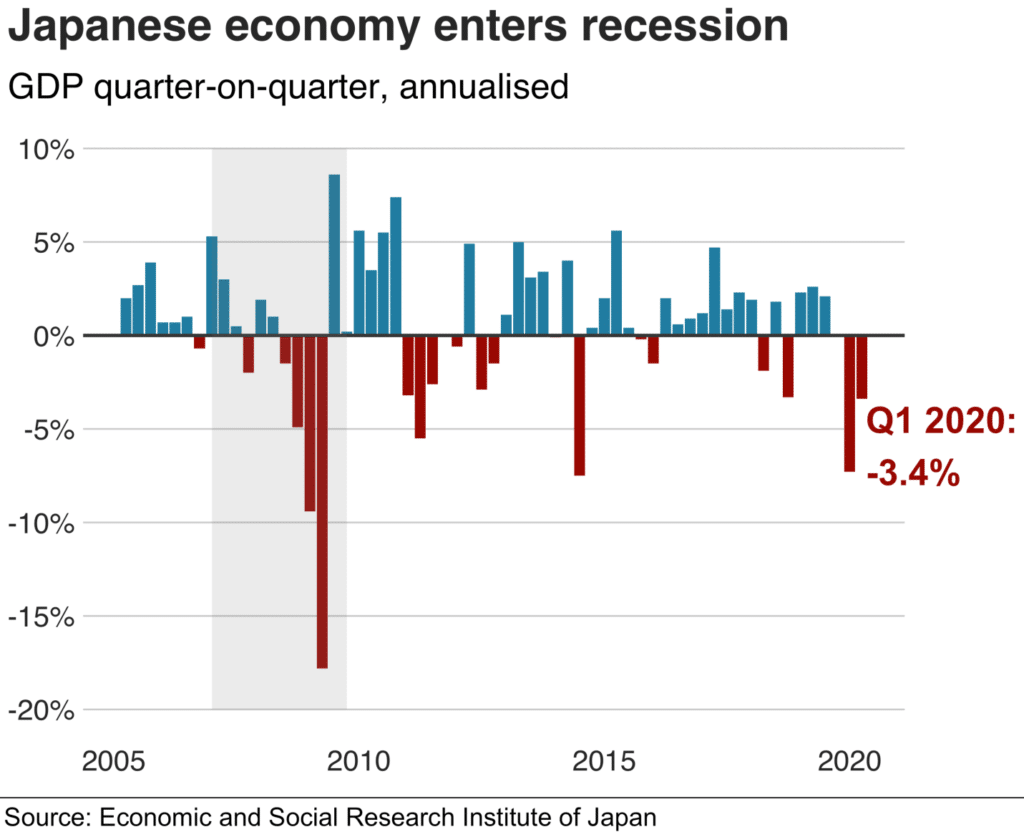

The yen exchange rate fluctuates against other fiats in response to the health and stability of the Japanese economy. While it is one of the biggest in the world, the lack of growth in recent years has been a major tailwind. Between 2012 and 2015, it plunged into recession after a 29% dip. The lack of inflation for over 20 years has also been a major factor influencing the native currency value.

Being one of the oldest economies in the world, it is often dominated by some of the lowest fertility rates. An aging workforce has been one of the biggest tailwinds to Japan’s economic growth, given the reduced productivity.

Dampened sentiments about the Japanese economy have continued to weigh heavily on the legal tender exchange rate over the years. Stagnation owing to slow growth, lack of inflation, and record low-interest rates have significantly taken a toll on yen strength over the years.

Low interest rates

Fiscal stimulus in the island nation has always revolved around low interest rates and sometimes negative rates. The net effect has always been strong overseas interest in the currency given the reduced borrowing costs.

However, this had little effect, with the economy not rising by more than 2.1% between 2011 and 2019. The stagnation has weighed heavily on the legal tender strength as traders and investors remain wary of the economy’s growth prospects.

Whenever the overall market is rallying, the Japanese yen tends to depreciate. During such times, investors sell it and, in return, buy other assets that guarantee higher returns. Similarly, in times of uncertainty, traders buy it as a hedge against uncertainty, therefore, driving its value higher against the majors.

The chatter in the forex market about the BOJ altering its policies on interest rates often influences the yen sentiments. In return, it sways its strength against the majors, thus the appreciation and depreciation that comes into play.

Market sentiments

Developments often sway the Japanese currency sentiments and price in the currency and stock markets. In times of market stability followed by high growth rates, stocks tend to outperform.

During this period, investors increase their bets and investments in high-yielding and riskier assets. Given the low yields associated with low-interest rates, traders tend to exit their positions in its depreciation.

However, in times of adverse market sentiments, investors often resort to capital preservation, opting to exit riskier bets. The yen acting as a safe haven often attracts bids during periods of uncertainty thus appreciates. Therefore, there exists a negative correlation between it and riskier bets.

Economic releases

Economic data also play a big part in influencing the yen value. Traders and investors are always looking for economic indicators such as the consumer price index and the Gross Domestic Product. The outcome of the releases paints a clear picture of the economy’s health, which influences the native currency strength and prices.

However, the low inflation levels in recent years have meant the currency is not as responsive to economic data as is the case with other peers.

Currency intervention

Monetary policies implemented by the central bank also impact the yen value against the majors. In most cases, the BOJ is known to sell the legal tender to make exports competitive and cheaper. In 2011, the government was forced to intervene as the currency soared to 75 per dollar following a tsunami and earthquake.

Tankan survey

The Tankan Survey is a short-term survey of the Japanese enterprises. Just like other economic releases, it is closely watched by traders to gauge how the yen is likely to perform. The report is the work of several Japanese companies with a specified minimum of capital.

Often, the companies discuss trends within the Japanese economy and the kind of impact it is likely to have over a given period. The outcome of the report is known to influence its sentiments.

Most-traded Pairs

USD/JPY

It is the second most traded pairing eliciting strong interest in the $6 trillion marketplaces. The couple signals the amount of the yen one would need to buy the greenback. The best time to speculate on the pair is when the London and New York sessions are opened.

Between 07:00 and 11:00, USD/JPY commands a huge volume and volatility, giving rise to some of the best trading opportunities. High trading volume also leads to tighter spreads.

EUR/JPY

The seventh most traded pair, EUR/JPY, signifies the amount of yen required to buy the euro. Its price fluctuates as traders react to economic developments in Europe and Japan. Similarly, monetary policies implemented by the European Central Bank and Bank of Japan also sway its sentiments and price.

The best time to trade the EUR/JPY is when both the Asian and European sessions are opened. Between 2:30 and 10:30 EST, the pair experiences increased volatility given the increased market participants.

GBP/JPY

GBP/JPY is another most traded pairing involving the British Pound and the Japanese money. The “Weepy,” as it is commonly known, can be extremely volatile thus should be approached with lots of caution.

The increased levels of volatility make the pair popular among traders who know what they are doing. Therefore, it should never be tried out by people trying to learn to trade. Interest rate differences between the UK and Japan make the pair an interesting pick for carrying trades.

GBP/JPY is best traded between 01:30 and 10:00 EST when both the Asian and European sessions overlap.

Bottom line

The Japanese yen is a force to reckon with in the forex market on being the third most popular fiat. When paired with the majors, it gives to some of the most traded pairs. Its value is influenced by policy measures imposed by the central bank, economic indicators, and market sentiments.