One of the advantages of having such a mammoth of market-like currencies is the seemingly countless strategies traders use to profit: from plotting a Simple Moving Average to drawing Elliot Waves with various Fibonacci retracements.

A popular strategy in forex which sits in the middle is the double grid strategy. It’s a system for taking advantage of all market conditions. Let’s explore this trading system in more detail and outline the most crucial aspects to consider.

What is the double grid strategy?

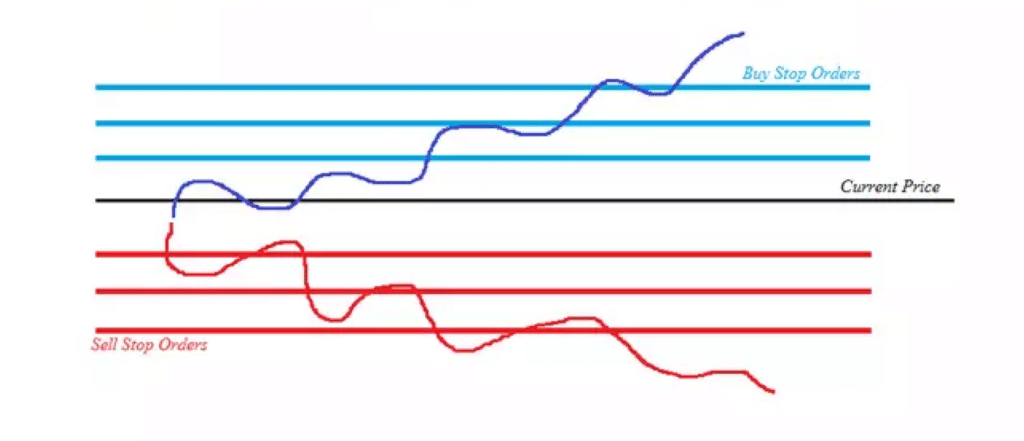

The double grid strategy in forex is a technique where traders place multiple pending orders above and below a particular price at set intervals, creating something resembling a grid.

The objective is to capitalize on price movements regardless of the direction and with little consideration for other aspects. More specifically, traders can take advantage of both trending and ranging markets.

In the former, a trader places pending buy orders usually every 10-15 pips above a specific price and sell orders below that level. Within a sideways market, they’d place pending buy orders below a particular level and sell orders above it.

Below is a picture illustrating the simple concept of the double grid system.

By having multiple orders, the net position accumulates, meaning your profit potential becomes larger the more orders are triggered as price runs in your favor. This aspect is the main attraction of grid trading.

However, this strategy is primarily geared towards scalpers and day traders because it comes with many risks, such as the likelihood of incurring significant losses and the complexity of managing stop losses and profits from the many opened positions.

Moreover, markets can quickly change from trending to ranging or vice versa.

