Transactions in the $6 trillion forex marketplace are not always free. Most come with the costs, which often amount to income to dealers. Bid and ask spreads are essentially the costs that people incur while buying and selling in the $6 trillion marketplaces.

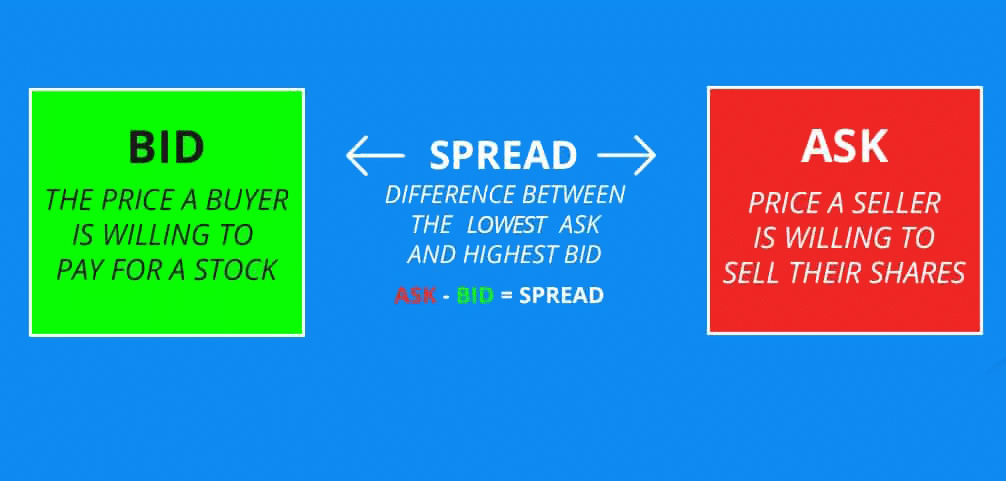

The bid price is the price one is willing to pay for a given share or financial instrument. In its simplest form, it is the buying price of a given security. On the other hand, the ask price is the minimum amount of money that a seller is willing to pay for a security.

It is possible to profit on price differentials as forex instruments appreciate or depreciate in value. When they are rising, one can enter a long or buy position. Similarly, when prices are falling, one can still profit by entering a short position.

The difference between the buy and sell price amounts to spread.

Assume GBP/USD = 1.20/1.30

This means that the higher rate of $1.30 is the cost of buying each British pound while the lower rate of $1.20 is the cost of selling each pound that one might have.

Conversely, a person traveling to the UK with dollars will buy each British pound for $1.30. Similarly, a person returning to the US will sell each pound at hand at $1.20. The difference between the two rates is spread, which is (1.30-1.20=0.1).

Quoting currencies

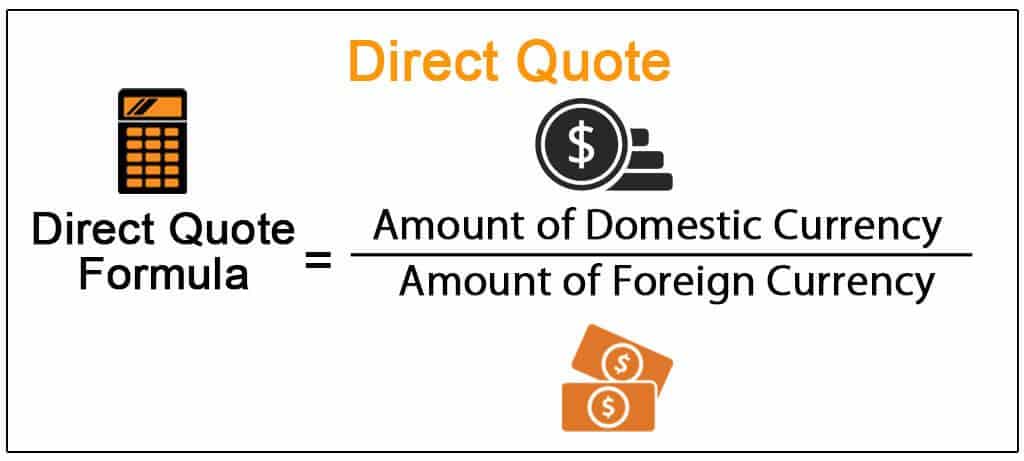

Two methods are leveraged when quoting. For direct quotes, the exchange rate signals the amount of domestic currency needed to purchase a foreign currency. In this case, the foreign currency acts as the base while the domestic unit acts as the quote.

