Gone are the days when one had to have thousands of dollars to pursue investment opportunities in the capital markets. With as little as $1000 or less, it’s become increasingly possible to buy and sell securities and profit from price changes. The availability of leverage means $1,000 can be magnified to pursue sizable investment opportunities.

One of the requirements to trading the US stock market is having a minimum of $25,000 in a trading account. However, in forex, you can day trade with $1,000 and place 3 to six positions thanks to leveraging and make a decent amount of money in the process.

Below are some of the ways to invest $1,000.

Forex day trading

One of the best ways to invest $1,000 or less for the greatest benefit is to engage in day trading in the forex market. There are several brokers that will allow you to open an account with such an amount or even less and start trading outright.

Day trading entails opening and closing positions before the end of the day. One can buy and sell a wide array of instruments ranging from currency pairs to commodities or even stocks. In this case, one gets to speculate on price changes and profit from the price differences.

In the chart above, a trader could have entered short or sell trades as soon as the price bounced to the long-term Moving Average (red) and closed on accumulating sizable profits. The profit could be repeated over and over as long as the price is below the Moving Average.

However, if you are just getting started in the business of day trading, it would be wise to first start in the demo account. The paper account would be the perfect place to accrue the much-needed experience and polish a trading strategy that can be used to trade real money in a live account.

Once sufficient experience has been accrued, deploying proper money management strategies to protect the $1,000 or less trading capital would be wise. Position sizing, in this case, is necessary while day trading. With $1,000, one does not have the free will to trade big lots.

For instance, a full lot on the $1,000 account guarantees one a $10 profit on one pip swing. Consequently, if one were to enter a long position on EURUSD at 1.1654 and close the position at 1.1690, that would be a cool $360 profit on the 36 pip swing. However, if the price was to edge lower and tank to 1.1618, one would have accrued a loss of $360.

To protect the $1000 capital while day trading, it would be best to open positions in micro-lots. Volumes like 0.1 or even 0.05 would not do significant damage to the trading account during downturns. In addition, one would stand a fair chance of growing the trading account at some of the lowest risks. In the case of the example above, one would only have accrued a loss of $18 instead of $350 on opening a position on a micro lot of 0.05.

Buying and holding

While day trading offers an ideal way of generating small profits throughout the day, it is not the only way. Day trading calls for a lot of discipline, emotional control, and hands-on-deck throughout the trading session.

For people who do not have the latitude of time to sit in front of a screen all day long, opening and closing positions playing the long-term game would be a smart way of investing the $1000 capital. Consequently, opening and holding positions for days or even weeks would be a safe play.

In this case, one gets to deploy long-term trading strategies, thus the name “positional trading.” Trend trading is one such strategy that can be deployed to try and profit as price moves from one level to another. With this strategy, a position is opened in the direction of a long-term trend.

In the Apple chart above, it is clear that anyone who opened a buy position on price moving to the 200 days Moving Average at about $108 ended up generating significant profit as the price moved to $144 the next time it touched the Moving Average.

In addition, a stop-loss order is placed a safe distance from the entry-level to ensure a position is not stopped out, given the wild swings that might come into play. Similarly, a take-profit order is placed at a much higher or lower level given that one is not in the run for small profits but rather sizable profits in the direction of the long-term trend.

With the buy and holding strategy, traders are usually not intrigued by the daily wild swings. Instead, they focus on riding a given trend until it changes direction. This strategy prevents one from overtrading and reduces the emotional aspect of opening and closing positions after minutes, as is the case with day trading.

Automated trading

Automated trading is also becoming increasingly popular, offering an ideal way of investing as little as $1,000. It stands out partly because it takes trading to a new level by encouraging rule-based trading. Everything is automated with this form of trading, right from market analysis to entering and closing of positions.

Currently, there are programmed systems that come with pre-set rules that govern the opening and closing of positions and money management. Therefore, instead of scanning the market for trading opportunities, such systems do everything. The systems also open positions based on pre-set strategies and when certain conditions are met.

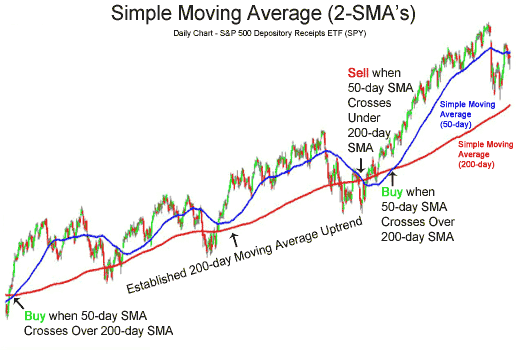

For instance, such systems could open a long position whenever the 50-day Moving Average moves above the 200-day MA, signaling the start of an uptrend. Similarly, they could open a shot position whenever the 50-day Moving Average moves below the 200-day Moving Average to signal the start of a downtrend,

In addition, the systems can close positions whenever pre-set profit targets are met. Similarly, they can close positions whenever losses start accumulating and price tanks to the predetermined stop loss level.

Automated trading systems are readily available but at a fee. Even though one gets to pay a small fee to leverage the systems, they may be worth every penny, especially for novice traders.

Automated trading systems avert emotions while trading, given that the systems open and close positions based on agreed rules and strategies. Such systems are also able to scan the market even when one is away, open and close positions with little or no human intervention. Additionally, they preserve discipline.

Bottom line

Investing in the capital markets has been simplified thanks to the proliferation of brokers, addressing different market niches. With as little as $1000, one can get a feel of the market investing in various instruments through automated trading systems, day trading, or even long-term trading and generate significant profits.