If you gave a candlestick chart to ten different traders, each of them would formulate their own unique trading ideas wildly diverse from the next. One of the beauties of the markets is there is no 100% all-time correct approach or strategy to trade. The markets are a culmination of the behaviors of millions of people.

Although we’ve only scratched the surface with the number of strategies that exist, some methods have stood the test of time. Classic trend continuation strategies have rarely changed in the last few decades, for example. Having a strategy is not just about the technical aspects, but also about the philosophies, you hold about the markets.

Even though one trader may use moving averages to spot a trend while another uses price action, their philosophy or reason for using such an approach is to follow the trend. Other traders may believe it can be a little risky to follow trends, opting instead to wait for the price to give them an aggressive sign it wants to move in a certain direction. Breakout traders are only looking for these sorts of opportunities, and their beliefs about a specific market would always lean towards breakouts instead of trends or reversals.

Either way, each of these types of trading strategies has its pros and cons. The following three are some of the most common kinds of trading strategies in forex (and the philosophies behind them as well):

Trend-following strategies

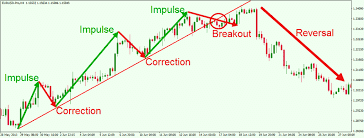

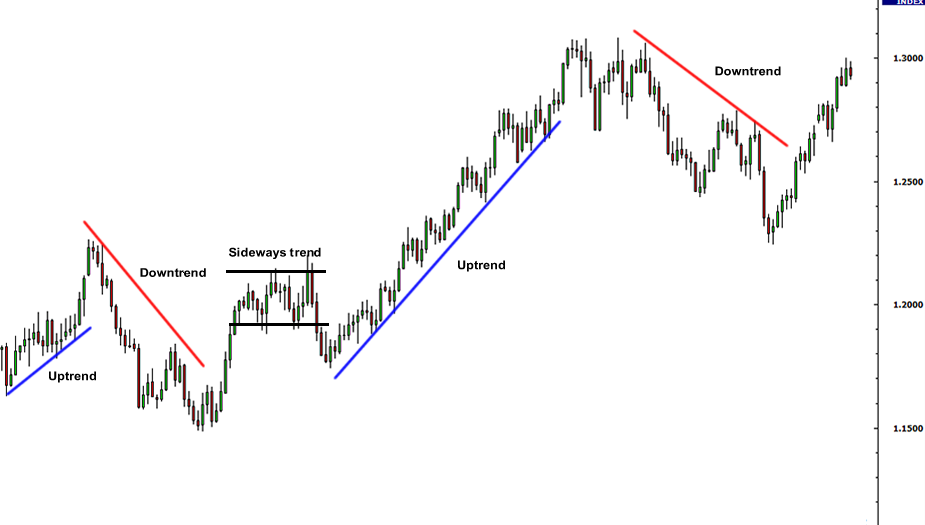

The idea of ‘the trend is your friend’ is one of the oldest to exist in all financial markets. It’s a simple way to think of any market. As a result, a broad spectrum of trend-following strategies employs a wide array of different indicators such as moving averages, Bollinger bands, and the RSI (Relative Strength Index) to spot trends. Even the most veteran of analysts use charting techniques like channels and trend lines to trade trends. Strategies based purely on trends are especially suitable for beginners due to their relative ease and philosophy.

The main reason why the notion of ‘the trend is your friend’ is always a hot topic is the belief that, in a bull market, for example, the more people keep buying, there exists a herd mentality where everyone else hops onto that trend. All trends are mostly driven by herd mentality as traders prefer to stick to the safest direction and not ‘fighting the path of least resistance.’ Trend traders typically always look for some form or correction or for the market to pull back to an explicit area before joining the resumption of the trend.

The advantage of these strategies is, again, the herd mentality occurrence. The disadvantage of trading trends is the difficulty in accurately predicting whether a trend is likely to resume or reverse. While trends can last for a very long time, they do not move in one direction forever, either. Sometimes traders can enter even the strongest of movements too late to realize it has already reversed against them.

