The City Index is a global international company giving service of access to financial markets. Office departments of the company are open in Europe, Asia, CIS and even in Australia. The company was established in 1983 in London, and it was changing the owner and activity profile for several times. Only in 2015, the broker was bought by a large financial organization GAIN Capital which is also owning the Forex.com project.

Do clients trust the City Index company

The organization has a high index of trust among clients as the company is publicly traded on the stock exchange and is licensed by a number of reputable regulators.

Currently, it is licensed by the following regulatory organizations:

- FCA (UK);

- IIROC (Canada);

- ASIC (Australia);

- MAS (Singapore).

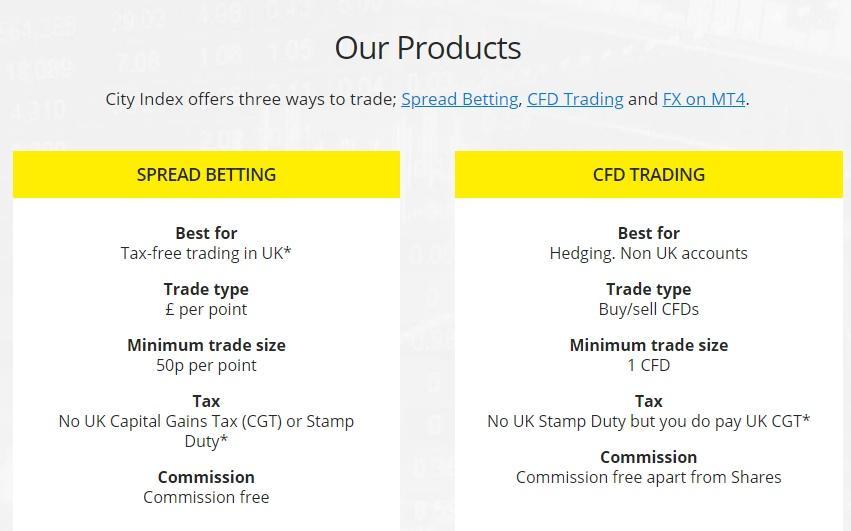

The specialization of the broker is the opening of access to trade Contracts for Difference (CFDs) and currency pairs. A common list of instruments is not big. Bonds and indices are unavailable for trading. But the cryptocurrency category is open. At the same time, the company does not hide the high level of risk of independent trading. The warning is posted on the City Index website.

Information about accounts and trading conditions

- Keys conditions for trading in City Index are:

- The minimum deposit is not specified;

- The minimum spread is 0.5 points;

- Leverage is up to 1: 100;

- Type of transaction is the Dealing Desk (the broker does not send orders to international markets, due to the small minimum deposit and the minimum size of the spread).

There are several account categories on the official website of the City Index broker:

Personal, SMSF (Self-Managed Super Fund), Corporate and Joint. From the name we can understand that one account is intended for individuals, the other is for corporate use, the third is for trust management of a deposit, and so on. Accordingly, there is no division into Cent, Classic and VIP accounts. It can be considered to be an advantage as there are no privileges for users with a large deposit. You can count on full technical support, managers consulting on cooperation and trading issues even with 100$ on the account.

Commissions and fees

Like any other broker, the City Index is having fees and commissions that are forming a potential income off the company. By 2018 the size of spreads was competitive. And someone in the reviews even called it a discount. The average size of spreads is 0.5-0.6 points. Positive dynamics in reducing and optimizing the size of spreads began to be observed after the owner of the company changed (the organization GAIN Capital became the owner). There are no additional fees and charges for the deposit and withdrawal of funds – everything remains as part of the tariff plan of payment systems. You can use popular systems for depositing and withdrawing funds, including VISA, Master Card, PayPal, Skrill.

How the technical support of the City Index broker is working

Users note that consulting support for this company is provided at GAIN Capital contact centers. For example, one of the largest broker offices in Australia does not have its own contact department. Appeals are outsourced to GAIN Capital professionals. Calls can be processed in English, in Chinese, and in German. Russian is not supported, so there are very few customers among the citizens of the CIS.

You can write to the company’s email, make a call to a contact center or contact via online chat to get the consultation.

Investment services

An integral part of any financial company is the analytical department which publishes its own forecasts, opinions, and analytics on a daily basis. On the official website, you can go to the economic calendar and even the full-fledged Trading Central platform. It published not. a simple technical analysis, but full signals ready for execution in the terminal. In this line, the company decided to give users access to a number of independent analytical services. One of them is Faraday. Directly through the website, you can go and get detailed information about financial markets. This is definitely a plus!

Overview of City Index trading terminals

The broker has opened access to the following trading platforms:

- Web Trader;

- AT Pro;

- Metatrader 4 (desktop and mobile versions).

The clients of the company liked the AT Platform the most which received an informative design and many opportunities for analysis. In addition, you can open the platform from any device.

We recommend

The broker deserves the attention of traders from different regions of the world. But shortcomings such as the lack of NDD accounts and a limited choice of languages of the site do not allow to put the highest score.