For instance, USD/JPY quotation indicates the US dollar amount that each unit of the Japanese yen can buy at any given time.

An indirect quote shows the number of domestic units received upon selling a unit of foreign money. GBP/USD is a perfect example, as it shows the US dollar amount needed to purchase one unit of the sterling.

The direct and indirect quote relation depends on the location one is as location determines the domestic unit.

Commonwealth currencies which include the Aussie, euro, and sterling, are represented using indirect quotes. Conversely, the EUR/USD exchange rate will show the number of dollars that exist per unit of the base.

The quotation always takes the form 1EUR= USD 1.234, which expresses the amount of foreign unit (USD) equivalent to the domestic currency.

The indirect form of this pair would be 1 USD= 0.810 euro.

Understanding exchange rates

A clear understanding of how rates are calculated and arrived at is crucial if one is to stand a fair chance of accruing optimum returns on each conversion. For instance, people traversing different countries, the conversion from one currency to another is often inevitable.

For instance, a Canadian visiting Germany will have to convert the Canadian dollars to euros to buy goods and pay for services. When there is no actual exchange rate between the two, it is still possible to carry out a conversion. However, in this case, another currency will have to come into play to enable the conversion.

For instance if:

1 USD= 1.1234 CAD and 1 EUR = 1.3000 USD.

The approximated EUR/CAD exchange rate will be

EUR/CAD= EUR/USD X USD/CAD

Conversely EUR/CAD= 1.3000 X 1.1234= 1.6042

In this case, the Canadian will have to pay 1.6042 Canadian dollars to get one euro.

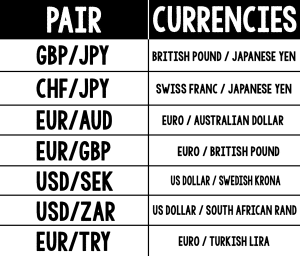

Cross-currencies

Not all people transact in dollars. When the buck is not one of the fiats involved in a transaction, a cross-currency exists. Conversely, a cross-currency is a pair that does not have a dollar as one of its constituents.

Consider a British national traveling to Japan. He or she would need to convert pounds to yen to transact business in the island nation.

Likewise if GBP/EUR= 1.16 and EUR/JPY = 130.24

Then GBP/JPY= GBP/EUR X EUR/JPY= 1.16 X 130.24= 150.8

In this case, the traveler will get 150.8 yens for each British pound held.

Variations

The same way brokers offer different ask and bid prices in trading platforms is the same way dealers provide different rates for day-to-day transactions. As rates vary between dealers, they differ from one location to another, depending on supply and demand forces.

Likewise, it is advisable to carry out an in-depth analysis comparing various rates to walk away with the best deal for exchange rates. Given the strong demand and low supply in airports, Airport kiosks are some of the worst places to convert currencies. It’s possible to end up with 5% less when converting money at the airport kiosks than elsewhere outside the booths, such as in banks or forex bureaus.

Depending on the amount of money one wishes to convert, a dealer may opt to offer a good exchange rate. However, some may not offer favorable rates until one haggles for the same.

Bottom line

Spreads are the main reason why the bid and ask prices differ. The spread is usually the amount of money that a dealer or broker makes on each transaction when buying or selling a currency. It is important to use the dealers that offer narrow spreads if one ends up with the most amount of money whenever conversions occur.