Implementing the double grid strategy

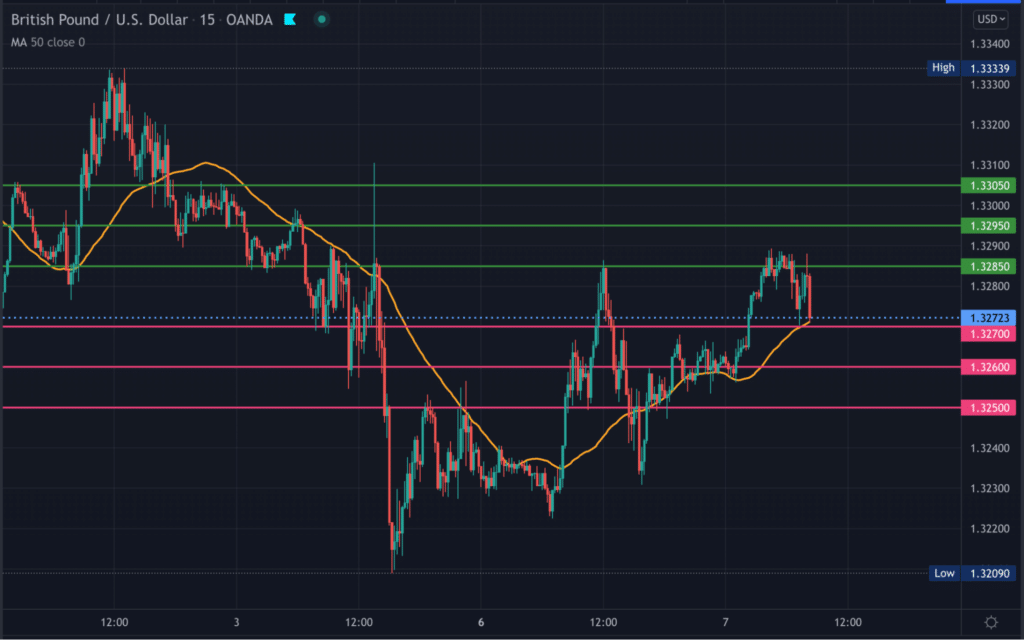

The first factor to grasp about grid trading is successfully identifying whether a pair is trending or ranging. We’ll use a 50-day Simple Moving Average on the 15-minute chart using a trending grid for simplicity’s sake.

Traders observe the slope for any Moving Average strategy to determine whether the price is likely trending or moving sideways. When trending, the slant is typically at around a 45-degree angle.

Example

On the GBPUSD chart below, we see the market is above 50 MA, suggesting an uptrend. However, with grid trading, it wouldn’t necessarily matter what the direction of the trend is, only that the market is trending.

Another step in the double grid strategy is determining the pip interval between the orders. Of course, there’s no universally correct answer, but we’ve used 10 pips as it’s the typical figure.

The other crucial point is determining the number of orders within the grid. Generally, you don’t want to go above three as anything above this figure becomes increasingly challenging to manage.

In the chart, the three green lines would represent buy orders at 1.32850, 1.32950, and 1.33050. Conversely, the three pink lines would represent sell orders at 1.32700, 1.32600, and 1.32500.

The next consideration would be the possible scenarios if price triggered any of the orders. Let’s assume the market hit the sell orders, with the first level at 1.32700 (order #1). Let’s also imagine the lot size for each order was 1, and the trader decides to exit all positions after the price moved 50 pips (1.32200).

When the market hits 1.32700 (#1), one may set a 15 pip stop ($150) at 1.32850, the same level as the first order of their ‘buying grid.’ We’ll have two possible outcomes in this instance.

In the worst-case scenario, the price would hit 1.32850 for a $150 loss while triggering the first buy order in this area.

They’d have to employ a new strategy to manage the buy orders. If the market instead continued in their favor and triggered the second sell order at 1.32600 (#2), they could move the stop loss of order #1 to breakeven and apply a stop loss to order #2 at 1.32750 ($150 loss).

If the price continued in their favor and triggered the third order 1.32500 (#3), they could move order #2’s stop loss to breakeven and move the stop loss of order #3 to 1.32650.

At this point, they’d have a total running profit of $200 from order #1 (20 pips X $10 – as every pip with 1 lot on GBPUSD is worth $10) + $100 from order #2 (10 pips X $10).

Ultimately, if the price moved to their desired profit at 1.32200, the net profit after closing all trades would be $1200 ($500 from order #1, $400 from order #2, and $300 from order #3).

The main risk considerations to know about the double grid strategy

Perhaps the biggest danger of the double grid strategy is managing the multiple positions. Even if the trades are at the same lot size, you’d need to determine a logical point to place the stop losses of each order.

Many traders might use wider stops on each order to allow the market enough ‘breathing room,’ but in doing so, you understandably increase the amount you could lose once all positions are closed.

A trader will need to set the parameters of the pip interval for each position to levels at which they can logically manage them. The second obvious risk is the market conditions can suddenly move from trending to ranging, or vice versa.

This unexpected change will undoubtedly affect the outcome of each position, adding another layer of complexity the more orders need to be changed. So, what could be some of the methods to minimize the risks?

Aside from sticking to a maximum number of three orders, traders will want to stick with pairs with above-average volatility, namely most non-exotic GBP markets, yen pairs, and other minor/cross pairs like EURNZD EURAUD, etc.

With higher volatility, you stand a greater chance of experiencing a stronger movement. Also, you’ll want to employ grid trading during the relevant trading sessions for a particular market.

Lastly, this strategy should be implemented on a larger account or where a trader ensures they can cover the required margin.

Final word

Overall, grid trading requires a lot of micro-managing. Moreover, if you’re used to single prediction-based positions, you might need to think about the outcome of multiple orders within the grid.

On the plus side, one of the benefits of the double grid strategy is the ability to profit from either directional moves without any intense analysis and the potential for amplified gains.

However, only experienced traders should generally employ this system after thorough practice following a strict set of rules and logical risk management.