Reversal strategies

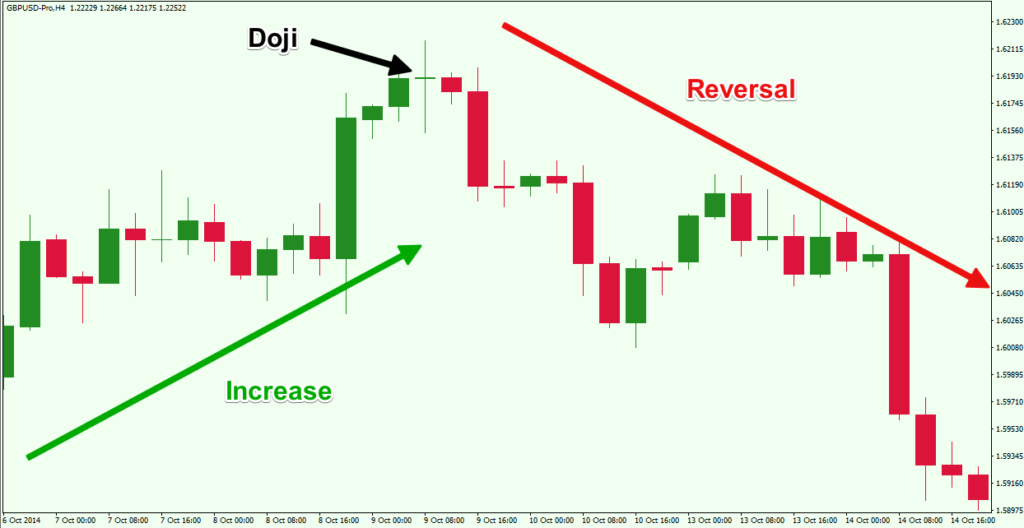

Reversal strategies are the opposite of trend following as they seek to capitalize on trends that have ‘lost steam.’ The philosophy of someone who trades reversals is a contrarian who does not follow the herd, believing that trends don’t last forever. ‘The trend is your friend until it ends’ or ‘The trend is your friend until it bends.’ As with any strategy, analysts use many indicators, charting techniques, and patterns to varying degrees of success in trading reversals.

In truth, no one can surely know if a trend has definitively ended and is reversing until after some time. A reversal trader desires to be the ‘early bird’ that catches the start of that counter-trend as traders who entered the prevailing trend too late get trapped.

Counter-trends are usually a lot harder to master than traditional trend-trading, which is why they are better suited for more skilled and experienced traders. The advantages are easy to see; anyone at the start of a new trend makes the most money as they would have sold at the highest price possible (vice versa for buying). Similarly to trends, the disadvantage is that it’s tough to tell precisely when a trend will truly end. Even if a trade looks to have taken a break, it does not always mean it’s reversing, at least to a considerable degree.

The breakout strategies

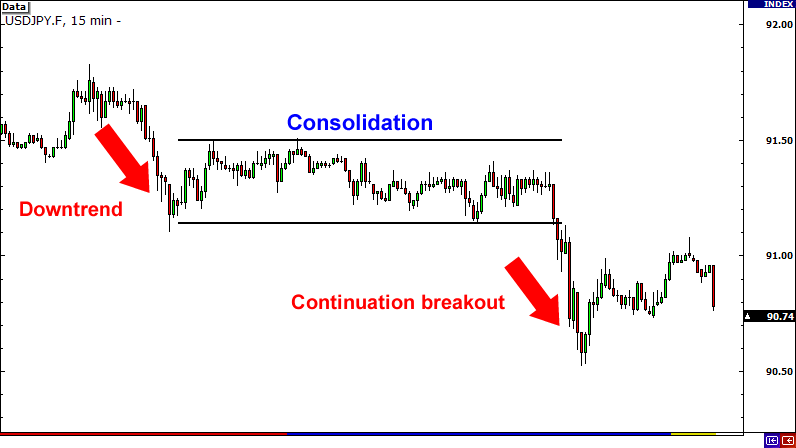

Breakout strategies mainly look to exploit fast and sudden bursts of price in a little space of time. Traders that trade breakouts don’t necessarily lean towards any particular trend in the market as they are only interested in looking for areas where price may potentially ‘break out’ with a surge of increasing volume. Some breakouts are quite impressive in patterns like wedges and flags. Still, in most cases, a breakout trader acts when the price is already moving in a particular direction close to the targeted ‘breakout point.’

They are a staple of short-term traders like scalpers because they can provide unusually high momentum in a relatively short period. However, other traders do trade them as trend continuation signals in bigger trends. As with any strategy, traders utilize a plethora of indicators and price patterns to trade breakouts.

The disadvantage of breakout strategies is a phenomenon known as a bull or bear trap where bulls and bears (buyers and sellers) are ‘fooled’ into taking a direction in the breakout area where, consequently, price reserves aggressively to the other side. We refer to this event as a fakeout, false break, or false breakout. Most market participants consider the possibility of fakeouts one of the main disadvantages of trading breakouts, requiring much experience to avoid them where possible.

Conclusion

These forms of strategies are just a tip of the iceberg when new traders introduce themselves to forex. Ultimately, there is no strategy that is superior nor more correct than another. Each of these requires different shifts in beliefs and actions. With any strategy, the trader precisely needs to know what they’re trading, why they’re trading it, and how it aligns with their opinion of the market, they’re trading. The main goal of any strategy is to exploit any weakness shown by market participants on the charts.